Motorola 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MOTOROLA SOLUTIONS, INC.

2014 ANNUAL REPORT

TO STOCKHOLDERS

Table of contents

-

Page 1

MOTOROLA SOLUTIONS, INC. 2014 ANNUAL REPORT TO STOCKHOLDERS -

Page 2

-

Page 3

... executive offices) 1303 East Algonquin Road, Schaumburg, Illinois 60196 (847) 576-5000 (Registrant's telephone number) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $.01 Par Value per Share New York Stock... -

Page 4

... Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 5

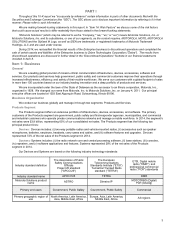

... in our financial statements included in Item 8. Item 1: Business General We are a leading global provider of mission-critical communication infrastructure, devices, accessories, software and services. Our products and services help government, public safety and commercial customers improve their... -

Page 6

... software and hardware solutions. These solutions support video monitoring, data analytics, and content management with the objective of enabling smart policing. Smart Public Safety Solutions represented 3% of the net sales of the Services segment in 2014. Integrated Digital Enhanced Network ("iDEN... -

Page 7

... government contracting requirements, please refer to "Item 1A. Risk Factors." Net sales in North America continued to comprise a significant portion of our business, accounting for 61%, 63% and 62% of our consolidated net sales in 2014, 2013, and 2012, respectively. Payment terms with our customers... -

Page 8

.... We provide custom products which require the stocking of inventories and a large variety of piece parts and replacement parts in order to meet delivery and warranty requirements. To the extent suppliers' product life cycles are shorter than ours, stocking of lifetime buy inventories is required... -

Page 9

... is now allocated to support public safety narrowband and broadband communications systems. This includes 24 MHz of spectrum previously allocated by the FCC and an additional ten MHz of spectrum (the "D block") allocated in February 2012 as part of the Middle Class Tax Relief and Job Creation Act of... -

Page 10

...country administrations to allocate public safety spectrum quickly without a protracted process or agreement. Employees At December 31, 2014, we had approximately 15,000 employees, compared to 21,000 employees at December 31, 2013. Material Dispositions • On October 27, 2014, we completed the sale... -

Page 11

... governance documents may also be obtained without charge by contacting Investor Relations, Motorola Solutions, Inc., Corporate Offices, 1303 East Algonquin Road, Schaumburg, Illinois 60196, E-mail: [email protected]. This annual report on Form 10-K and Definitive Proxy Statement... -

Page 12

.... Failure to comply with these laws could cost us opportunities to seek certain government sales opportunities or even result in fines, prosecution, or debarment. Government regulation of radio frequencies may limit the growth of public safety broadband systems or reduce barriers to entry for new... -

Page 13

... Many government customers, including most U.S. government customers, award business through a competitive bidding process, which results in greater competition and increased pricing pressure. The competitive bidding process involves significant cost and managerial time to prepare bids for contracts... -

Page 14

... customers' to an elevated risk over our private networks. Our Company outsources certain business operations, including, but not limited to IT, HR information systems, manufacturing, repair, distribution and engineering services. These arrangements are governed by various contracts and agreements... -

Page 15

... by Lenovo, we may find that an incompatible third-party owns the Motorola Marks. We have a worldwide, perpetual and royalty-free license from MTH to use the Motorola Marks as part of our corporate name and in connection with the manufacture, sale, and marketing of our current products and services... -

Page 16

... the materials, components, subsystems and services they supply, or secure preferred warranty and indemnity coverage from their suppliers which might result in greater product returns, service problems, warranty claims and costs and regulatory compliance issues and could harm our business, financial... -

Page 17

... results, (iv) cyber security risk, especially in managed services contracts with public safety and commercial customers that process data, and (v) political risk, especially related to the contracts with government customers. In addition, multi-year awards from governmental customers may often only... -

