Mazda 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8 IMPAIRMENT OF LONG-LIVED ASSETS

For the purpose of reviewing for impairment, assets are generally grouped by company; however, idle assets, assets

for rent and assets for selling are individually reviewed for impairment.

For the years ended March 31, 2013 and 2012, the Domestic Companies recognized an impairment loss of

¥2,795 million ($29,734 thousand) and ¥763 million, respectively, on idle assets.

In addition, for the year ended March 31, 2012, the Company and a consolidated foreign subsidiary in the United

States reduced the value of its land and buildings for selling by ¥6,408 million.

As a result, the total impairment loss that was recognized in the consolidated statement of operations for the

years ended March 31, 2013 and 2012 amounted to ¥2,795 million ($29,734 thousand) and ¥7,171 million, respectively.

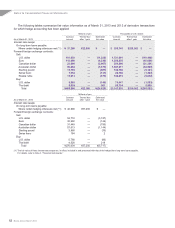

9 SHORT-TERM DEBT AND LONG-T ERM DEBT

Short-term debt as of March 31, 2013 and 2012 consisted of loans, principally from banks with interest averaging

1.04% and 0.94% for the respective years.

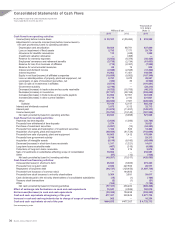

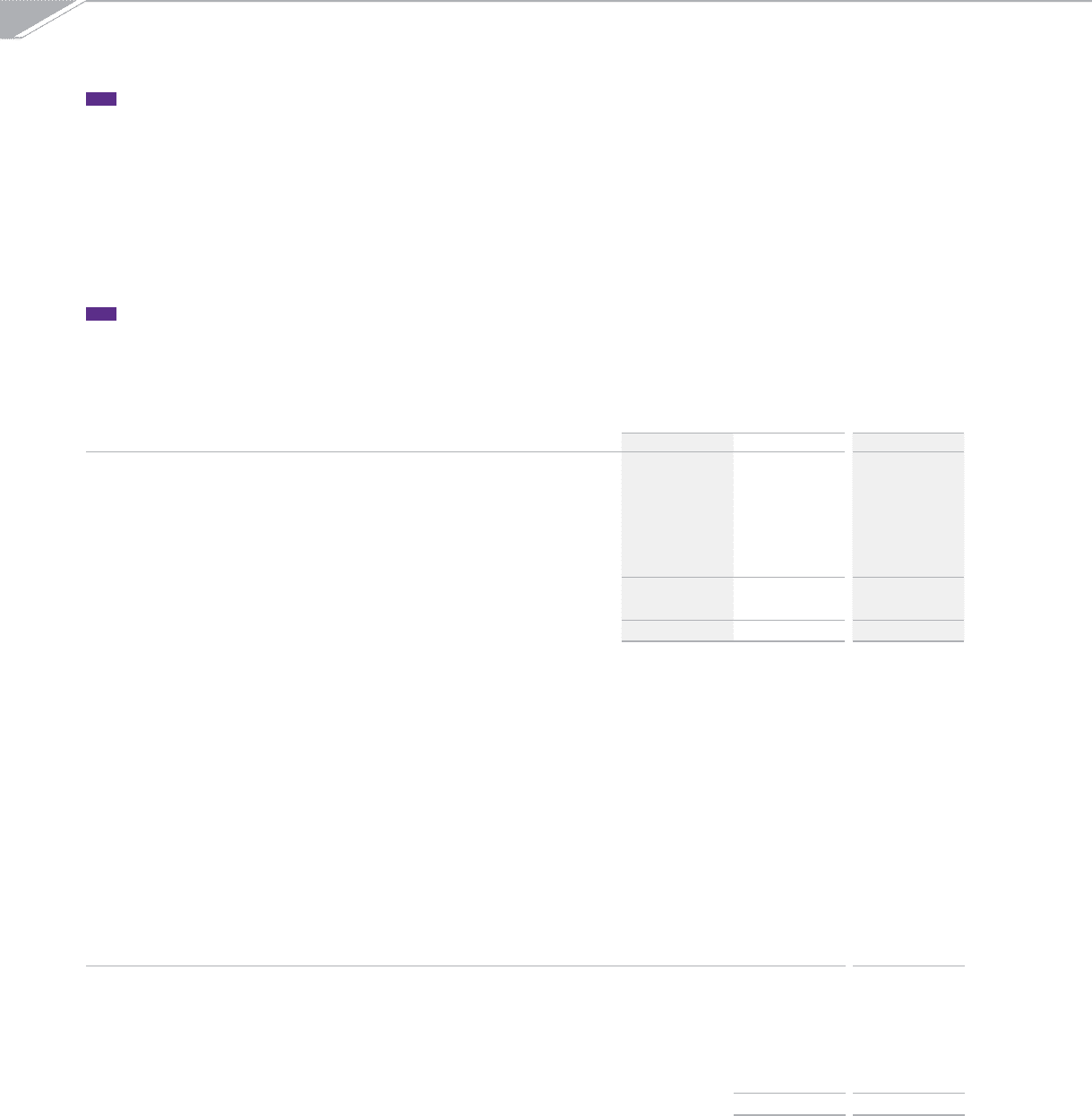

Long-term debt as of March 31, 2013 and 2012 consisted of the following:

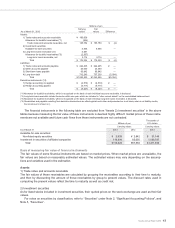

Millions of yen

Thousands of

U.S. dollars

As of March 31 2013 2012 2013

Domestic unsecured bonds due serially 2013 through 2016

at rate of 0.56% to 1.87% per annum ¥ 50,650(*) ¥ 95,750 $ 538,830

Loans principally from banks, maturing through 2072:

Secured loans 93,605 103,495 995,798

Unsecured loans 471,028 500,987 5,010,935

Lease obligations, maturing through 2020 5,867 12,011 62,415

