Lumber Liquidators 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

Recent Accounting Pronouncements

In February 2008, FASB issued amendments that delayed the effective date of the fair value disclosure requirements for

all nonfinancial assets and nonfinancial liabilities. The Company adopted this standard on January 1, 2009. The adoption of

this standard did not have a material impact on the Company’s consolidated financial statements.

In April 2009, FASB issued an accounting standard regarding interim disclosures about fair value of financial

instruments. This standard requires interim disclosures regarding the fair value of financial instruments that were previously

required only annually and certain additional disclosures regarding the methods and significant assumptions used to estimate

the fair value of financial instruments. The Company adopted this standard on July 1, 2009. The adoption of this standard did

not have a material impact on the Company’s consolidated financial statements.

In June 2009, FASB established the “FASB Accounting Standards Codification” (the “Codification”) and in doing so,

authorized the Codification as the sole source for authoritative U.S. GAAP. Other than resolving certain minor

inconsistencies in current U.S. GAAP, the Codification does not change U.S. GAAP. Instead, it is intended to make it easier

to find and research U.S. GAAP applicable to particular transactions or specific accounting issues by organizing accounting

pronouncements into approximately 90 accounting topics. The Codification is the single source of authoritative U.S. GAAP.

The Codification is effective for financial statements issued for reporting periods ending after September 15, 2009. The

application of the Codification did not have an impact on the Company’s consolidated financial statements, however, all

references to authoritative accounting literature will now be references in accordance with the Codification.

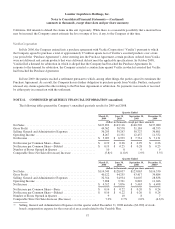

NOTE 2. NOTES RECEIVABLE

As of December 31, 2009, notes receivable from a merchandise vendor had an outstanding balance due to the Company

of $994, of which $315 had been included in other current assets. As of December 31, 2008, the outstanding balance due to

the Company was $1,168, of which $251 had been included in other current assets.

NOTE 3. PROPERTY AND EQUIPMENT

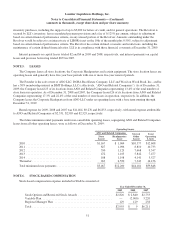

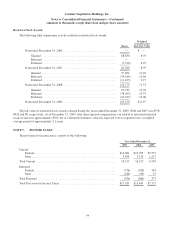

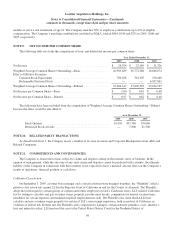

Property and equipment consisted of:

December 31,

2009 2008

Vehicles (including Forklifts) ......................................... $ 9,478 $ 8,984

Finishing Equipment ................................................ 3,566 3,432

Office Equipment ................................................... 1,730 677

Computer Software and Hardware ...................................... 11,330 6,309

Store Fixtures ...................................................... 6,619 4,494

Leasehold Improvements ............................................. 6,005 3,997

38,728 27,893

Less: Accumulated Depreciation and Amortization ........................ 18,237 14,113

Property and Equipment, net ...................................... $20,491 $13,780

Computer software and hardware at December 31, 2009 includes $3,897 related to the Company’s integrated

information technology solution.

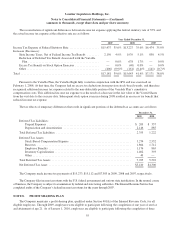

NOTE 4. REVOLVING CREDIT AGREEMENT

A revolving credit agreement (the “Revolver”) providing for borrowings up to $25,000 is available to LLI through

expiration on August 10, 2012. During 2009 and 2008, LLI did not borrow against the Revolver and at December 31, 2009

and 2008, there were no outstanding commitments under letters of credit. The Revolver is primarily available to fund

50