Lenovo 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lenovo Group Limited • Annual Report 2007/08

40

CORPORATE GOVERNANCE

Share Option Scheme

The Company operates two share option schemes, the “New Option Scheme” and the “Old Option Scheme”.

Details of the programs are set out in the Directors’ Report on pages 52 and 53. Options outstanding for executive

and non-executive directors as of March 31, 2008 under these schemes are presented in the Directors’ Report on

page 54.

No options were granted under these Schemes during the year.

Retirement Benefits

The Company operates a number of retirement schemes for its employees, including executive directors and senior

management. These schemes are reviewed regularly and intended to deliver benefit levels that are consistent with

local market practices. Details of the programs are set out in the Directors’ Report on pages 65 to 67.

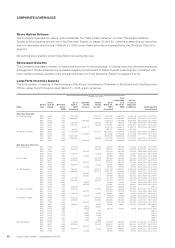

Long-Term Incentive Awards

The total number of awards of the members of the Board, including the Chairman of the Board and Chief Executive

Officer, under the LTI Program as at March 31, 2008 is set out below.

Number of units

Name

Award

type

Fiscal

Year of

Award

Effective

price

As at

April 1,

2007

Awarded

during

the year

Vested

during

the year

As at

March 31,

2008

Total

outstanding

as at

March 31,

2008

Max no.

of shares

subject to

conditions Vesting period

(HK$) (unvested) (unvested) (mm.dd.yyyy)

Executive Directors

Mr. Yang Yuanqing SAR 05/06 2.42 4,772,056 –1,590,700 3,181,356 6,362,756 6,362,756 05.01.2006 - 05.01.2009

SAR 06/07 2.35 13,385,665 –3,346,416 10,039,249 13,385,665 13,385,665 06.01.2007 - 06.01.2010

SAR 07/0 8 3.94 –6,002,009 –6,002,009 6,002,009 6,002,009 06.01.2008 - 06.01.2011

RSU 05/06 2.42 696,595 –232,200 464,395 464,395 464,395 05.01.2006 - 05.01.2009

RSU 06/07 2.35 2,974,593 –743,648 2,230,945 2,230,945 2,230,945 06.01.2007 - 06.01.2010

RSU 07/0 8 3.94 –3,556,710 –3,556,710 3,556,710 3,556,710 06.01.2008 - 06.01.2011

PSU 05/06 2.42 928,795 – – 928,795 928,795 1,857,590 Note 3

Mr. William J. Amelio SAR 06/07 2.35 17, 8 3 1, 4 8 9 –4, 4 57,87 2 13,373,617 17, 8 3 1, 4 8 9 17, 8 3 1, 4 8 9 06.01.2007 - 06.01.2010

SAR 07/0 8 3.94 –6,773,696 –6,773,696 6,773,696 6,773,696 06.01.2008 - 06.01.2011

RSU 06/07 3.10 10,013,000 – – 10,013,000 10,013,000 10,013,000 01.01.2009

RSU 06/07 2.35 3,962,553 – 990,638 #2,971,915 2,971,915 2,971,915 06.01.2007 - 06.01.2010

RSU 07/0 8 3.94 –4,014,002 –4,014,002 4,014,002 4,014,002 06.01.2008 - 06.01.2011

Non-Executive Directors

Mr. Liu Chuanzhi SAR 05/06 3.15 376,000 –188,000 188,000 564,000 564,000 05.01.2006 - 05.01.2008

SAR 06/07 2.99 390,000 –130,000 260,000 390,000 390,000 06.01.2007 - 06.01.2009

SAR 07/0 8 3.94 –297,000 –297,000 297,000 297,000 06.01.2008 - 06.01.2010

RSU 06/07 2.99 130,000 –43,333 86,667 86,667 86,667 06.01.2007 - 06.01.2009

RSU 07/0 8 3.94 –99,000 –99,000 99,000 99,000 06.01.2008 - 06.01.2010

Mr. Zhu Linan SAR 05/06 3.15 376,000 –188,000 188,000 564,000 564,000 05.01.2006 - 05.01.2008