Page 18

... non-traditional suppliers, including public carriers, telecom equipment providers, consumer device manufacturers and software companies. New products are expensive to develop and bring to market and additional complexities are added when this process is outsourced as we have done in certain cases... -

Page 19

In some cases, if the quality issue affects the product's performance, safety or regulatory compliance, then such a "defective" product may need to be "stop-shipped" or recalled. Depending on the nature of the quality issue and the number of products in the field, it could cause us to incur ... -

Page 20

... assert, intellectual property infringement claims against us and against our customers and suppliers. Many of these assertions are brought by non-practicing entities whose principle business model is to secure patent licensing-based revenue from product manufacturing companies. The patent holders... -

Page 21

...of our pension plans is affected by the performance of the financial markets, particularly the equity and debt markets, and the interest rates used to calculate our pension obligations for funding and expense purposes. Minimum annual pension contributions are determined by government regulations and... -

Page 22

... and compliance programs in Europe. Item 1B: Unresolved Staff Comments None. Item 2: Properties Motorola Solutions' principal executive offices are located at 1303 East Algonquin Road, Schaumburg, Illinois 60196. Motorola Solutions also operates manufacturing facilities and sales offices in other... -

Page 23

... 2009 to September 2010. Mark S. Hacker; age 43; Executive Vice President, General Counsel and Chief Administrative Officer since January 21, 2015; Senior Vice President and General Counsel from June 2013 to January 2015; Corporate Vice President, Law, Sales and Product Operations, International... -

Page 24

... information with respect to acquisitions by the Company of shares of its common stock during the quarter ended December 31, 2014. ISSUER PURCHASES OF EQUITY SECURITIES (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Program (2) 3,596,438 14,414,401 3,934,678 21,945,517... -

Page 25

... This graph assumes $100 was invested in the stock or the indices on December 31, 2009 and reflects the payment of dividends, including the Company's distribution to its shareholders of one share of Motorola Mobility for every eight shares of its common stock on January 4, 2011. For purposes of this... -

Page 26

...) 5.29 245.6 1.30 $ $ 3.45 4.06 270.5 1.14 $ $ 2.25 2.96 297.4 0.96 $ $ 1.71 3.41 339.7 0.22 $ $ 0.37 1.87 338.1 - 2014 $ 5,881 (1,006) (697) 2013 $ 6,227 947 933 2012 $ 6,269 920 670 2011 $ 5,738 598 582 2010 $ 5,482 591 125 Amounts attributable to Motorola Solutions, Inc. common shareholders. 24 -

Page 27

... consolidated financial statements and footnotes for all periods presented. Our Business We are a leading global provider of mission-critical communication infrastructure, devices, accessories, software, and services. Our products and services help government, public safety and commercial customers... -

Page 28

...-year software & hardware maintenance contracts; Significant growth in managed services orders and pipeline opportunities; and Won six public safety accounts for our Smart Public Safety Solutions Awarded largest public safety LTE system in the world for $175 million; North America ended 2014 with... -

Page 29

...years. The majority of iDEN sales are accounted for in our Services segment. We remain committed to employing disciplined financial policies, including an additional reduction of over $100 million in selling, general, administrative, research, and development expenses in 2015, brining our cumulative... -

Page 30

... 31 (Dollars in millions, except per share amounts) Net sales from products Net sales from services Net sales Costs of product sales Costs of services sales Costs of sales Gross margin Selling, general and administrative expenses Research and development expenditures Other charges Operating earnings... -

Page 31

... sales in 2014, compared to $1.3 billion, or 21.4% of net sales in 2013. The decrease in SG&A expenditures is primarily due to: (i) the reduction of sales support costs by lowering our overall non-quota carrying employee base, (ii) lower pension expenses, (iii) lower incentive compensation expenses... -

Page 32

..., or $3.45 per diluted share, in 2013. The decrease in net earnings (loss) from continuing operations attributable to Motorola Solutions, Inc. in 2014, as compared to 2013, was primarily driven by: (i) a $1.9 billion charge related to the settlement of a U.S. pension plan and (ii) a $278 million... -

