Mazda 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

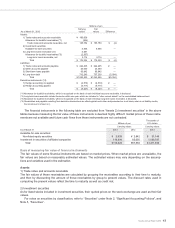

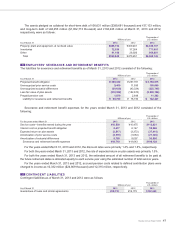

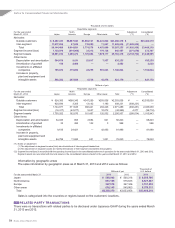

14 INCOME TAXES

The effective tax rate reflected in the consolidated statement of operations for the year ended March 31, 2013 differs

from the statutory tax rate for the following reasons.

For the year ended March 31 2013

Statutory tax rate 37.8%

Valuation allowance (31.3)

Equity in net income of affiliated companies (9.7)

Effect of adjustment of gain on sales of stock for subsidiaries and affiliates 17.1

Other (2.1)

Effective tax rate 11.8%

For the year ended March 31, 2012, since loss before income taxes was reported, the information on the recon-

ciliation from statutory tax rate to effective tax rate is not provided in accordance with the applicable provisions of

Japanese GAAP.

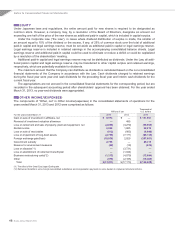

Deferred tax assets and liabilities reflect the estimated tax effects of loss carryforwards and accumulated

temporary differences between assets and liabilities for financial accounting purposes and those for tax purposes.

The significant components of deferred tax assets and liabilities as of March 31, 2013 and 2012 were as follows:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2013 2012 2013

Deferred tax assets:

Allowance for doubtful receivables ¥ 1,528 ¥ 1,619 $ 16,255

Employees’ severance and retirement benefits 23,417 25,390 249,117

Loss on impairment of long-lived assets 5,308 8,740 56,468

Accrued bonuses and other reserves 19,226 19,855 204,532

Inventory valuation 6,613 7,075 70,351

Valuation loss on investment securities, etc. 1,399 1,589 14,883

Deferred gains/(losses) on hedges 9,043 2,146 96,202

Net operating loss carryforwards 119,359 128,920 1,269,777

Other 46,082 38,748 490,234

Total gross deferred tax assets 231,975 234,082 2,467,819

Less valuation allowance (162,737) (178,423) (1,731,245)

Total deferred tax assets 69,238 55,659 736,574

Deferred tax liabilities:

Asset retirement cost corresponding to asset retirement obligations, and others (7,050) (7,582) (75,000)

Net deferred tax assets ¥ 62,188 ¥ 48,077 $ 661,574

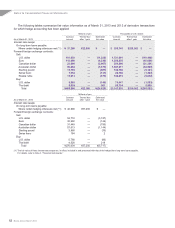

The net deferred tax assets are included in the following accounts in the consolidated balance sheet:

Millions of yen

Thousands of

U.S. dollars

As of March 31 2013 2012 2013

Current assets—Deferred tax assets ¥59,999 ¥45,997 $638,287

Investments and other assets—Deferred tax assets 5,155 6,035 54,840

Current liabilities—Other current liabilities (38) (69) (404)

Long-term liabilities—Other long-term liabilities (2,928) (3,886) (31,149)

Net deferred tax assets ¥62,188 ¥48,077 $661,574

Mazda Annual Report 2013 49