Motorola 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

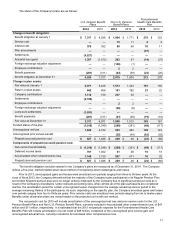

81

The Company had outstanding commitments to provide long-term financing to third-parties totaling $293 million at December 31,

2014, compared to $50 million at December 31, 2013.

Sales of Receivables

From time to time, the Company sells accounts receivable and long-term receivables to third-parties under one-time

arrangements while others are sold to third-parties. The Company may or may not retain the obligation to service the sold

accounts receivable and long-term receivables.

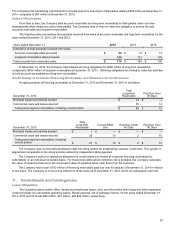

The following table summarizes the proceeds received from sales of accounts receivable and long-term receivables for the

years ended December 31, 2014, 2013 and 2012.

Years ended December 31 2014 2013 2012

Cumulative annual proceeds received from sales:

Accounts receivable sales proceeds $ 50 $ 14 $ 12

Long-term receivables sales proceeds 124 131 178

Total proceeds from receivable sales $ 174 $ 145 $ 190

At December 31, 2014, the Company had retained servicing obligations for $496 million of long-term receivables,

compared to $434 million of long-term receivables at December 31, 2013. Servicing obligations are limited to collection activities

of sold accounts receivables and long-term receivables.

Credit Quality of Customer Financing Receivables and Allowance for Credit Losses

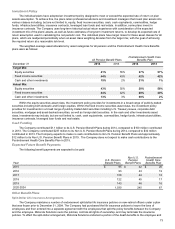

An aging analysis of financing receivables at December 31, 2014 and December 31, 2013 is as follows:

December 31, 2014

Total

Long-term

Receivable Past Due Over

90 Days

Municipal leases secured tax exempt $ 14 $ —

Commercial loans and leases secured 35 12

Total gross long-term receivables, including current portion $ 49 $ 12

December 31, 2013

Total

Long-term

Receivable Current Billed

Due Past Due Under

90 Days Past Due Over

90 Days

Municipal leases secured tax exempt $ 1 $ — $ — $ —

Commercial loans and leases secured 26 10 2 10

Total gross long-term receivables, including

current portion $ 27 $ 10 $ 2 $ 10

The Company uses an internally developed credit risk rating system for establishing customer credit limits. This system is

aligned and comparable to the rating systems utilized by independent rating agencies.

The Company’s policy for valuing the allowance for credit losses is to review all customer financing receivables for

collectability on an individual receivable basis. For those receivables where collection risk is probable, the Company calculates

the value of impairment based on the net present value of expected future cash flows from the customer.

The Company had a total of $12 million of financing receivables past due over 90 days as of December 31, 2014 in relation

to two loans. The Company is not accruing interest on these loans as of December 31, 2014, which are adequately reserved.

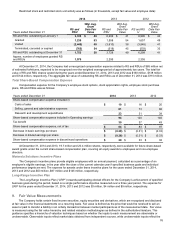

11. Commitments and Contingencies

Lease Obligations

The Company leases certain office, factory and warehouse space, land, and information technology and other equipment

under principally non-cancelable operating leases. Rental expense, net of sublease income, for the years ended December 31,

2014, 2013 and 2012 was $62 million, $51 million, and $45 million, respectively.