Lenovo 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

2Lenovo Group Limited • Annual Report 2007/08

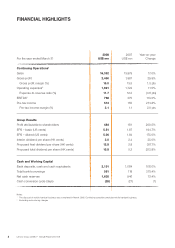

FINANCIAL HIGHLIGHTS

2008 2007 Year-on-year

For the year ended March 31 US$ mn US$ mn Change

Continuing Operations1

Sales 16,352 13,978 17.0%

Gross profit 2,450 1,887 29.8%

Gross profit margin (%) 15.0 13.5 1.5 pts

Operating expenses21,921 1,722 11.5%

Expense-to-revenue ratio (%) 11.7 12.3 (0.6 pts)

EBITDA2798 375 113.0%

Pre-tax income 513 155 231.8%

Pre-tax income margin (%) 3.1 1.1 2.0 pts

Group Results

Profit attributable to shareholders 484 161 200.5%

EPS – basic (US cents) 5.51 1.87 194.7%

EPS – diluted (US cents) 5.06 1.84 175.0%

Interim dividend per share (HK cents) 3.0 2.4 25.0%

Proposed final dividend per share (HK cents) 12.8 2.8 357.1%

Proposed total dividend per share (HK cents) 15.8 5.2 203.8%

Cash and Working Capital

Bank deposits, cash and cash equivalents 2,191 1,064 106.0%

Total bank borrowings 561 118 375.4%

Net cash reserves 1,630 946 72.4%

Cash conversion cycle (days) (28) (27) (1)

Notes:

1 The disposal of mobile handset business was completed in March 2008. Continuing operations exclude mobile handset business.

2 Excluding restructuring charges