SAR 06/07 2.99 390,000 –130,000 260,000 390,000 390,000 06.01.2007 - 06.01.2009

SAR 07/0 8 3.94 –297,000 –297,000 297,000 297,000 06.01.2008 - 06.01.2010

RSU 06/07 2.99 130,000 –43,333 86,667 86,667 86,667 06.01.2007 - 06.01.2009

RSU 07/0 8 3.94 –99,000 –99,000 99,000 99,000 06.01.2008 - 06.01.2010

Ms. Ma Xuezheng SAR 05/06 2.42 1,561,125 –520,375 1,040,750 2,081,500 2,081,500 05.01.2006 - 05.01.2009

SAR 06/07 2.35 4,109,895 –1,0 27,474 3,082,421 4,109,895 4,109,895 06.01.2007 - 06.01.2010

SAR 07/0 8 3.94 –297,000 –297,000 297,000 297,000 06.01.2008 - 06.01.2010

SAR 07/0 8 5.62 –693,130 –693,130 693,130 693,130 06.01.2008 - 06.01.2011

RSU 05/06 2.42 227,925 –75,975 151,950 151,950 151,950 05.01.2006 - 05.01.2009

RSU 06/07 2.35 1,369,965 –342,491 1,027,474 1, 0 2 7,474 1,0 27,474 06.01.2007 - 06.01.2010

RSU 07/0 8 3.94 –99,000 –99,000 99,000 99,000 06.01.2008 - 06.01.2010

RSU 07/0 8 5.62 –231,041 –231,041 231,041 231,041 06.01.2008 - 06.01.2011

PSU 05/06 2.42 303,900 – – 303,900 303,900 6 0 7, 8 0 0 Note 3

Mr. James G. Coulter SAR 06/07 2.99 390,000 –130,000 260,000 390,000 390,000 06.01.2007 - 06.01.2009

SAR 07/0 8 3.94 –297,000 –297,000 297,000 297,000 06.01.2008 - 06.01.2010

RSU 06/07 2.99 130,000 –43,333 86,667 86,667 86,667 06.01.2007 - 06.01.2009

RSU 07/0 8 3.94 –99,000 –99,000 99,000 99,000 06.01.2008 - 06.01.2010

Mr. William O. Grabe SAR 05/06 3.15 376,000 –188,000 188,000 564,000 564,000 05.01.2006 - 05.01.2008

SAR 06/07 2.99 390,000 –130,000 260,000 390,000 390,000 06.01.2007 - 06.01.2009

SAR 07/0 8 3.94 –297,000 –297,000 297,000 297,000 06.01.2008 - 06.01.2010

RSU 06/07 2.99 130,000 –43,333 86,667 86,667 86,667 06.01.2007 - 06.01.2009

RSU 07/0 8 3.66 –24,046 24,046 ––– Note 1

RSU 07/0 8 3.94 –99,000 –99,000 99,000 99,000 06.01.2008 - 06.01.2010

RSU 07/0 8 4.63 –679 679 – – – Note 2

RSU 07/0 8 5.20 –18,822 18,822 ––– Note 1

RSU 07/0 8 8.74 –11,098 11,098 ––– Note 1

RSU 07/0 8 6.91 –620 620 ––– Note 2

RSU 07/0 8 5.52 –17, 6 6 3 17, 6 6 3 ––– Note 1

Mr. Shan Weijian* SAR 05/06 3.15 376,000 –188,000 188,000 564,000 564,000 05.01.2006 - 05.01.2008

SAR 06/07 2.99 390,000 –130,000 260,000 390,000 390,000 06.01.2007 - 06.01.2009

SAR 07/0 8 3.94 –297,000 –297,000 297,000 297,000 06.01.2008 - 06.01.2010

RSU 06/07 2.99 130,000 –43,333 86,667 86,667 86,667 06.01.2007 - 06.01.2009

RSU 07/0 8 3.94 –99,000 –99,000 99,000 99,000 06.01.2008 - 06.01.2010