Page 33

...) a $9 million tax benefit for prior year R&D tax credits. The tax benefit associated with the excess foreign tax credits relates to the earnings of certain non-U.S. subsidiaries reorganized under our holding company structure implemented during 2013. Our effective tax rate in 2013 was unfavorably... -

Page 34

... related to the settlement of a U.S. pension plan and (ii) a decrease in net sales, resulting in lower gross margin, partially offset by lower SG&A and R&D expenditures as a result of cost savings actions taken and lower variable compensation expenses. Segment Results-2013 Compared to 2012 In 2013... -

Page 35

... in 2012 related to employees of discontinued operations. The $57 million reorganization of businesses accrual remaining at December 31, 2014, relates entirely to employee separation costs that are expected to be paid in 2015. As part of the sale of its Enterprise business, the Company retained... -

Page 36

... sale and sold or collected in 2012, partially offset by approximately $190 million of lower defined benefit plan contributions in 2012 as compared to 2013. In September 2014, we entered into a Definitive Purchase Agreement ("the Agreement") by and among Motorola Solutions, The Prudential Insurance... -

Page 37

...our employee stock option and employee stock purchase plans, and (iii) $93 million of distributions received from discontinued operations. Cash used for financing activities in 2013 was primarily comprised of: (i) $1.7 billion used for purchases of our common stock under our share repurchase program... -

Page 38

... inventory and raw materials attributable to canceled orders. Our liability would only arise in the event we terminate the agreements for reasons other than "cause." We outsource certain corporate functions, such as benefit administration and information technology-related services, the longest of... -

Page 39

... $ 2013 14 131 145 $ $ 2012 12 178 190 At December 31, 2014, the Company had retained servicing obligations for $496 million of long-term receivables, compared to $434 million of long-term receivables at December 31, 2013. Servicing obligations are limited to collection activities for sold accounts... -

Page 40

... revenue, and include the related shipping costs in cost of sales. We sell software and equipment obtained from other companies. We establish our own pricing and retain related inventory risk, are the primary obligor in sales transactions with customers, and assume the credit risk for amounts billed... -

Page 41

... non-software deliverables. We allocate arrangement consideration to multiple software or software-related deliverables, including the sale of software upgrades or software support agreements to previously sold software, in accordance with software accounting guidance. For such arrangements, revenue... -

Page 42

... buys at the end of supplier production runs, business exits, and a shift of production to outsourced manufacturing. If future demand or market conditions are less favorable than those projected by management, additional inventory writedowns may be required. Income Taxes Our effective tax rate... -

Page 43

... service costs are being amortized over periods ranging from six to twelve years. Benefits under all pension plans are valued based on the projected unit credit cost method. Our pension deficit is impacted by the volatility of corporate bond rates which are used to determine the plan discount rate... -

Page 44

... programs and employee separation costs, (g) our ability and cost to repatriate funds, (h) the impact of the timing and level of sales and the geographic location of such sales, (i) the impact of maintaining inventory, (j) future cash contributions to pension plans or retiree health benefit plans... -

Page 45

... possible, by managing net asset positions, product pricing and component sourcing. At December 31, 2014, we had outstanding foreign exchange contracts totaling $628 million, compared to $837 million outstanding at December 31, 2013. Management believes that these financial instruments should not... -

Page 46

® Reg. U.S. Patent & Trademark Office. MOTOROLA MOTO, MOTOROLA SOLUTIONS and the Stylized M Logo, as well as iDEN are trademarks or registered trademarks of Motorola Trademark Holdings, LLC and are used under license. All other products or service names are the property of their respective owners... -

Page 47

... with the standards of the Public Company Accounting Oversight Board (United States), Motorola Solutions, Inc.'s internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring... -

