Lumber Liquidators 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

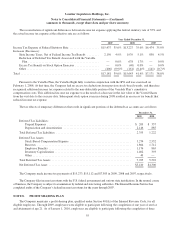

months of service and attainment of age 21. The Company matches 50% of employee contributions up to 6% of eligible

compensation. The Company’s matching contributions, included in SG&A, totaled $404, $344 and $231 in 2009, 2008 and

2007, respectively.

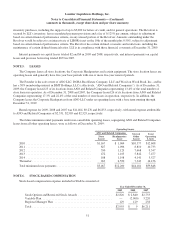

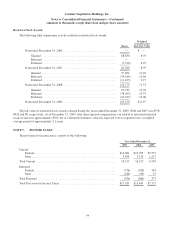

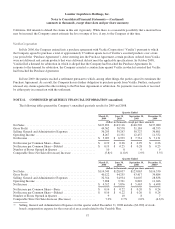

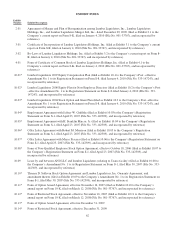

NOTE 9. NET INCOME PER COMMON SHARE

The following table sets forth the computation of basic and diluted net income per common share:

Year Ended December 31,

2009 2008 2007

Net Income ....................................................... $ 26,924 $ 22,149 $ 11,326

Weighted Average Common Shares Outstanding—Basic ................... 26,983,689 26,772,288 16,646,674

Effect of Dilutive Securities:

Common Stock Equivalents ...................................... 700,858 318,305 150,460

Redeemable Preferred Stock ..................................... — — 6,837,861

Weighted Average Common Shares Outstanding—Diluted ................. 27,684,547 27,090,593 23,634,995

Net Income per Common Share—Basic ................................ $ 1.00 $ 0.83 $ 0.68

Net Income per Common Share—Diluted ............................... $ 0.97 $ 0.82 $ 0.48

The following have been excluded from the computation of Weighted Average Common Shares Outstanding—Diluted

because the effect would be anti-dilutive:

As of December 31,

2009 2008 2007

Stock Options ............................................. 10,436 435,760 170,000

Restricted Stock Awards ..................................... — 5,800 81,300

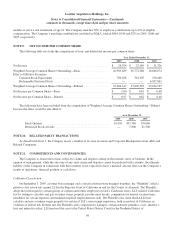

NOTE 10. RELATED PARTY TRANSACTIONS

As described in Note 5, the Company leases a number of its store locations and Corporate Headquarters from ANO and

Related Companies.

NOTE 11. COMMITMENTS AND CONTINGENCIES

The Company is, from time to time, subject to claims and disputes arising in the normal course of business. In the

opinion of management, while the outcome of any such claims and disputes cannot be predicted with certainty, the ultimate

liability of the Company in connection with these matters is not expected to have a material adverse effect on the Company’s

results of operations, financial position or cash flows.

California Class Action

On September 3, 2009, a former store manager and a current assistant store manager (together, the “Plaintiffs”) filed a

putative class action suit against LLI in the Superior Court of California in and for the County of Alameda. The Plaintiffs

allege that with regard to certain groups of current and former employees in LLI’s California stores, LLI violated California

law by failing to calculate and pay overtime wages properly, provide meal breaks, compensate for unused vacation time,

reimburse for certain expenses and maintain required employment records. The Plaintiffs also claim that LLI did not

calculate and pay overtime wages properly for certain of LLI’s non-exempt employees, both in and out of California, in

violation of federal law. In their suit, the Plaintiffs seek compensatory damages, certain statutory penalties, costs, attorney’s

fees and injunctive relief. LLI removed the case to the United States District Court for the Northern District of

56