Motorola 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Retirement Benefits

Our benefit obligations and net periodic pension cost (benefits) associated with our domestic noncontributory pension

plans (“U.S. Pension Benefit Plans”), our foreign noncontributory pension plans (“Non-U.S. Plans”), as well as our domestic

postretirement health care plan (“Postretirement Health Care Benefits”), are determined using actuarial assumptions. The

assumptions are based on management’s best estimates, after consulting with outside investment advisors and actuaries.

Accounting methodologies use an attribution approach that generally spreads the effects of individual events over the

service lives of the participants in the plan, or estimated average lifetime when almost all of the plan participants are considered

"inactive." Examples of “events” are plan amendments and changes in actuarial assumptions such as discount rate, expected

long-term rate of return on plan assets, and rate of compensation increases.

There are various assumptions used in calculating the net periodic benefit expense and related benefit obligations. One of

these assumptions is the expected long-term rate of return on plan assets. The required use of the expected long-term rate of

return on plan assets may result in recognized pension income that is greater or less than the actual returns of those plan assets

in any given year. Over time, however, the expected long-term returns are designed to approximate the actual long-term returns.

We use a five-year, market-related asset value method of recognizing asset related gains and losses.

We use long-term historical actual return experience with consideration of the expected investment mix of the plans’

assets, as well as future estimates of long-term investment returns, to develop our expected rate of return assumption used in

calculating the net periodic pension cost and the net retirement healthcare expense. Our investment return assumption for the

U.S. Pension Benefit Plans and Postretirement Healthcare Benefits Plan was 7.00% in both 2014 and 2013. At December 31,

2014, the pension plans and the Postretirement Health Care Benefits Plan investment portfolios were comprised of

approximately 43 percent and 20 percent equity investments, respectively.

A second key assumption is the discount rate. The discount rate assumptions used for pension benefits and

postretirement health care benefits reflect, at December 31 of each year, the prevailing market rates for high-quality, fixed-

income debt instruments that, if the obligation was settled at the measurement date, would provide the necessary future cash

flows to pay the benefit obligation when due. Our discount rates for measuring our U.S. pension benefit obligations were 4.30%

and 5.15% at December 2014 and 2013, respectively. Our discount rates for measuring the Postretirement Health Care Benefits

Plan obligation were 3.90% and 4.65% at December 31, 2014 and 2013, respectively.

A final set of assumptions involves the cost drivers of the underlying benefits. The rate of compensation increase is a key

assumption used in the actuarial model for pension accounting and is determined by us based upon our long-term plans for such

increases. Our 2014 and 2013 rate for future compensation increase for the U.S. Pension Benefit Plans was 0%, as the salaries

to be utilized for calculation of benefits under these plans have been frozen. For the Postretirement Health Care Benefits Plan,

we review external data and our own historical trends for health care costs to determine the health care cost trend rates. The

health care cost trend rate used to determine the accumulated postretirement benefit obligation and 2015 net periodic benefit

was 7.75%, then grading down to a rate of 5.00% in 2021. The health care cost trend rate used to determine the December 31,

2013 accumulated postretirement benefit obligation was 8.50% for 2014, remaining flat at 8.50% through 2015, then grading

down to a rate of 5.00% in 2020.

Prior to 2013, unrecognized gains and losses were amortized over periods ranging from three to thirteen years. At the

close of fiscal 2012, we determined that the majority of the plan participants in our Regular and United Kingdom pension plans

were no longer actively employed due to significant employee exits as a result of our recent divestitures. Under relevant

accounting rules, when almost all of the plan participants are considered inactive, the amortization period for certain

unrecognized losses changes from the average remaining service period to the average remaining lifetime of the participant. As

such, depending on the specific plan, we amortize gains and losses over periods ranging from four to thirty-six years. Prior

service costs are being amortized over periods ranging from six to twelve years. Benefits under all pension plans are valued

based on the projected unit credit cost method.

Our pension deficit is impacted by the volatility of corporate bond rates which are used to determine the plan discount rate

as well as returns on the pension plan asset portfolio. The discount rate used to measure the New Plan liability at the end of

2014 was 4.30%, compared to 5.15% in the prior year. As of December 31, 2014, changing the New Plan discount rate by one

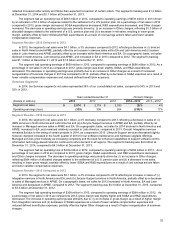

percentage point would change the net periodic pension cost in 2015 as follows:

1% Point

Increase 1% Point

Decrease

Increase (decrease) in:

New Plans' net periodic pension costs $ (7) $ 4

Valuation and Recoverability of Goodwill

We assess the recorded amount of goodwill for recovery on an annual basis in the fourth quarter of each fiscal year.

Goodwill is assessed more frequently if an event occurs or circumstances change that would indicate it is more-likely-than-not

that the fair value of a reporting unit is below its carrying amount. We continually assess whether any such events and

circumstances have occurred, which requires a significant amount of judgment. Such events and circumstances may include:

adverse changes in macroeconomic conditions, adverse changes in the entity's industry or market, changes in cost factors

negatively impacting earnings and cash flows, negative or declining overall financial performance, events affecting the carrying