Lumber Liquidators 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

inventory purchases, including the support of up to $5,000 for letters of credit, and for general operations. The Revolver is

secured by LLI’s inventory, has no mandated payment provisions and a fee of 0.125% per annum, subject to adjustment

based on certain financial performance criteria, on any unused portion of the Revolver. Amounts outstanding under the

Revolver would be subject to an interest rate of LIBOR (reset on the 10th of the month) plus 0.50%, subject to adjustment

based on certain financial performance criteria. The Revolver has certain defined covenants and restrictions, including the

maintenance of certain defined financial ratios. LLI is in compliance with these financial covenants at December 31, 2009.

Interest payments on capital leases totaled $2 and $4 in 2009 and 2008, respectively, and interest payments on capital

leases and previous borrowing totaled $679 in 2007.

NOTE 5. LEASES

The Company leases all store locations, the Corporate Headquarters and certain equipment. The store location leases are

operating leases and generally have five-year base periods with one or more five-year renewal periods.

The Founder is the sole owner of ANO LLC, DORA Real Estate Company, LLC and Wood on Wood Road, Inc., and he

has a 50% membership interest in BMT Holdings, LLC (collectively, “ANO and Related Companies”). As of December 31,

2009, the Company leased 25 of its locations from ANO and Related Companies representing 13.4% of the total number of

store leases in operation. As of December 31, 2008 and 2007, the Company leased 26 of its locations from ANO and Related

Companies representing 17.3% and 22.4% of the total number of store leases in operation, respectively. In addition, the

Company leases the Corporate Headquarters from ANO LLC under an operating lease with a base term running through

December 31, 2019.

Rental expense for 2009, 2008 and 2007 was $11,464, $9,276 and $6,853, respectively, with rental expense attributable

to ANO and Related Companies of $2,531, $2,505 and $2,529, respectively.

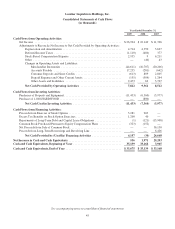

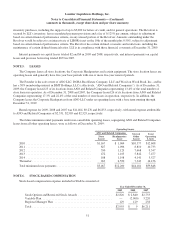

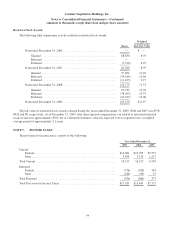

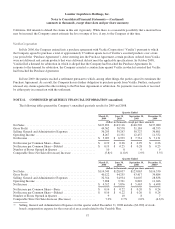

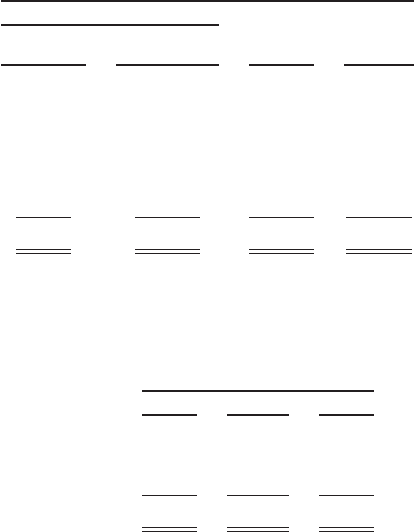

The future minimum rental payments under non-cancellable operating leases, segregating ANO and Related Companies

leases from all other operating leases, were as follows at December 31, 2009:

Operating Leases

ANO and Related Companies Store &

Other

Leases

Total

Operating

Leases

Store

Leases

Headquarters

Lease

2010 ............................................ $1,167 $ 1,064 $10,377 $12,608

2011 ............................................ 827 1,096 8,810 10,733

2012 ............................................ 550 1,129 7,668 9,347

2013 ............................................ 472 1,163 5,842 7,477

2014 ............................................ 188 1,198 4,141 5,527

Thereafter ........................................ 263 6,550 7,343 14,156

Total minimum lease payments ....................... $3,467 $12,200 $44,181 $59,848

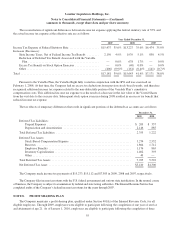

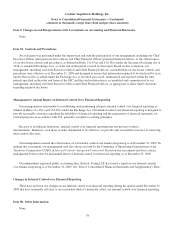

NOTE 6. STOCK-BASED COMPENSATION

Stock-based compensation expense included in SG&A consisted of:

Year Ended December 31,

2009 2008 2007

Stock Options and Restricted Stock Awards ....................... $2,826 $ 2,840 $2,733

Variable Plan ............................................... — (2,960) 3,220

Regional Manager Plan ....................................... 129 129 258

Total ...................................................... $2,955 $ 9 $6,211

51