Motorola 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Other Information

Backlog

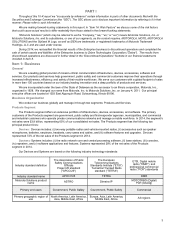

Our backlog for the Products and Services segments includes all product and service orders that have been received and

are believed to be firm. As of December 31, 2014 and December 31, 2013 our backlog was as follows:

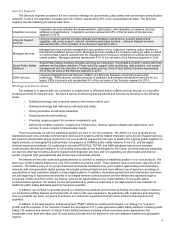

December 31

(In millions) 2014 2013

Products $ 1,194 $ 1,141

Services 4,582 4,314

$ 5,776 $ 5,455

Approximately 58% of the Products backlog and 26% of the Services segment backlog is expected to be recognized as

revenue during 2015. The forward-looking estimate of the firmness of such orders is subject to future events that may cause the

amount recognized to change.

Research and Development

We continue to prioritize investments in R&D to expand and improve our portfolio of products through both new product

introductions and continuous enhancements to our core products. Our R&D programs are focused on the development of: (i)

new public safety devices, infrastructure, and solutions, (ii) public safety broadband solutions based on the LTE technology, (iii)

smart public safety applications that include voice, data, and video.

R&D expenditures were $681 million in 2014, $761 million in 2013, and $790 million in 2012. As of December 31, 2014, we

had approximately 5,000 employees engaged in R&D activities. In addition, we engage in R&D activities with joint development

and manufacturing partners and outsource certain activities to engineering firms to further supplement our internal spend.

Intellectual Property Matters

Patent protection is important to our operations. We have a U.S. and international portfolio of patents relating to our

products, systems and technologies, including research developments in radio frequency technology and circuits, wireless

network technologies, over-the-air protocols, and mission critical two-way radio communications. We have filed patent

applications with the U.S. Patent and Trademark Office, as well as with foreign patent offices.

We license some of our patents to third-parties, but licensing revenue is not significant. We are also licensed to use certain

patents owned by others. Royalty and licensing fees vary from year-to-year and are subject to the terms of the agreements and

sales volumes of the products subject to licenses. In addition, Motorola Solutions has a royalty free-license under all of the

patents and patent applications assigned to Motorola Mobility at the time of the separation of the two businesses in 2011.

We actively participate in the development of standards for interoperable, mission-critical digital two-way radio systems.

Our patents are used in standards in which our products and services are based. We offer licenses to those patents on fair,

reasonable and non-discriminatory terms.

We believe that our patent portfolio will continue to provide us with a competitive advantage in our core product areas as

well as provide leverage for the development of future technologies. Furthermore, we believe we are not dependent upon a

single patent or a few patents. Our success depends more upon our extensive know-how, innovative culture, technical

leadership and distribution channel. We do not rely primarily on patents or other intellectual property rights to protect or establish

our market position; however, we will enforce our intellectual property rights in certain technologies when attempts to negotiate

mutually agreeable licenses are not successful.

We seek to obtain patents and trademarks to protect our proprietary position whenever possible and practical. As of

December 31, 2014, we owned approximately 4,300 patents in the U.S. and in foreign countries. As of December 31, 2014,

we had approximately 1,200 U.S. and foreign patent applications pending. Foreign patents and patent applications are mostly

counterparts of our U.S. patents. During 2014, we were granted approximately 450 patents in the U.S. and in foreign countries.

We no longer own certain logos and other trademarks, trade names and service marks, including MOTOROLA, MOTO,

MOTOROLA SOLUTIONS and the Stylized M logo and all derivatives thereof (“Motorola Marks”) and we license the Motorola

Marks from Motorola Mobility, which is currently owned by Lenovo.

Inventory and Raw Materials

Our practice is to carry reasonable amounts of inventory to meet customers’ delivery requirements in a manner consistent

with industry standards. We provide custom products which require the stocking of inventories and a large variety of piece parts

and replacement parts in order to meet delivery and warranty requirements. To the extent suppliers’ product life cycles are

shorter than ours, stocking of lifetime buy inventories is required to meet long-term warranty and contractual requirements. In

addition, replacement parts are stocked for delivery on customer demand within a short delivery cycle.

Availability of required materials and components is generally dependable; however, fluctuations in supply and market

demand could cause selective shortages and affect our results of operations. We currently procure certain materials and

components from single-source vendors. A material disruption from a single-source vendor may have a material adverse impact