Mazda 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Mazda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

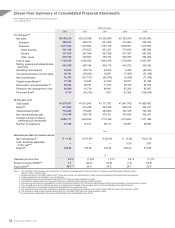

2013 2014 (Outlook)

77.2

130.0

Capital Expenditures

Billions of yen

2013 2014 (Outlook)

89.9 100.0

R&D Costs

Billions of yen

US$ / Yen 83

€ / Yen 107

US$ / Yen 90

€ / Yen 120

2013 2014(Outlook)

Volume & Mix

+49.9

Foreign

exchange

+56.0

Cost

improvements

+15.7

Marketing

expenses

(18.3) Others

(37.2)

53.9

120.0

Operating Income Change

Billions of yen

YoY +66.1

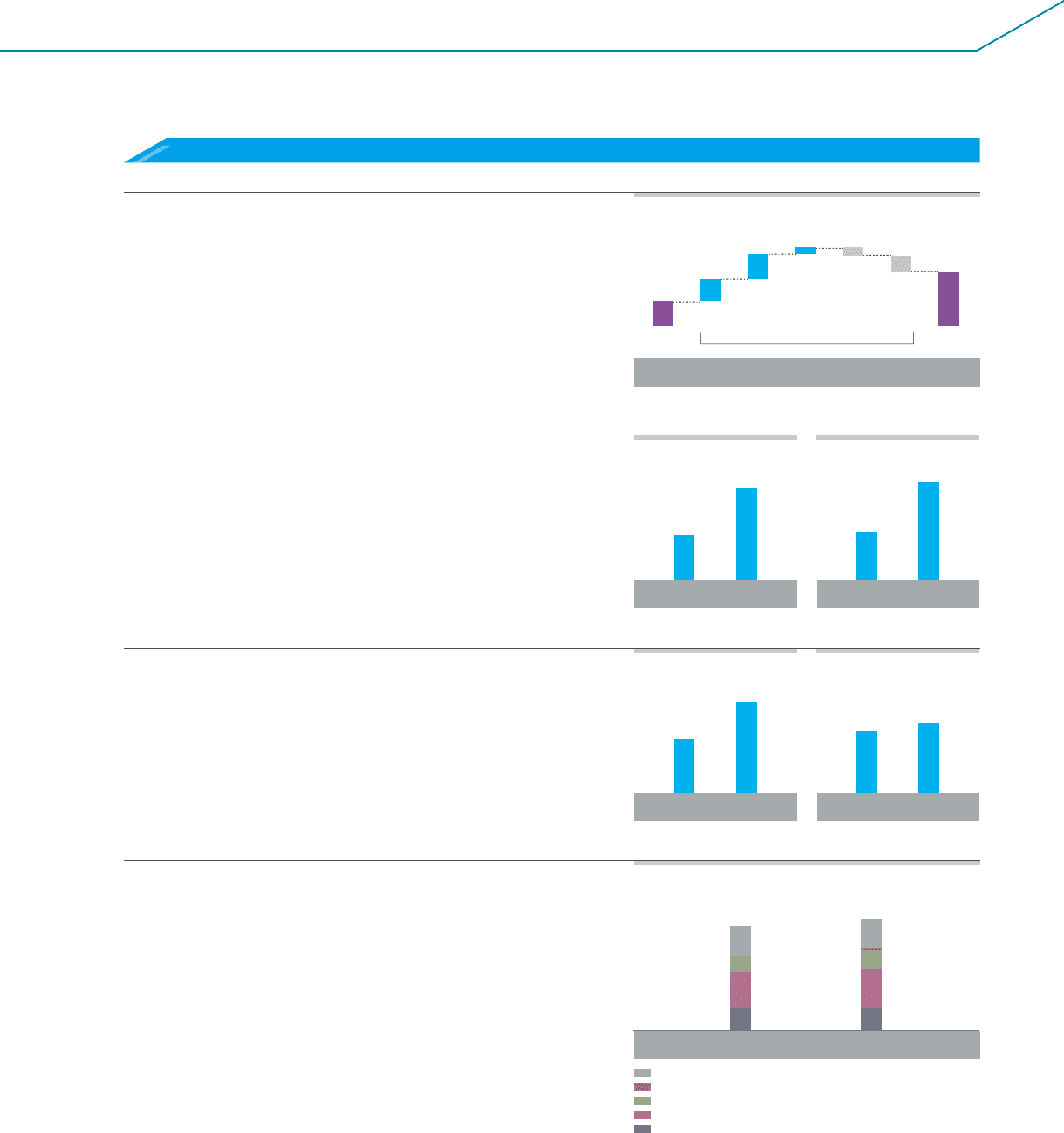

2013 2014 (Outlook)

1,053 1,120

295 291

414

158 191

226 228

370 396

Consolidated Wholesales

Thousands of units

Other markets

China

Europe

North America

Japan

2013 2014 (Outlook)

34.3

70.0

Net Income

Billions of yen

2013 2014 (Outlook)

11.5

23.4

Net Income/(Loss) per Share

Yen

(Years ended March 31)

(Years ended March 31)

(Years ended March 31)

(Years ended March 31)

(Years ended March 31)

(Years ended March 31)

Operating income and net income

We are forecasting a ¥66.1 billion improvement in operating income for

the March 2014 fiscal year, to ¥120.0 billion. This includes an anticipated

¥49.9 billion improvement from increased sales volume and an improved

model mix, from an increase in sales of SKYACTIV-equipped vehicles. We

also expect a ¥56.0 billion boost from foreign exchange factors (based

on exchange rate assumptions of ¥90/USD and ¥120/euro).

With regard to variable costs, we expect a ¥15.7 billion improvement

from ongoing cost improvement activities. We are planning for a ¥18.3

billion increase in marketing expenses as we strengthen our sales pro-

motion activities for SKYACTIV-equipped vehicles at the global level,

focusing on the new Mazda3 (Japanese name: Axela). We are forecast-

ing a ¥37.2 billion increase in other fixed expenses as we increase our

investment for the future.

As for net income, we are forecasting a ¥35.7 billion improvement to

¥70.0 billion, with an ¥1 1.9 improvement in net income per share, to ¥23.4.

Capital expenditures and R&D costs

We are planning to increase capital expenditures by ¥52.8 billion in the

March 2014 fiscal year, to ¥130.0 billion. The main components of this

increase are investments for the plant in Mexico and the transmission

plant in Thailand to establish our global production footprint. We are

forecasting a ¥10.1 billion increase in research and development costs,

to ¥100.0 billion.

Consolidated wholesales

We are planning for an increase of about 67,000 units in consolidated

wholesales for the March 2014 fiscal year, to 1,120,000 units. We expect

strong sales of the SKYACTIV-equipped CX-5 and new Mazda6 to lead to

increased wholesales in all major markets, particularly in Europe and

the United States.

Outlook for the March 2014 Fiscal Year

Mazda Annual Report 2013 19