LinkedIn 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note Hedges and Warrants

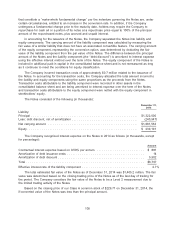

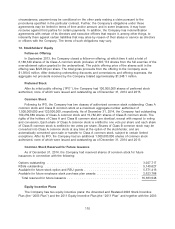

Concurrently with the issuance of the Notes, the Company purchased options (‘‘Note Hedges’’)

with respect to its Class A common stock for $248.0 million with certain bank counterparties. The Note

Hedges cover up to 4,490,020 shares of the Company’s Class A common stock at a strike price of

$294.54 per share, which corresponds to the initial conversion price of the Notes, and are exercisable

by the Company upon conversion of the Notes. The Note Hedges are intended to reduce the potential

economic dilution upon conversion of the Notes. The Note Hedges are separate transactions and are

not part of the terms of the Notes. Holders of the Notes will not have any rights with respect to the

Note Hedges.

Concurrently with the issuance of the Notes, the Company sold warrants to bank counterparties for

total proceeds of $167.3 million that provides the counterparties with the right to buy up to 4,490,020

shares of our Class A common stock at a strike price of $381.82 per share. The warrants are separate

transactions and are not part of the Notes or Note Hedges. Holders of the Notes and Note Hedges will

not have any rights with respect to the Warrants.

The amounts paid and received for the Note Hedges and warrants have been recorded in

additional paid-in capital in the consolidated balance sheets. The fair value of the Note Hedges and

warrants are not remeasured through earnings each reporting period. The amounts paid for the Note

Hedges are tax deductible expenses, while the proceeds received from the warrants are not taxable.

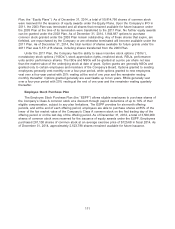

Impact to Earnings per Share

The Notes will have no impact to diluted earnings per share until the average price of our Class A

common stock exceeds the conversion price of $294.54 per share because the principal amount of the

Notes is intended to be settled in cash upon conversion. Under the treasury stock method, in periods

the Company reports net income, the Company is required to include the effect of additional shares

that may be issued under the Notes when the price of the Company’s Class A common stock exceeds

the conversion price. Under this method, the cumulative dilutive effect of the Notes would be

approximately 1,026,000 shares if the average price of the Company’s Class A common stock is

$381.82. However, upon conversion, there will be no economic dilution from the Notes, as exercise of

the Note Hedges eliminate any dilution from the Notes that would have otherwise occurred when the

price of the Company’s Class A common stock exceeds the conversion price. The Note Hedges are

required to be excluded from the calculation of diluted earnings per share, as they would be

anti-dilutive under the treasury stock method.

The warrants will have a dilutive effect when the average share price exceeds the warrant’s strike

price of $381.82 per share. As the price of the Company’s Class A common stock continues to

increase above the warrant strike price, additional dilution would occur at a declining rate so that a $10

increase from the warrant strike price would yield cumulative dilution of approximately 1,229,000 diluted

shares for EPS purposes. However, upon conversion, the Note Hedges would neutralize the dilution

from the Notes so that there would only be dilution from the warrants, which would result in actual

dilution of approximately 115,000 shares at a common stock price of $391.82.

106