Lenovo 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

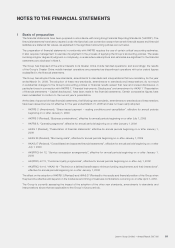

NOTES TO THE FINANCIAL STATEMENTS

1 Basis of preparation

The financial statements have been prepared in accordance with Hong Kong Financial Reporting Standards (“HKFRS”). The

financial statements have been prepared under the historical cost convention except that certain financial assets and financial

liabilities are stated at fair values, as explained in the significant accounting policies set out below.

The preparation of financial statements in conformity with HKFRS requires the use of certain critical accounting estimates.

It also requires management to exercise its judgment in the process of applying the Group’s accounting policies. The areas

involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the financial

statements are disclosed in Note 4.

The Group has disposed of the entire interests in its Greater China mobile handset operations; and accordingly, the results

of the Group’s Greater China mobile handset operations are presented as discontinued operations with prior period figures

reclassified in the financial statements.

The Group has adopted those new standards, amendments to standards and interpretations that are mandatory for the year

ended March 31, 2008. The adoption of these new standards, amendments to standards and interpretations do not result

in substantial changes to the Group’s accounting policies or financial results except that new and revised disclosures, in

particular those in connection with HKFRS 7, “Financial instruments: Disclosures” and amendment to HKAS 1 “Presentation

of financial statements – Capital disclosures”, have been made in the financial statements. Certain comparative figures have

been reclassified to conform to the current year’s presentation.

At the date of approval of these financial statements, the following new standards, amendments to standards and interpretations

have been issued but are not effective for the year ended March 31, 2008 and have not been early adopted:

– HKFRS 2 (Amendment), “Share-based payment – vesting conditions and cancellation”, effective for annual periods

beginning on or after January 1, 2009

– HKFRS 3 (Revised), “Business combinations”, effective for annual periods beginning on or after July 1, 2009

– HKFRS 8, “Operating segments”, effective for annual periods beginning on or after January 1, 2009

– HKAS 1 (Revised), “Presentation of financial statements”, effective for annual periods beginning on or after January 1,

2009

– HKAS 23 (Revised), “Borrowing costs”, effective for annual periods beginning on or after January 1, 2009

– HKAS 27 (Revised), “Consolidated and separate financial statements”, effective for annual periods beginning on or after

July 1, 2009

– HK(IFRIC)-Int 12, “Service concession arrangements”, effective for annual periods beginning on or after January 1,

2008

– HK(IFRIC)-Int 13, “Customer loyalty programmes”, effective for annual periods beginning on or after July 1, 2008

– HK(IFRIC)-Int 14, “HKAS 19 – The limit on a defined benefit asset, minimum funding requirements and their interactions”,

effective for annual periods beginning on or after January 1, 2008

The effect on the adoption of HKFRS 3 (Revised) and HKAS 27 (Revised) to the results and financial position of the Group when

they become effective will depend on the incidence and timing of business combinations occurring on or after April 1, 2010.

The Group is currently assessing the impact of the adoption of the other new standards, amendments to standards and

interpretations above that are applicable to the Group in future periods.

Lenovo Group Limited • Annual Report 2007/08 81