LinkedIn 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.common stock, representing approximately 54.3% of the voting power of our outstanding capital stock

as of December 31, 2014. Mr. Hoffman has significant influence over the management and affairs of

the company and over all matters requiring stockholder approval, including election of directors and

significant corporate transactions, such as a merger or other sale of our company or its assets.

Mr. Hoffman will continue to have significant influence over these matters for the foreseeable future.

In addition, the holders of our Class B common stock collectively will continue to be able to control

all matters submitted to our stockholders for approval even though their stock holdings represent less

than 50% of the outstanding shares of our common stock. Because of the 10-to-1 voting ratio between

our Class B and Class A common stock, the holders of our Class B common stock collectively will

continue to control a majority of the combined voting power of our common stock even when the

shares of Class B common stock represent as little as 10% of the combined voting power of all

outstanding shares of our Class A and Class B common stock. This concentrated control will limit the

ability of our Class A stockholders to influence corporate matters for the foreseeable future, and, as a

result, the market price of our Class A common stock could be adversely affected.

Future transfers by holders of our Class B common stock will generally result in those shares

converting to Class A common stock, which will have the effect, over time, of increasing the relative

voting power of those holders of Class B common stock who retain their shares in the long term. If, for

example, Mr. Hoffman retains a significant portion of his holdings of Class B common stock for an

extended period of time, he could, in the future, continue to control a majority of the combined voting

power of our Class A and Class B common stock. As a board member, Mr. Hoffman owes a fiduciary

duty to our stockholders and must act in good faith in a manner he reasonably believes to be in the

best interests of our stockholders. As a stockholder, even a controlling stockholder, Mr. Hoffman is

entitled to vote his shares in his own interests, which may not always be in the interests of our

stockholders generally.

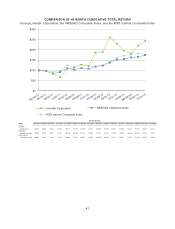

Our stock price has been volatile in the past and may be subject to volatility in the future.

The trading price of our Class A common stock has been volatile historically, and could be subject

to wide fluctuations in response to various factors, some of which are beyond our control. During 2014,

the closing price of our Class A common stock ranged from $142.33 to $238.43. Fluctuations in the

valuation of companies perceived by investors to be comparable to us or in valuation metrics, such as

our price to earnings ratio, could impact our stock price. Additionally, the stock markets have at times

experienced extreme price and volume fluctuations that have affected and might in the future affect the

market prices of equity securities of many companies. These fluctuations have, in some cases, been

unrelated or disproportionate to the operating performance of these companies. Further, the trading

prices of publicly traded shares of companies in our industry have been particularly volatile and may be

very volatile in the future. These broad market and industry fluctuations, as well as general economic,

political and market conditions such as recessions, interest rate changes, international currency

fluctuations or political unrest, may negatively impact the market price of our Class A common stock.

Volatility in our stock price also impacts the value of our equity compensation, which affects our ability

to recruit and retain employees. In addition, some companies that have experienced volatility in the

market price of their stock have been subject to securities class action litigation. We may be the target

of this type of litigation in the future. Securities litigation against us could result in substantial costs and

divert our management’s attention from other business concerns, which could harm our business.

There may be a limited market for investors in our industry.

There are few publicly traded companies in the social and professional networking and related

industries at this time, and we were among the first social networking companies to go public. Investors

may have limited funds to invest in the social and professional networking sector, and as publicly

traded securities in these industries become more available, investors who have purchased or may in

41