Lumber Liquidators 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

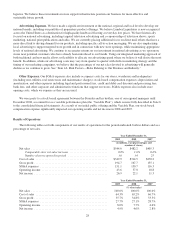

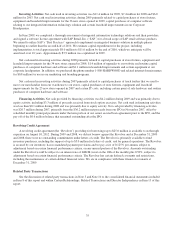

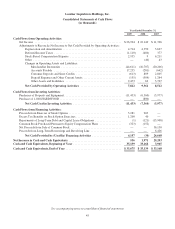

Contractual Commitments and Contingencies

Our significant contractual obligations and commitments as of December 31, 2009 are summarized in the following

table:

Payments Due by Period

Total

Less Than

1 Year

1to3

Years

3to5

Years 5+ Years

(in thousands)

Contractual obligations

Operating lease obligations(1) .................................. $59,848 $12,608 $20,080 $13,004 $14,156

Total contractual obligations .................................. $59,848 $12,608 $20,080 $13,004 $14,156

(1) Included in this table is the base period or current renewal period for our operating leases. The operating leases

generally contain varying renewal provisions.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements or other financing activities with special-purpose entities.

Inflation

Inflationary factors such as increases in the cost of our product and overhead costs may adversely affect our operating

results. Although we do not believe that inflation has had a material impact on our financial position or results of operations

to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross

profit and selling, general and administrative expenses as a percentage of net sales if the selling prices of our products do not

increase with these increased costs.

Critical Accounting Policies and Estimates

Critical accounting policies are those that we believe are both significant and that require us to make difficult, subjective

or complex judgments, often because we need to estimate the effect of inherently uncertain matters. We base our estimates

and judgments on historical experiences and various other factors that we believe to be appropriate under the circumstances.

Actual results may differ from these estimates, and we might obtain different estimates if we used different assumptions or

conditions. We believe the following critical accounting policies affect our more significant judgments and estimates used in

the preparation of our financial statements:

Recognition of Net Sales

We recognize net sales for products purchased at the time the customer takes possession of the merchandise. We

recognize service revenue, which consists primarily of freight charges for in-home delivery, when the service has been

rendered. We report revenue net of sales and use taxes collected from customers and remitted to governmental taxing

authorities. Net sales are reduced by an allowance for anticipated sales returns that we estimate based on historical sales

trends and experience. Any reasonably likely changes that may occur in the assumptions underlying our allowance estimates

would not be expected to have a material impact on our financial condition or operating performance. In addition, customers

who do not take immediate delivery of their purchases are generally required to leave a deposit of up to 50% of the sales

amount with the balance payable when the products are delivered. These customer deposits benefit our cash flow and return

on investment capital, since we receive partial payment for our customers’ purchases immediately. We record these deposits

as a liability on our balance sheet under the line item “Customer Deposits and Store Credits” until the customer takes

possession of the merchandise.

Merchandise Inventories

We value our merchandise inventories at the lower of merchandise cost or market value. We determine merchandise

cost using the average cost method. All of the hardwood flooring we purchase from suppliers is either prefinished or

unfinished, and in immediate saleable form. To the extent that we finish and box unfinished products, we include those costs

in the average unit cost of related merchandise inventory. In determining market value, we make judgments and estimates as

to the market value of our products, based on factors such as historical results and current sales trends. Any reasonably likely

changes that may occur in those assumptions in the future may require us to record charges for losses or obsolescence against

these assets, but would not be expected to have a material impact on our financial condition or operating performance.

36