LinkedIn 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

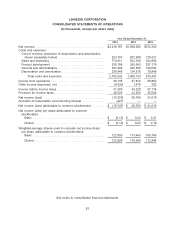

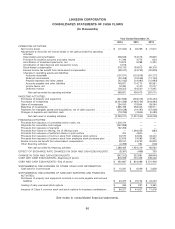

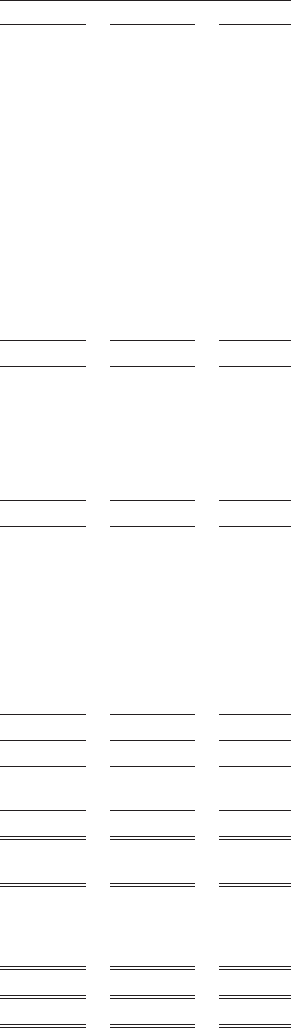

LINKEDIN CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2014 2013 2012

OPERATING ACTIVITIES:

Net income (loss) .......................................... $ (15,320) $ 26,769 $ 21,610

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Depreciation and amortization ................................. 236,946 134,516 79,849

Provision for doubtful accounts and sales returns .................... 11,346 4,775 623

Amortization of investment premiums, net ......................... 13,613 8,268 5,330

Amortization of debt discount and transaction costs ................... 5,916 — —

Stock-based compensation .................................. 319,133 193,915 86,319

Excess income tax benefit from stock-based compensation .............. (99,247) (43,755) (35,829)

Changes in operating assets and liabilities:

Accounts receivable ..................................... (137,571) (102,618) (91,277)

Deferred commissions .................................... (22,409) (18,249) (17,145)

Prepaid expenses and other assets ............................ (42,032) (19,481) (12,993)

Accounts payable and other liabilities .......................... 149,971 114,713 85,561

Income taxes, net ....................................... 19,280 3,120 27,077

Deferred revenue ....................................... 129,325 134,500 117,945

Net cash provided by operating activities ....................... 568,951 436,473 267,070

INVESTING ACTIVITIES:

Purchases of property and equipment ............................. (547,633) (278,019) (125,420)

Purchases of investments .................................... (3,431,566) (1,493,754) (443,992)

Sales of investments ........................................ 294,033 179,904 58,594

Maturities of investments ..................................... 1,665,199 258,425 139,911

Payments for intangible assets and acquisitions, net of cash acquired ......... (253,538) (19,197) (57,036)

Changes in deposits and restricted cash ........................... (19,766) (4,904) (5,085)

Net cash used in investing activities .......................... (2,293,271) (1,357,545) (433,028)

FINANCING ACTIVITIES:

Proceeds from issuance of convertible senior notes, net .................. 1,305,414 — —

Payments for convertible note hedges ............................. (247,969) — —

Proceeds from issuance of warrants .............................. 167,296 — —

Proceeds from follow-on offering, net of offering costs ................... — 1,348,059 (382)

Proceeds from issuance of preferred shares in joint venture ............... 400 4,600 —

Proceeds from issuance of common stock from employee stock options ........ 33,577 32,824 44,402

Proceeds from issuance of common stock from employee stock purchase plan . . . 32,816 24,589 16,862

Excess income tax benefit from stock-based compensation ................ 99,247 43,755 35,829

Other financing activities ..................................... (2,296) 392 (148)

Net cash provided by financing activities ....................... 1,388,485 1,454,219 96,563

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS . (6,367) (466) 755

CHANGE IN CASH AND CASH EQUIVALENTS ........................ (342,202) 532,681 (68,640)

CASH AND CASH EQUIVALENTS—Beginning of period .................. 803,089 270,408 339,048

CASH AND CASH EQUIVALENTS—End of period ...................... $ 460,887 $ 803,089 $ 270,408

SUPPLEMENTAL DISCLOSURES OF OTHER CASH FLOW INFORMATION:

Cash paid for income taxes ................................... $ 10,291 $ 6,049 $ 2,828

SUPPLEMENTAL DISCLOSURES OF NONCASH INVESTING AND FINANCING

ACTIVITIES:

Purchases of property and equipment recorded in accounts payable and accrued

liabilities .............................................. $ 43,472 $ 25,724 $ 22,223

Vesting of early exercised stock options ............................ $ 335 $ 937 $ 3,365

Issuance of Class A common stock and stock options for business combinations . . $ 64,207 $ 40,927 $ 71,478

See notes to consolidated financial statements.

86