Sub total 621,150 712,243 6,607,978

Amount due within one year (104,270) (94,241) (1,109,255)

Total ¥ 516,880 ¥618,002 $ 5,498,723

(*) As of March 31, 2013, certain of these unsecured bonds amounting to ¥650 million ($6,915 thousand) are bank-guaranteed under the condition that assets

are pledged to the bank as collateral by the issuer of the bonds.

The annual interest rates applicable to long-term loans and lease obligations outstanding averaged 1.62% and

2.26%, respectively, for obligations due within one year and 1.91% and 2.17%, respectively, for obligations due after

one year at March 31, 2013.

The annual interest rates applicable to long-term loans and lease obligations outstanding averaged 1.52% and

3.22%, respectively, for obligations due within one year and 1.86% and 2.31%, respectively, for obligations due after

one year at March 31, 2012.

As is customary in Japan, general agreements with banks include provisions that security and guarantees will be

provided if requested by banks. Banks have the right to offset cash deposited with them against any debt or obligation

that becomes due and, in the case of default or certain other specified events, against all debts payable to banks.

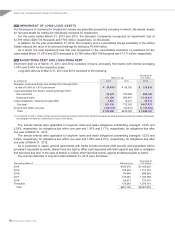

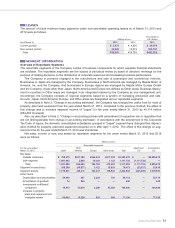

The annual maturities of long-term debt at March 31, 2013 were as follows:

Year ending March 31 Millions of yen

Thousands of

U.S. dollars

2014 ¥104,270 $1,109,255

2015 108,229 1,151,372

2016 84,546 899,426

2017 125,245 1,332,394

2018 69,317 737,415

Thereafter 129,543 1,378,116

Total ¥621,150 $6,607,978

Notes to Consolidated Financial Statements

Mazda Annual Report 2013

46