LinkedIn 2014 Annual Report Download - page 72

Download and view the complete annual report

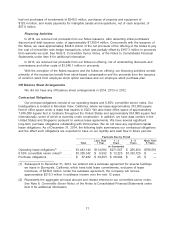

Please find page 72 of the 2014 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.funds outside the U.S. and our current plans do not demonstrate a need to repatriate them to fund our

domestic operations. We do not provide for federal income taxes on the undistributed earnings of our

foreign subsidiaries. However, we believe the income tax liability would be insignificant if these

earnings were to be repatriated. We believe that our existing cash and cash equivalents and

marketable securities balances, together with cash generated from operations, will be sufficient to meet

our working capital expenditure requirements for at least the next 12 months.

Operating Activities

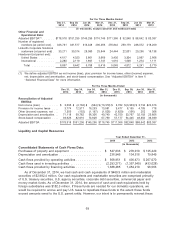

Operating activities provided $569.0 million of cash in 2014. The cash flow from operating activities

consisted primarily of the changes in our operating assets and liabilities, with deferred revenue

increasing $129.3 million and accounts payable and other liabilities increasing $150.0 million, partially

offset by an increase in accounts receivable of $137.6 million, and an increase in excess tax benefit

from stock-based compensation of $99.2 million, which is reclassified as a financing activity. The

increase in our deferred revenue and accounts payable and other liabilities was primarily due to

increases in transaction volumes in 2014 compared to 2013. We had a net loss in 2014 of

$15.3 million, which included non-cash stock-based compensation of $319.1 million and non-cash

depreciation and amortization of $236.9 million.

Operating activities provided $436.5 million of cash in 2013. The cash flow from operating activities

consisted primarily of the changes in our operating assets and liabilities, with deferred revenue

increasing $134.5 million and accounts payable and other liabilities increasing $114.7 million, partially

offset by an increase in accounts receivable of $102.6 million, and an increase in excess tax benefit

from stock-based compensation of $43.8 million, which is reclassified as a financing activity. The

increases in our deferred revenue and accounts payable and other liabilities were primarily due to

increases in transaction volumes in 2013 compared to 2012. We had net income in 2013 of

$26.8 million, which included non-cash stock-based compensation of $193.9 million and non-cash

depreciation and amortization of $134.5 million.

Operating activities provided $267.1 million of cash in 2012. The cash flow from operating activities

consisted primarily of the changes in our operating assets and liabilities, with deferred revenue

increasing $117.9 million and accounts payable and other liabilities increasing $85.6 million, partially

offset by an increase in accounts receivable of $91.3 million, an increase in excess tax benefit from the

exercise of stock options of $35.8 million, which is reclassified as a financing activity, and an increase

in prepaid expenses and other assets of $13.0 million. The increases in our deferred revenue and

accounts receivable were primarily due to increases in transaction volumes in 2012 compared to 2011.

We had net income in 2012 of $21.6 million, which included non-cash depreciation and amortization of

$79.8 million and non-cash stock-based compensation of $86.3 million.

Investing Activities

Our primary investing activities consisted of purchases of investments, purchases of property and

equipment, as well as payments for acquisitions and intangible assets. We continued to invest in

technology hardware to support our growth, software to support website functionality development,

website operations and our corporate infrastructure. Purchases of property and equipment may vary

from period to period due to the timing of the expansion of our operations. Our planned purchases of

property and equipment for 2015 are expected to be in the range of $525.0 million and $550.0 million.

In 2014, we had net purchases of investments of $1,472.3 million, purchases of property and

equipment of $547.6 million, which includes $178.7 million in purchases of land, and payments for

intangible assets and acquisitions, net of cash acquired, of $253.5 million. In 2013, we had net

purchases of investments of $1,055.4 million, purchases of property and equipment of $278.0 million,

and payments for intangible assets and acquisitions, net of cash acquired, of $19.2 million. In 2012, we

70