Page 48

Consolidated Statements of Operations Years ended December 31 (In millions, except per share amounts) Net sales from products Net sales from services Net sales Costs of product sales Costs of services sales Costs of sales Gross margin Selling, general and administrative expenses Research and ... -

Page 49

... to Motorola Solutions, Inc. common shareholders $ See accompanying notes to consolidated financial statements. 44 (353) (365) 1,168 (49) 1 46 (60) 432 1,732 1 1,731 $ 70 - 953 - (4) (2) (4) - 1,013 2,118 6 2,112 $ 177 87 (707) - 14 4 1 - (424) 457 - 457 $ 2014 1,300 $ 2013 1,105 $ 2012 881... -

Page 50

... Accounts payable Accrued liabilities Current liabilities held for disposition Total current liabilities Long-term debt Other liabilities Non-current liabilities held for disposition Stockholders' Equity Preferred stock, $100 par value Common stock, $.01 par value: Authorized shares: 600.0 Issued... -

Page 51

...and other retirement adjustments, net of tax of $571 Issuance of common stock and stock options exercised Share repurchase program Excess tax benefit from share-based compensation Share-based compensation expense Net loss on derivative hedging instruments, net of tax of $1 Purchase of noncontrolling... -

Page 52

...Loss on pension plan settlement Share-based compensation expense Gains on sales of investments Loss from the extinguishment of long-term debt Deferred income taxes Changes in assets and liabilities, net of effects of acquisitions and dispositions: Accounts receivable Inventories Other current assets... -

Page 53

...the related shipping costs in cost of sales. The Company sells software and equipment obtained from other companies. The Company establishes its own pricing and retains related inventory risk, is the primary obligor in sales transactions with customers, and assumes the credit risk for amounts billed... -

Page 54

... between software and non-software deliverables. The Company allocates arrangement consideration to multiple software or software-related deliverables, including the sale of software upgrades or software support agreements to previously sold software, in accordance with software accounting guidance... -

Page 55

...Company evaluates deferred tax assets on a quarterly basis to determine if valuation allowances are required by considering available evidence. Deferred tax assets are realized by having sufficient future taxable income to allow the related tax benefits to reduce taxes otherwise payable. The sources... -

Page 56

... rights are generally determined using a Black-Scholes option pricing model which incorporates assumptions about expected volatility, risk free rate, dividend yield, and expected life. Compensation cost for sharebased awards is recognized on a straight-line basis over the vesting period. Retirement... -

Page 57

... ASU on its consolidated financial statements and footnote disclosures. 2. Discontinued Operations On April 14, 2014, the Company entered into a Master Acquisition Agreement (the "Acquisition Agreement") with Zebra Technologies Corporation ("Zebra") to sell the Company's Enterprise business for... -

Page 58

... Other Financial Data Statement of Operations...related insurance matters, net Gain on sale of building and land $ $ 2014 4 64 1,917 8 (21) 1,972 $ $ 2013 1 70 - - - 71 $ $ 2012 1 27 - (16) - 12 During 2014, the Company completed the sale of a building and parcel of land on its Schaumburg, Illinois... -

Page 59

.... In the computation of diluted earnings per common share from continuing operations and on a net earnings basis for the years ended December 31, 2013 and December 31, 2012, the assumed exercise of 5.6 million and 5.9 million stock options, respectively, were excluded because their inclusion would... -

Page 60

... - - 70 70 - - 70 $ $ Cost Basis 14 16 2 1 33 191 22 246 Recorded Value December 31, 2013 Available-for-sale securities: Government, agency, and government-sponsored enterprise obligations Corporate bonds Mutual funds Common stock and equivalents Other investments, at cost Equity method investments... -

Page 61

...and production materials Less inventory reserves $ Other Current Assets Other current assets consist of the following: December 31 Costs and earnings in excess of billings Tax-related deposits and refunds receivable Zebra receivable for cash transferred Other $ 2014 $ 417 103 49 171 740 $ $ 2013 405... -

