Lumber Liquidators 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

Lumber Liquidators is the largest specialty retailer of hardwood flooring in the United States, based on industry sources

and our experience. We believe we have achieved a reputation for offering great value, superior service and a broad selection

of high-quality hardwood flooring products.

We offer an extensive selection of premium hardwood flooring products under multiple proprietary brands at everyday

low prices designed to appeal to a diverse customer base. Substantially all of our products are purchased directly from mills

or associated brokers with whom we have cultivated long-standing relationships to ensure a consistent supply of high-quality

product at the lowest prices. We believe that our vertically integrated business model enables us to offer a broad assortment

of high-quality products to our customers at a lower cost than our competitors.

We believe that our brands, value proposition and integrated multi-channel approach are important competitive

advantages in a hardwood flooring market that is highly fragmented. We compete on the basis of price, quality, selection and

availability of the wood flooring that we offer our customers, as well as the level of customer service we can provide. We

position ourselves as hardwood flooring experts and believe our high level of customer service reflects this positioning.

We offer our products through multiple, complementary channels, including 186 Lumber Liquidators stores in 45 states

at December 31, 2009, a full-service call center in Toano, Virginia, our website and our catalog. We seek to appeal to

customers who desire a high-quality product at an attractive value and are willing to travel to less convenient locations to get

it. We sell our products principally to existing homeowners, who we believe represent over 90% of our customer count.

Historically, these homeowners are in their mid-30’s or older, are well-educated and have been living in their homes for at

least several years.

We have grown our store base rapidly with over 50% of our total store locations opened in the past three years,

including 36 new stores in 2009. We believe our existing primary and secondary metropolitan markets will benefit from

additional store locations, and in 2009, we opened 12 new store locations in these markets. Our experience has shown that

our store model is well suited for markets smaller than the primary and secondary metropolitan areas, and going forward,

these will represent the majority of our new market stores. We expect to open 36 to 40 new store locations in each of the next

few years, with an approximately equal mix of new markets and existing markets.

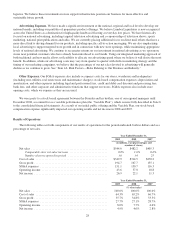

Our recent store opening activity is as follows:

2009 2008 2007

Number of stores at January 1 .......................................... 150 116 91

New stores ..................................................... 36 34 25

Number of stores at December 31 ..................................... 186 150 116

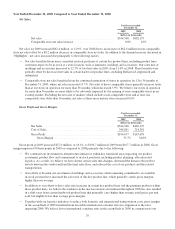

Due primarily to the weak macroeconomic environment and its impact on the residential flooring market, net sales at

our comparable stores in 2009 were unchanged from their net sales in 2008. We generally consider a store comparable on the

first day of the 13th month of operation, and stores in operation from 13 months to 36 months have historically shown greater

net sales increases than our more mature stores. Comparable store net sales had previously contributed to our total net sales

growth, with increases of 1.6% in 2008 and 8.6% in 2007. As the residential flooring market slowly strengthens from low

points in 2009, we expect our comparable store net sales to again show increases. However, we believe increases in baseline

store volumes and new store openings in existing markets will generally result in comparable store net sales increases lower

than increases in 2007 and earlier years.

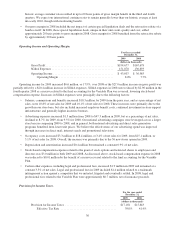

We continue to invest in the infrastructure supporting our store growth and operations, with focus in more recent years

on broadening our product assortment, enhancing our store management training programs, strengthening our in-stock

inventory position, reducing transportation costs and seeking integrated technology solutions to increase both our operational

effectiveness and efficiency.

Our gross profit is driven primarily by the cost of acquiring the products we sell from our suppliers, but also includes

international and domestic transportation costs, customs and duty charges, transportation charges from our distribution center

24