LinkedIn 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2015, our philosophy is to continue to invest for long-term growth and we expect to continue to

invest heavily in the following:

•Talent. We expect to increase our workforce, which will result in an increase in headcount-

related expenses, including stock-based compensation expense. As of December 31, 2014, we

had 6,897 employees, which represented an increase of 37% compared to the prior year end.

•Technology. We expect to continue to make significant capital expenditures to upgrade our

technology and network infrastructure to improve the ability of our website to handle expected

increases in usage, to enable the release of new features and solutions, and to scale for future

growth.

•Product. We expect to continue to invest heavily in our product development efforts, specifically

around mobile, to enable our members and customers to derive more value from our platform.

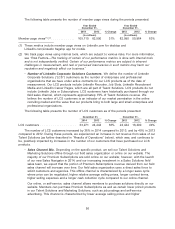

For example, in 2014, the Company launched Sponsored Updates in Marketing Solutions and

the next generation of Sales Navigator in Premium Subscriptions, both of which are available on

mobile devices. Mobile continues to be the fastest growing channel for member engagement,

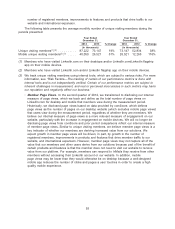

growing at nearly three times the rate of overall site traffic. We internally track and define traffic

in terms of the average number of members who have visited LinkedIn.com on either mobile or

desktop devices at least once during a month. Mobile unique visiting members represented 46%

of unique visiting members in 2014.

•Monetization. We expect to continue to aggressively expand our field sales organization to

market our solutions both in the United States and internationally.

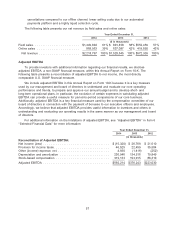

As a result of our investment philosophy, we do not expect to be profitable on a U.S. generally

accepted accounting principles (‘‘GAAP’’) basis in 2015.

Key Metrics

We regularly review a number of metrics, including the following key metrics, to evaluate our

business, measure our performance, identify trends affecting our business, formulate financial

projections and make strategic decisions.

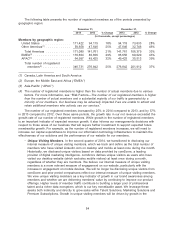

•Number of Registered Members. We define the number of registered members in our network

as the number of individual users who have created a member profile on LinkedIn.com as of the

date of measurement. We believe the number of registered members is an indicator of the

growth of our network and our ability to receive the benefits of the network effects resulting from

such growth. Growth in our member base depends, in part, on our ability to successfully develop

and market our solutions to professionals who have not yet become members of our network.

Member growth will also be contingent on our ability to translate our offerings into additional

languages, create more localized products in certain key markets, and more broadly expand our

member base internationally. We believe that a higher number of registered members will result

in increased sales of our Talent Solutions, Marketing Solutions and Premium Subscriptions, as

customers will have access to a larger pool of professional talent. However, a higher number of

registered members will not immediately increase sales, nor will a higher number of registered

members in a given region immediately increase sales in that region, as growth of sales and

marketing activities generally takes more time to develop than membership growth.

53