Page 62

... Compensation Billings in excess of costs and earnings Tax liabilities Customer liabilities Dividend payable Other $ Other Liabilities Other liabilities consist of the following: December 31 Defined benefit plans Postretirement health care benefit plan Deferred revenue Unrecognized tax benefits... -

Page 63

... hedges: Foreign exchange contracts $ $ Unrealized Gains and Losses on Available-for-Sale Securities: Realized gain 2014 1 1 $ $ 2013 Statement of Operations Location (1) Cost of sales (1) Net of tax $ $ - - - $ $ (4) Gains on sales of investments and businesses, net 1 Tax benefit (3) Net of... -

Page 64

... Solutions Credit Agreement or the 2014 Motorola Solutions Credit Agreement during the twelve months ended December 31, 2014. As of December 31, 2014, the Company had a letter of credit sub-limit of $450 million under the 2014 Motorola Solutions Credit Agreement. No letters of credit were issued... -

Page 65

5. Risk Management Foreign Currency Risk The Company uses financial instruments to reduce its overall exposure to the effects of currency fluctuations on cash flows. The Company's policy prohibits speculation in financial instruments for profit on exchange rate price fluctuations, trading in ... -

Page 66

... Instruments Derivatives not designated as hedging instruments: Interest rate contracts Foreign exchange contracts Total derivatives not designated as hedging instruments $ $ 2014 2013 2012 Statement of Operations Location 1 (5) $ 2 6 8 $ (1) Other income (expense) (13) Other income (expense... -

Page 67

...net gains (losses) on derivative instruments and fair value adjustments to available-for-sale securities. The adjustments were $286 million, $606 million and $(272) million for the years ended December 31, 2014, 2013 and 2012, respectively. The Company evaluates its permanent reinvestment assertions... -

Page 68

... tax credits relating to the earnings of certain non-U.S. subsidiaries reorganized under the holding company structure. Differences between income tax expense (benefit) computed at the U.S. federal statutory tax rate of 35% and income tax expense (benefit) as reflected in the consolidated statements... -

Page 69

... Non-U.S. Subsidiaries: China tax losses Japan tax losses Germany tax losses United Kingdom tax losses Singapore tax losses Other subsidiaries tax losses Spain tax credits Other subsidiaries tax credits The Company had unrecognized tax benefits of $96 million and $147 million at December 31, 2014... -

Page 70

... Malaysia Singapore United Kingdom Tax Years 2008-2014 2002-2014 2010-2014 2008-2014 1997-2014 2012-2014 2011-2014 2009-2014 2010-2014 2008-2014 Although the final resolution of the Company's global tax disputes is uncertain, based on current information, in the opinion of the Company's management... -

Page 71

... $16 million of prior service cost credit, respectively, was recognized into the Company's consolidated statements of operations for amendments to the Postretirement Health Care Benefits Plan. In September 2014, the Company entered into a Definitive Purchase Agreement (the "Agreement") by and among... -

Page 72

... (77) 22 (3) - 25 $ $ Postretirement Health Care Benefits Plan 2014 2 10 (10) 9 (50) - (39) $ $ 2013 2 11 (10) 14 (43) - (26) $ $ 2012 3 16 (12) 12 (16) - 3 U.S. Pension Benefit Plans Years ended December 31 Service cost Interest cost Expected return on plan assets Amortization of: Unrecognized net... -

Page 73

... years. Benefits under all pension plans are valued based on the projected unit credit cost method. The net periodic cost for 2015 will include amortization of the unrecognized net loss and prior service costs for the U.S. Pension Benefit Plans and Non U.S. Pension Benefit Plans, currently included... -

Page 74

... to determine benefit obligations for the plans were as follows: Postretirement Health Care Benefits Plan 2014 3.90% n/a 2013 4.65% n/a U.S. Pension Benefit Plans 2014 Discount rate Future compensation increase rate 4.30% n/a 2013 5.15% n/a Non U.S. Pension Benefit Plans 2014 3.19% 2.54% 2013 4.24... -

