Lenovo 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

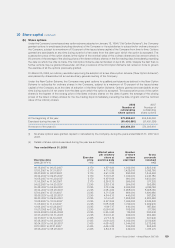

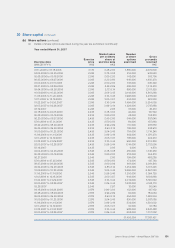

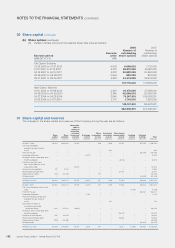

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

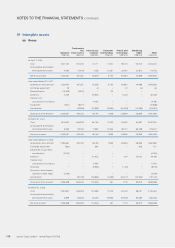

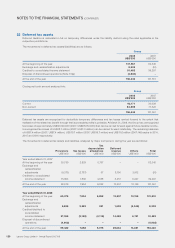

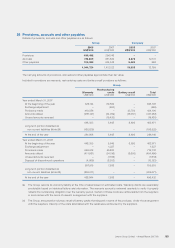

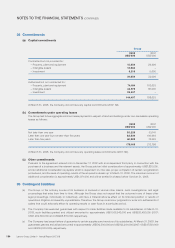

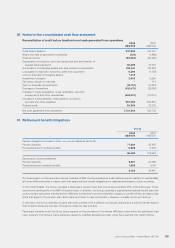

29 Non-current liabilities

Group Company

2008 2007 2008 2007

US$’000 US$’000 US$’000 US$’000

Amount payable for marketing rights

(Note 29(a)) 5,417 18,123 ––

Interest-bearing bank loans repayable within

five years (Note 29(b)) 465,000 100,000 465,000 100,000

Share-based compensation (Note 29(c)) 6,430 11,019 6,430 11,019

Convertible preferred shares (Note 29(d)) 211,181 317, 4 9 5 211,181 3 17, 4 9 5

Warranty provision (Note 28) 209,071 166,525 ––

Retirement benefit obligations (Note 37) 85,490 102,948 ––

Deferred revenue 88,701 5 7,16 6 ––

Derivative financial liabilities 1,788 –1,788 –

Other non-current liabilities 25,045 15,782 ––

1,098,123 789,058 684,399 428,514

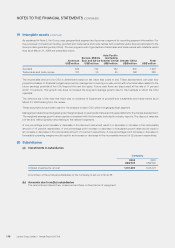

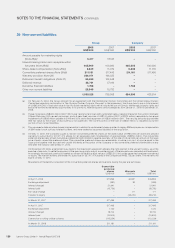

(a) On February 5, 2004, the Group entered into an agreement with the International Olympic Committee and the United States Olympic

Committee regarding participation in The Olympic Partner Program. Pursuant to the agreement, the Group has to pay a total amount

of US$65,000,000 in cash and value in kind to obtain marketing rights which include the use of Olympic intellectual property rights and

exclusive worldwide marketing opportunities in its products, technology and service categories from January 1, 2005 to December 31,

2008.

(b) These comprise a US$400 million (2007: Nil) 5-year revolving term loan with syndicated banks, bearing interest at the London Interbank

Offered Rate plus 0.52 percent per annum; and a 5-year fixed rate loan of US$100 million (2007: US$100 million) repayable by two equal

installments of US$35 million payable in 2009 and 2010, and a final repayment of US$30 million in 2011. The carrying amounts approximate

their fair value as the impact of discounting is not significant. The current portion of the loan of US$35 million is classified as current

portion of non-current liabilities.

(c) This represents deferred share-based compensation in relation to replacement shares granted to legacy IBM employees as compensation

of IBM vested stock options forfeited by them, and were treated as assumed liabilities of the acquisition.

(d) On May 17, 2005, the Company issued 2,730,000 convertible preferred shares at the stated value of HK$1,000 per share and unlisted

warrants to subscribe for 237,417,474 shares for an aggregate cash consideration of approximately US$350 million. The convertible

preferred shares bear a fixed cumulative preferential cash dividend, payable quarterly, at the rate of 4.5 percent per annum on the issue

price of each convertible preferred share. The convertible preferred shares are redeemable, in whole or in part, at a price equal to the

issue price together with accrued and unpaid dividends at the option of the Company or the convertible preferred shareholders at any

time after the maturity date at May 17, 2012.

On November 28, 2006, amendment was made to the investment agreement whereby the right granted to the warrant holders, upon the

exercise of warrants, to settle the payment of the exercise price by way of surrendering part of the warrants was cancelled and terminated.

Accordingly, the warrants previously treated as a financial liability at a fair value of US$35,210,000 on the same day have been transferred

to equity. The warrant holders are entitled to subscribe for 237,417,474 shares in the Company at HK$2.725 per share. The warrants will

expire on May 17, 2010.

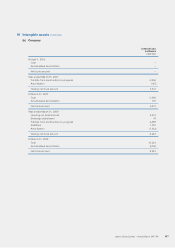

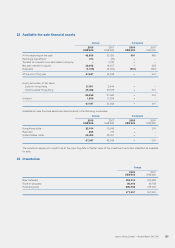

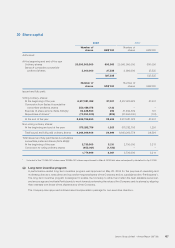

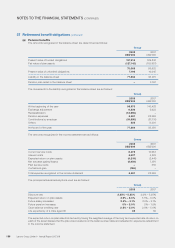

Movements of the liability component of the convertible preferred shares and warrants during the year are as follows:

Convertible

preferred

shares Warrants Total

US$’000 US$’000 US$’000

At April 1, 2006 311,895 34,957 346,852

Exchange adjustment (591) 82 (509)

Interest charged 21,941 –21,941

Interest paid (15,750) –(15,750)

Fair value change –171 171

Transfer to equity –(35,210) (35,210)

At March 31, 2007 317, 49 5 –317, 4 9 5

At April 1, 2007 3 17, 4 9 5 –317, 4 9 5

Exchange adjustment 1,720 –1,720

Interest charged 18,700 –18,700

Interest paid (13,500) –(13,500)

Conversion to voting ordinary shares (113, 234) –(113,23 4)

At March 31, 2008 211,181 –211,181

Lenovo Group Limited • Annual Report 2007/08

126