Motorola 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

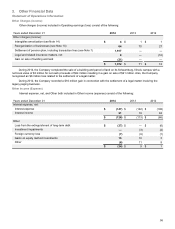

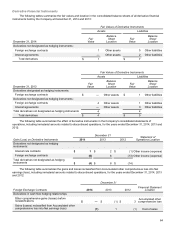

Derivative instruments activity, net of tax, included in Accumulated other comprehensive loss within the consolidated

statements of stockholders’ equity for the years ended December 31, 2014, 2013 and 2012 were as follows:

2014 2013 2012

Balance at January 1 $ (1) $ 1 $ (3)

Increase (decrease) in fair value —(1) 3

Reclassifications to earnings, net of tax 1(1) 1

Balance at December 31 $ — $ (1) $ 1

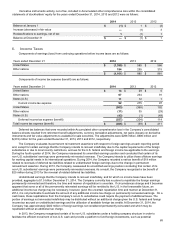

6. Income Taxes

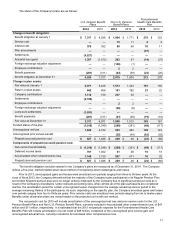

Components of earnings (loss) from continuing operations before income taxes are as follows:

Years ended December 31 2014 2013 2012

United States $ (1,355) $ 585 $ 566

Other nations 194 295 315

$ (1,161) $ 880 $ 881

Components of income tax expense (benefit) are as follows:

Years ended December 31 2014 2013 2012

United States $ 14 $ 29 $ 5

Other nations 67 234 91

States (U.S.) 11 12 1

Current income tax expense 92 275 97

United States (503) (368) 192

Other nations (11) 35 (29)

States (U.S.) (43) (1) (49)

Deferred income tax expense (benefit) (557) (334) 114

Total income tax expense (benefit) $ (465) $ (59) $ 211

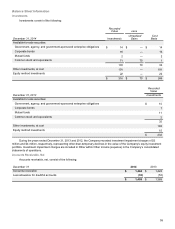

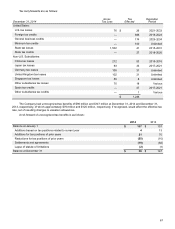

Deferred tax balances that were recorded within Accumulated other comprehensive loss in the Company’s consolidated

balance sheets resulted from retirement benefit adjustments, currency translation adjustments, net gains (losses) on derivative

instruments and fair value adjustments to available-for-sale securities. The adjustments were $286 million, $606 million and

$(272) million for the years ended December 31, 2014, 2013 and 2012, respectively.

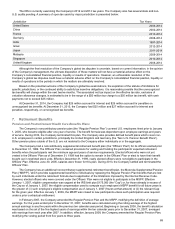

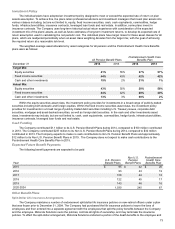

The Company evaluates its permanent reinvestment assertions with respect to foreign earnings at each reporting period

and, except for certain earnings that the Company intends to reinvest indefinitely due to the capital requirements of the foreign

subsidiaries or due to local country restrictions, accrues for the U.S. federal and foreign income tax applicable to the earnings.

During the fourth quarter of 2014, the Company reassessed its unremitted earnings position and concluded that certain of its

non-U.S. subsidiaries’ earnings were permanently reinvested overseas. The Company intends to utilize these offshore earnings

for working capital needs in its international operations. During 2014, the Company recorded a net tax benefit of $19 million

related to reversals of deferred tax liabilities related to undistributed foreign earnings due to the change in permanent

reinvestment assertion. During 2013, the Company reassessed its unremitted earnings position concluding that certain of its

non-U.S. subsidiaries' earnings were permanently reinvested overseas. As a result, the Company recognized a tax benefit of

$25 million during 2013 for the reversal of related deferred tax liabilities.

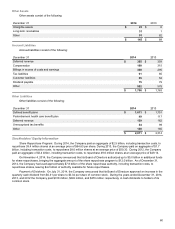

Undistributed earnings that the Company intends to reinvest indefinitely, and for which no income taxes have been

provided, aggregate to $1.5 billion December 31, 2014. The Company currently has no plans to repatriate the foreign earnings

permanently reinvested and therefore, the time and manner of repatriation is uncertain. If circumstances change and it becomes

apparent that some or all of the permanently reinvested earnings will be remitted to the U.S. in the foreseeable future, an

additional income tax charge may be necessary; however, given the uncertain repatriation time and manner at December 31,

2014, it is not practicable to estimate the amount of any additional income tax charge on permanently reinvested earnings. On a

cash basis, these repatriations from the Company's non-U.S. subsidiaries could require the payment of additional taxes. The

portion of earnings not reinvested indefinitely may be distributed without an additional charge given the U.S. federal and foreign

income tax accrued on undistributed earnings and the utilization of available foreign tax credits. At December 31, 2014, the

Company has approximately $400 million of foreign earnings not considered permanently reinvested and which may be

repatriated without an additional tax charge.

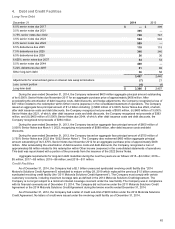

In 2013, the Company reorganized certain of its non-U.S. subsidiaries under a holding company structure in order to

facilitate the efficient movement of non-U.S. cash and provide a platform to fund foreign investments, such as potential