Page 75

... 2004. The Company had purchased the life insurance policies to insure the lives of employees and then entered into a separate agreement with the employees that split the policy benefits between the Company and the employee. Motorola Solutions owns the policies, controls all rights of ownership, and... -

Page 76

...remainder of the death benefits. It is currently expected that minimal cash payments will be required to fund these policies. The net periodic pension cost for these split-dollar life insurance arrangements was $5 million for the years ended December 31, 2014, 2013 and 2012. The Company has recorded... -

Page 77

... exercisable at December 31 Approx. number of employees granted options At December 31, 2014, the Company had $21 million of total unrecognized compensation expense, net of estimated forfeitures, related to stock option plans and the employee stock purchase plan that will be recognized over the... -

Page 78

...31, 2014 was $110 million. Total Share-Based Compensation Expense Compensation expense for the Company's employee stock options, stock appreciation rights, employee stock purchase plans, RS and RSUs was as follows: Years ended December 31 Share-based compensation expense included in: Costs of sales... -

Page 79

... bonds held in one of our non-U.S. pension plans. These corporate bonds are valued using pricing models which contain unobservable inputs and have limited liquidity. Determining the fair value of these securities requires the use of unobservable inputs, such as indicative quotes from dealers... -

Page 80

... 31, 2014 and 2013 were as follows: U.S. Pension Benefit Plans December 31, 2014 Common stock and equivalents Commingled equity funds Preferred stock Government, agency and government-sponsored enterprise obligations Other government bonds Corporate bonds Mortgage-backed bonds Commingled short... -

Page 81

Non-U.S. Pension Benefit Plans December 31, 2014 Common stock and equivalents Commingled equity funds Government, agency, and government-sponsored enterprise obligations Corporate bonds Commingled bond funds Commingled short-term investment funds Total investment securities Cash Accrued income ... -

Page 82

Postretirement Health Care Benefits Plan December 31, 2014 Common stock and equivalents Commingled equity funds Government, agency, and government-sponsored enterprise obligations Other government bonds Corporate bonds Commingled bond funds Commingled short-term investment funds Fair value plan ... -

Page 83

... at December 31, 2013. Servicing obligations are limited to collection activities of sold accounts receivables and long-term receivables. Credit Quality of Customer Financing Receivables and Allowance for Credit Losses An aging analysis of financing receivables at December 31, 2014 and December 31... -

Page 84

...and manages through following two segments: Products: The Products segment offers an extensive portfolio of infrastructure, devices, accessories, and software. The primary customers of the Products segment are government, public safety and first-responder agencies, municipalities, and commercial and... -

Page 85

...at defined services levels. Smart Public Safety Solutions includes software and hardware solutions for our customers' "Command & Control" centers providing video monitoring support, data analytics, and content management with the objective of enabling smart policing. iDEN services consists primarily... -

Page 86

...The employees affected were located in all geographic regions. 2014 Charges During 2014, the Company recorded net reorganization of business charges of $73 million, including $9 million of charges in Costs of sales and $64 million of charges in Other charges in the Company's consolidated statements... -

Page 87

...December 31 Products Services $ 2012 $ 22 11 33 The following table displays a rollforward of the reorganization of businesses accruals established for exit costs and employee separation costs, including those related to discontinued operations which were maintained by the Company after the sale of... -

Page 88

... Company accounts for acquisitions using purchase accounting with the results of operations for each acquiree included in the Company's consolidated financial statements for the period subsequent to the date of acquisition. The pro forma effects of the acquisitions completed in 2014, 2013, and 2012... -

Page 89

... including macroeconomic conditions, industry and market conditions, cost factors, overall financial performance, changes in share price, and entity-specific events. For fiscal years 2014, 2013, and 2012, the Company concluded it was more-likely-than-not that the fair value of each reporting unit... -

