Lumber Liquidators 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

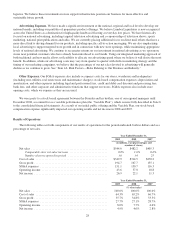

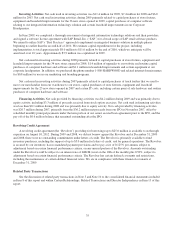

Year Ended December 31, 2009 Compared to Year Ended December 31, 2008

Net Sales.

For the year ended

December 31,

2009 2008

(dollars in thousands)

Net sales ................................................ $544,568 $482,179

Comparable store net sales increase ........................... 0.0% 1.6%

Net sales for 2009 increased $62.4 million, or 12.9%, over 2008 due to an increase of $62.6 million in non-comparable

store net sales offset by a $0.2 million decrease in comparable store net sales. In addition to the demand increase discussed in

“Highlights”, net sales increased due principally to the following factors:

• Net sales benefited from more consistent in-stock positions of certain key product lines, including product lines

customers expect to be in-stock at a store location, such as laminates, moldings and accessories. Our sales mix of

moldings and accessories increased to 12.7% of total net sales in 2009, from 11.0% in 2008. These benefits were

partially offset by decreased net sales in certain hardwood product lines, including Bellawood, engineered and

unfinished.

• Comparable store net sales benefited from the continued maturation of stores in operation for 13 to 36 months at

December 31, 2009, where net sales increased 15.7%. Net sales at these comparable stores generally increase faster

than at our stores in operation for more than 36 months, which decreased 3.9%. We believe our stores in operation

for more than 36 months are more likely to be adversely impacted by the opening of non-comparable stores in an

existing market. Excluding the net sales of markets which include a non-comparable store and at least one

comparable store older than 36 months, net sales at these more mature stores increased 0.6%.

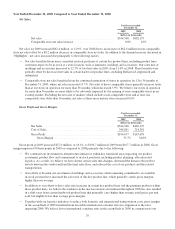

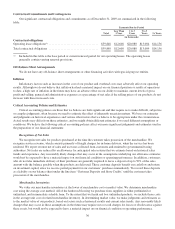

Gross Profit and Gross Margin.

For the year ended

December 31,

2009 2008

(dollars in thousands)

Net Sales ................................................ $544,568 $482,179

Cost of Sales ............................................. 349,891 314,501

Gross Profit .............................................. $194,677 $167,678

Gross Margin ........................................ 35.7% 34.8%

Gross profit in 2009 increased $27.0 million, or 16.1%, to $194.7 million in 2009 from $167.7 million in 2008. Gross

margin improved 90 basis points in 2009 as compared to 2008 primarily due to the following:

• We continued our investment in infrastructure initiatives within key functional areas impacting our product

assortment, product flow and commitment to in-stock positions, including product planning, allocation and

logistics. As a result, we believe we have driven certain sales mix changes, shortened the distance the product

travels between the vendor-mill and the final sales floor, and reduced the cost of our products and the related

transportation.

• Our efforts to broaden our assortment of moldings and accessories while remaining committed to an available

in-stock position have increased the sales mix of this key product line, which generally carries gross margins

higher than our average.

• In addition to our efforts to drive sales mix increases in certain key product lines and the premium products within

those product lines, we believe the weakness in the macroeconomic environment throughout 2009 has also resulted

in a shift away from certain hardwood product lines that generally carry higher than average retail prices per unit

sold, but slightly lower than average gross margins.

• Together with our logistics initiatives to reduce both domestic and international transportation costs, gross margin

in the second half of 2009 benefited from favorable international container rates in comparison to the rates

impacting 2008. We believe lower international container rates in the second half of 2009 in comparison to our

29