Lumber Liquidators 2009 Annual Report Download - page 41

Download and view the complete annual report

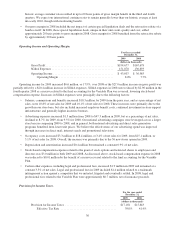

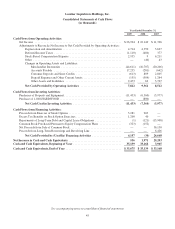

Please find page 41 of the 2009 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investing Activities. Net cash used in investing activities was $11.4 million for 2009, $7.4 million for 2008 and $6.0

million for 2007. Net cash used in investing activities during 2009 primarily related to capital purchases of store fixtures,

equipment and leasehold improvements for the 36 new stores opened in 2009, capital purchases of computer software

relating to our integrated information technology solution and certain leasehold improvements in our Corporate

Headquarters.

In June 2009, we completed a thorough assessment of integrated information technology solutions and their providers,

and signed a software license agreement with SAP Retail, Inc. (“SAP”) for a broad scope of SAP retail software products.

We intend to utilize SAP’s “Best Practices” approach to implement an integrated business solution in multiple phases

beginning no earlier than the second half of 2010. We estimate capital expenditures for the project, including

implementation, to total approximately $8.0 million to $11.0 million by the end of 2010, which we anticipate will be

amortized over 10 years. Approximately $3.9 million was capitalized in 2009.

Net cash used in investing activities during 2008 primarily related to capital purchases of store fixtures, equipment and

leasehold improvements for the 34 new stores opened in 2008, $1.4 million of upgrades to our website and routine capital

purchases of computer hardware and software and $1.1 million in leasehold improvements and certain equipment at our

corporate headquarters. In addition, we purchased the phone number 1-800-HARDWOOD and related internet domain names

for $0.8 million for use in our marketing and branding programs.

Net cash used in investing activities during 2007 primarily related to capital purchases of truck trailers that we used to

move our merchandise from our warehouse to our stores, capital purchases of store fixtures, equipment and leasehold

improvements for the 25 new stores opened in 2007 and certain IT costs, including certain point of sale hardware and routine

purchases of computer hardware and software.

Financing Activities. Net cash provided by financing activities was $4.2 million during 2009 and was primarily due to

equity activity, including $3.3 million of proceeds received from stock option exercises. Net cash used in financing activities

was less than $0.1 million during 2008 and was primarily due to equity activity. Net cash provided by financing activities

was $26.7 million during 2007, primarily from the $36.2 million net proceeds from our IPO in November 2007, offset by

scheduled monthly principal payments under the term portion of our senior secured loan agreement prior to the IPO, and the

pay off of the $6.6 million balance that remained outstanding after the IPO.

Revolving Credit Agreement

A revolving credit agreement (the “Revolver”) providing for borrowings up to $25.0 million is available to us through

expiration on August 10, 2012. During 2009 and 2008, we did not borrow against the Revolver and at December 31, 2009

and 2008, there were no outstanding commitments under letters of credit. The Revolver is primarily available to fund

inventory purchases, including the support of up to $5.0 million for letters of credit, and for general operations. The Revolver

is secured by our inventory, has no mandated payment provisions and we pay a fee of 0.125% per annum, subject to

adjustment based on certain financial performance criteria, on any unused portion of the Revolver. Amounts outstanding

under the Revolver would be subject to an interest rate of LIBOR (reset on the 10th of the month) plus 0.50%, subject to

adjustment based on certain financial performance criteria. The Revolver has certain defined covenants and restrictions,

including the maintenance of certain defined financial ratios. We are in compliance with these financial covenants at

December 31, 2009.

Related Party Transactions

See the discussion of related party transactions in Note 5 and Note 10 to the consolidated financial statements included

in Item 8 of this report and within Certain Relationships, Related Transactions and Director Independence in Item 13 of this

report.

35