Page 90

...747 750 339 195 13 203 223 258 $ 2013 3rd 1,517 752 765 319 183 17 246 261 307 $ 4th 1,817 916 901 347 196 34 324 292 342 Operating Results Net sales Costs of sales Gross margin Selling, general and administrative expenses Research and development expenditures Other charges Operating earnings (loss... -

Page 91

... and Exchange Commission ("SEC") reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) is accumulated and communicated to Motorola Solutions' management, including our chief executive officer and chief financial officer, as... -

Page 92

... REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders Motorola Solutions, Inc.: We have audited Motorola Solutions, Inc.'s internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework (2013) issued by... -

Page 93

... free of charge, upon request to Investor Relations, Motorola Solutions, Inc., Corporate Offices, 1303 East Algonquin Road, Schaumburg, Illinois 60196, E-mail: [email protected]. Any amendment to, or waiver from, the Code applicable to executive officers will be posted on our Internet... -

Page 94

... Exhibit Index attached hereto, which is incorporated herein by this reference. Exhibit numbers 10.7 through 10.71, listed in the attached Exhibit Index, are management contracts or compensatory plans or arrangements required to be filed as exhibits to this form by Item 15(b) hereof. (b) Exhibits... -

Page 95

... of the years in the three-year period ended December 31, 2014, and the effectiveness of internal control over financial reporting as of December 31, 2014, which reports appear in the December 31, 2014 annual report on Form 10-K of Motorola Solutions, Inc. Chicago, Illinois February 13, 2015 93 -

Page 96

...Q. Brown Chairman and Chief Executive Officer February 13, 2015 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of Motorola Solutions, Inc. and in the capacities and on the dates indicated. Signature Title Date... -

Page 97

.... 2 to the Form 10 Registration Statement filed on October 8, 2010 by Motorola Mobility Holdings, Inc. (formerly Motorola SpinCo Holdings Corporation (File No. 1-34805)). 10.6 Stock Purchase Agreement, dated as of November 4, 2014, by and among Motorola Solutions, Inc. and ValueAct (incorporated by... -

Page 98

... to Motorola Solutions' Annual Report on Form 10K for the fiscal year ended December 31, 2010 ( File No. 1-7221)). 10.25 Form of Motorola, Inc. Award Document-Terms and Conditions Related to Employee Nonqualified Stock Options for Gregory Q. Brown, relating to the Motorola Omnibus Incentive Plan of... -

Page 99

...reference to Exhibit 10.37 to Motorola Solutions' Annual Report on Form 10-K for the fiscal year ended December 31, 2010 (File No. 1-7221)). 10.33 Form of Deferred Stock Units Agreement between Motorola, Inc. and its non-employee directors, relating to the deferred stock units issued in lieu of cash... -

Page 100

... *10.57 Description of Insurance covering non-employee directors and their spouses (including a description incorporated by reference from the information under the caption "Director Retirement Plan and Insurance Coverage" of the Motorola Solutions' Proxy Statement. 10.58 Employment Agreement dated... -

Page 101

23 Consent of Independent Registered Public Accounting Firm, see page xx of the Annual Report on Form 10-K of which this Exhibit Index is a part. *31.1 Certification of Gregory Q. Brown pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. *31.2 Certification of Gino A. Bonanotte pursuant to ... -

Page 102

[This page intentionally left blank] -

Page 103

... online at www.motorolasolutions.com investors Inquiries should be directed to: Investor Relations Motorola Solutions, Inc. 1303 E. Algonquin Road Schaumburg, IL 60196 U.S.A. Email investors motorolasolutions.com +1 847 538 7367 Common Stock Motorola Solutions common stock is listed on the New York... -

Page 104

....com MOTOROLA, MOTO, MOTOROLA SOLUTIONS and the Stylized M Logo are trademarks or registered trademarks of Motorola Trademark Holdings, LLC and are used under license. All other trademarks are the property of their respective owners. © 2015 Motorola Solutions, Inc. All rights reserved. Motorola...