Mazda 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

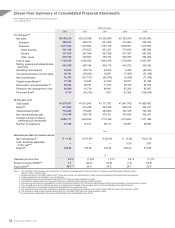

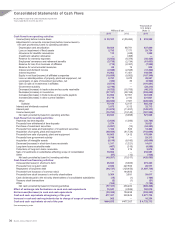

Eleven-Year Summary of Consolidated Financial Statements

Mazda Motor Corporation and Consolidated Subsidiaries

Years ended March 31

Millions of yen

2013 2012 2011 2010 2009

For the year*2:

Net sales ¥2,205,270 ¥2,033,058 ¥2,325,689 ¥2,163,949 ¥2,535,902

Domestic 588,042 560,216 541,490 574,982 620,336

Overseas 1,617,228 1,472,842 1,784,199 1,588,967 1,915,566

North America 651,165 575,633 631,327 574,640 697,600

Europe 347,918 347,346 427,398 477,337 653,382

Other areas 618,145 549,863 725,474 536,990 564,584

Cost of sales 1,729,296 1,662,592 1,863,678 1,710,699 2,021,851

Selling, general and administrative

expenses 422,038 409,184 438,176 443,792 542,432

Operating income/(loss) 53,936 (38,718) 23,835 9,458 (28,381)

Income/(loss) before income taxes 39,101 (55,262) 16,081 (7,265) (51,339)

Net income/(loss) 34,304 (107,733) (60,042) (6,478) (71,489)

Capital expenditures*377,190 78,040 44,722 29,837 81,838

Depreciation and amortization*459,954 68,791 71,576 76,428 84,043

Research and development costs 89,930 91,716 90,961 85,206 95,967

Free cash flow*58,746 (79,415) 1,627 67,394 (129,244)

At the year-end:

Total assets ¥1,978,567 ¥1,915,943 ¥1,771,767 ¥1,947,769 ¥1,800,981

Equity*6513,226 474,429 430,539 509,815 414,731

Interest-bearing debt 718,983 778,085 693,000 722,128 753,355

Net interest-bearing debt 274,108 300,778 370,151 375,825 532,631

Average number of shares

outstanding (in thousands) 2,989,171 1,863,949 1,770,198 1,519,652 1,371,456

Number of employees 37,745 37,617 38,117 38,987 39,852

Yen

Amounts per share of common stock:

Net income/(loss)*7¥ 11.48 ¥ (57.80) ¥ (33.92) ¥ (4.26) ¥ (52.13)

Cash dividends applicable

to the year*8—— — 3.00 3.00

Equity*9166.04 156.85 242.24 286.92 314.98

%

Operating income ratio 2.4% (1.9)% 1.0 % 0.4 % (1.1)%

Return on equity (ROE)*10 7.1 (24.0) (12.8) (1.4) (14.8)

Equity ratio*10 25.1*11 24.5 24.2 26.1 22.9

Notes: 1. The translation of the Japanese yen amounts into U.S. dollars is presented solely for the convenience of readers, using the prevailing exchange rate on

March 31, 2013, of ¥94 to US$1.

2. Results information for the March 2004 and 2011 fiscal years include 15-month results for certain overseas subsidiaries that changed their fiscal year-end.

3. Capital expenditures are calculated on an accrual basis.

4. Amortization expenses are not included for the March 2007 fiscal year and preceding fiscal years.

5. Free cash flow represents the sum of net cash flows from operating activities and from investing activities.

6. Prior-year amounts have been reclassified to conform to figures for the March 2007 fiscal year and subsequent fiscal years presentation to include minority interests.

7. The computations of net income/(loss) per share of common stock are based on the average number of shares outstanding during each fiscal year.

8. Cash dividends per share represent actual amounts applicable to the respective years.

9. The amounts of equity used in the calculation of equity per share exclude minority interests (and, from the March 2007 fiscal year, stock acquisition rights).

10. The amounts of equity exclude minority interests (and, from the March 2007 fiscal year, stock acquisition rights).

11. Percentage after consideration of the equity credit attributes of the subordinated loan is 26.9%.

Mazda Annual Report 2013

28