Mazda 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

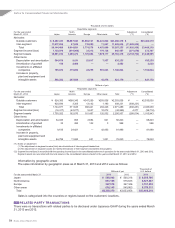

12 EQUITY

Under Japanese laws and regulations, the entire amount paid for new shares is required to be designated as

common stock. However, a company may, by a resolution of the Board of Directors, designate an amount not

exceeding one half of the price of the new shares as additional paid-in capital, which is included in capital surplus.

Under the Corporate Law (“the Law”), in cases where dividend distribution of surplus is made, the smaller of

an amount equal to 10% of the dividend or the excess, if any, of 25% of common stock over the total of additional

paid-in capital and legal earnings reserve, must be set aside as additional paid-in capital or legal earnings reserve.

Legal earnings reserve is included in retained earnings in the accompanying consolidated balance sheets. Legal

earnings reserve and additional paid-in capital could be used to eliminate or reduce a deficit or could be capitalized

by a resolution of the shareholders’ meeting.

Additional paid-in capital and legal earnings reserve may not be distributed as dividends. Under the Law, all addi-

tional paid-in capital and legal earnings reserve may be transferred to other capital surplus and retained earnings,

respectively, which are potentially available for dividends.

The maximum amount that the Company can distribute as dividends is calculated based on the non-consolidated

financial statements of the Company in accordance with the Law. Cash dividends charged to retained earnings

during the fiscal year were year-end cash dividends for the preceding fiscal year and interim cash dividends for the

current fiscal year.

The appropriations are not accrued in the consolidated financial statements for the corresponding period, but are

recorded in the subsequent accounting period after shareholders’ approval has been obtained. For the year ended

March 31, 2013, no year-end dividends were appropriated.

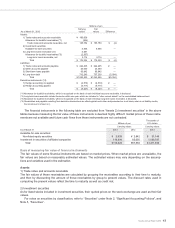

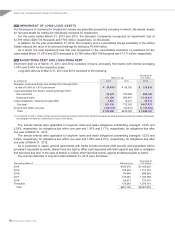

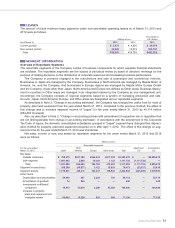

13 OTHER INCOME/(EXPENSES)

The components of “Other, net” in Other income/(expenses) in the consolidated statements of operations for the

years ended March 31, 2013 and 2012 were comprised as follows:

Millions of yen

Thousands of

U.S. dollars

For the years ended March 31 2013 2012 2013

Gain on sale of investment in affiliates, net ¥ 9,574 ¥ — $ 101,851

Reversal of investment valuation allowance — 495 —

Loss on retirement and sale of property, plant and equipment, net (2,825) (3,270) (30,053)

Rental income 2,088 1,885 22,213

Loss on sale of receivables (813) (983) (8,649)

Loss on impairment of long-lived assets (2,795) (7,171) (29,734)

Foreign exchange gain/(loss) (19,538) 2,929 (207,851)

Government subsidy 2,746 — 29,213

Reserve for environment measures (60) (19) (638)

Loss on disaster(*1) —(3,731) —

Loss on abolishment of retirement benefit plan —(1,044) —

Business restructuring costs(*2) (1,212) (4,079) (12,894)

Other (976) (2,185) (10,383)

Total ¥(13,811) ¥(17,173) $(146,925)

(*1) The effect of the Great East Japan Earthquake.

(*2) Retirement benefits in some foreign consolidated subsidiaries and compensation payments to some dealers to implement structural reforms.

Notes to Consolidated Financial Statements

Mazda Annual Report 2013

48