Mazda 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management of market risks (i.e., risks associated to fluctuations in foreign exchange rates and interest rates)

The Company and some of its consolidated subsidiaries hedge the risk of foreign exchange rate fluctuation on

foreign-currency-denominated receivables and payables, using foreign exchange forward contracts, on a monthly

and individual currency basis. Foreign exchange forward contracts are executed as necessary, up to six months

ahead at longest, on foreign-currency-denominated receivables and payables that are expected to arise with

certainty as a result of forecasted export and import transactions.

The Company and some of its consolidated subsidiaries use interest rate swaps in order to reduce the risk of

interest rate fluctuation on loans payable.

For details on management of derivative transactions, refer to Note 15, “Derivative Financial Instruments and

Hedging Transactions”.

As regards short-term investments and investment securities, their fair values as well as the financial standing of

their issuing entities are monitored on a regular basis. Ownership of available-for-sale securities are reviewed on a

continuous basis.

Management of liquidity risks related to financing (i.e., risks of non-performance of payments on their due dates)

The liquidity risks of the Company and its consolidated subsidiaries are managed mainly through the preparation

and update of the cash schedule by the Treasury Department.

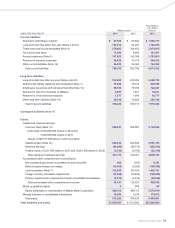

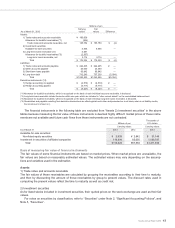

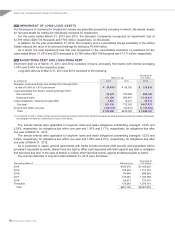

Fair values of financial instruments

As of March 31, 2013 and 2012, the carrying values on the consolidated balance sheet, the fair values, and the dif-

ferences between these amounts, respectively, of financial instruments were as follows. Financial instruments which

fair value is deemed highly difficult to measure are excluded from the following table.

Millions of yen Thousands of U.S. dollars

As of March 31, 2013

Carrying

values

Fair

values Difference

Carrying

values

Fair

values Difference

Assets:

1) Trade notes and accounts receivable ¥ 171,770 $ 1,827,340

Allowance for doubtful receivables (*1) (208) (2,213)

Trade notes and accounts receivable, net 171,562 ¥ 171,560 ¥ (2) 1,825,127 $ 1,825,106 $ (21)

2) Investment securities

Available-for-sale securities 6,884 6,884 — 73,234 73,234 —

3) Long-term loans receivable (*2) 5,750 61,170

Allowance for doubtful receivables (*3) (2,561) (27,245)

Long-term loans receivable, net 3,189 3,189 — 33,925 33,925 —

Total ¥ 181,635 ¥ 181,633 ¥ (2) $ 1,932,286 $ 1,932,265 $ (21)

Liabilities:

1) Trade notes and accounts payable ¥ 279,642 ¥ 279,642 ¥ —$ 2,974,915 $ 2,974,915 $ —

2) Other accounts payable 22,146 22,146 — 235,596 235,596 —

3) Short-term loans payable 97,833 97,833 — 1,040,777 1,040,777 —

4) Long-term debt 621,150 636,170 15,020 6,607,978 6,767,765 159,787

Total ¥1,020,771 ¥1,035,791 ¥15,020 $10,859,266 $11,019,053 $159,787

Derivative instruments: (*4)

1) Hedge accounting not applied ¥ (15,940) ¥ (15,940) ¥ — $ (169,574) $ (169,574) $ —

2) Hedge accounting applied (24,025) (24,025) — (255,585) (255,585) —

Total ¥ (39,965) ¥ (39,965) ¥ — $ (425,159) $ (425,159) $ —

Notes to Consolidated Financial Statements

Mazda Annual Report 2013

42