Lenovo 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

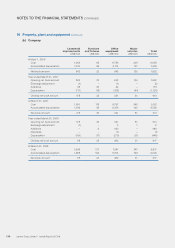

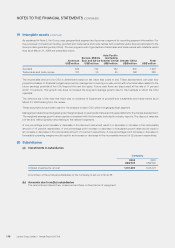

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

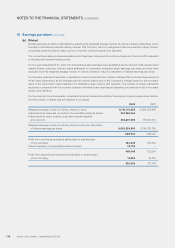

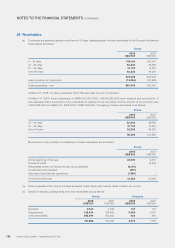

22 Deferred tax assets

Deferred taxation is calculated in full on temporary differences under the liability method using the rates applicable in the

respective jurisdictions.

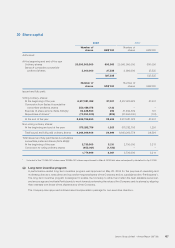

The movements in deferred tax assets/(liabilities) are as follows:

Group

2008 2007

US$’000 US$’000

At the beginning of the year 101,551 62,345

Exchange and reclassification adjustments 8,309 (91)

Credited to consolidated income statement 51,482 39,297

Disposal of discontinued operations (Note 13(a)) (4,902) –

At the end of the year 156,440 101,551

Closing net book amount analyzed into:

Group

2008 2007

US$’000 US$’000

Current 92,171 30,029

Non-current 64,269 71,522

156,440 101,551

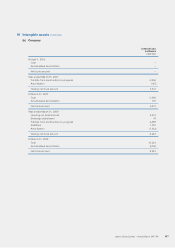

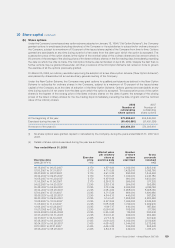

Deferred tax assets are recognized for deductible temporary differences and tax losses carried forward to the extent that

realization of the related tax benefit through the future taxable profits is probable. At March 31, 2008, the Group has unrecognized

ta x losses of approximately US$62,529,000 (2007: US$28,054,000) that can be carried forward against future taxable income.

Unrecognized tax losses of US$38.7 million (2007: US$1.0 million) can be carried forward indefinitely. The remaining balances

of US$7.4 million (2007: US$7.4 million), US$19.7 million (2007: US$19.7 million) and US$11.6 million (2007: Nil) expire in 2014,

2015 and 2016 respectively.

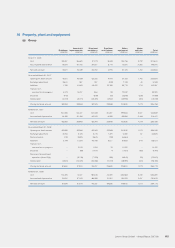

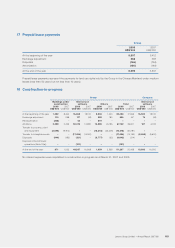

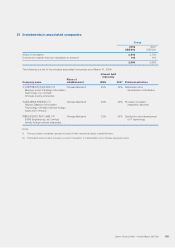

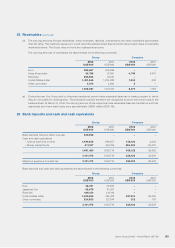

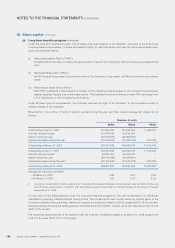

The movements in deferred tax assets and liabilities, analyzed by major component, during the year are as follows:

Provisions Tax losses

Tax

depreciation

allowances

Deferred

revenue Others Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Year ended March 31, 2007

At the beginning of the year 53,759 2,829 5,757 – – 62,345

Exchange and

reclassification

adjustments (9,373) (2,787) 57 8,10 0 3,912 (91)

Credited to consolidated

income statement 15,693 7, 8 6 2 4,038 5,457 6,247 39,297

At the end of the year 60,079 7,9 0 4 9,852 13,557 10,159 101,551

Year ended March 31, 2008

At the beginning of the year 60,079 7,904 9,852 13,557 10,159 101,551

Exchange and

reclassification

adjustments 6,586 2,922 241 1,609 (3,049) 8,309

Credited/(debited) to

consolidated

income statement 37,559 (3,168) (4,118) 14,468 6,741 51,482

Disposal of discontinued

operations (4,902) – – – – (4,902)

At the end of the year 99,322 7,65 8 5,975 29,634 13,851 156,440

Lenovo Group Limited • Annual Report 2007/08

120