Konica Minolta 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

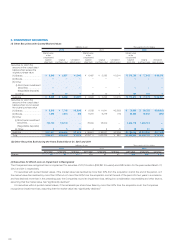

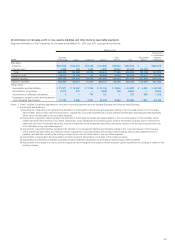

Millions of yen

2011

Business

Technologies Optics

Healthcare

(Note 2) Subtotal

Other

(Note 1) Total Adjustments

Total amounts

in consolidated

fi n a n c i a l

statements

Net sales

External .............................................. ¥539,639 ¥129,836 ¥84,990 ¥754,465 ¥23,487 ¥777,953 ¥ — ¥777,953

Intersegment ....................................... 3,067 799 1,598 5,466 50,451 55,917 (55,917) —

Total ................................................. 542,706 130,636 86,589 759,932 73,939 833,871 (55,917) 777,953

Segment profi t ....................................... 37,457 12,813 171 50,442 5,455 55,898 (15,876) 40,022

Segment assets ..................................... 390,299 130,592 61,032 581,924 54,869 636,794 208,659 845,453

Segment liabilities .................................. 196,669 81,952 39,054 317,676 74,413 392,089 24,375 416,465

Other items

Depreciation and amortization ................... ¥ 24,337 ¥ 21,093 ¥ 3,185 ¥ 48,615 ¥ 2,222 ¥ 50,837 ¥ 4,291 ¥ 55,129

Amortization of goodwill ........................ 7,854 402 — 8,256 145 8,401 — 8,401

Investments in affi liated companies ......... 3 — 732 735 — 735 928 1,664

Increases in property, plant and

equipment and intangible fi xed assets .... 12,960 19,624 3,002 35,587 1,695 37,283 5,699 42,982

Notes: 1. ‘Other’ consists of business segments not included in reporting segments such as Sensing Business and Industrial Inkjet Business.

2. In the year ended March 31, 2011, the segment title of the Medical & Graphic Imaging Business, which was utilized until the fi rst half of the fi scal year, was

changed to the Healthcare Business from to the third quarter. The results of the Healthcare Business for the fi scal year include those of the Medical &

Graphic Imaging Business for the fi rst half.

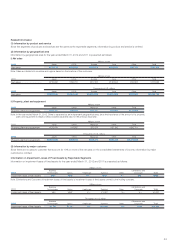

3. Information calculated based on segment information for the year ended March 31, 2012.

Obtaining the necessary comparative information to prepare segment information for the previous fi scal year or for the year ended March 31, 2012 in

accordance with the effective segment guidance/standard for the year ended March 31, 2012 has proved to be diffi cult. Doing so will impose an

excessive burden on the Company. Furthermore, no such segment information has been reported to management. Considering those reasons and the

utilization of such segment information, we have not disclosed such information except for in regards to external net sales.

If segment information was prepared for the previous fi scal year based on segment information for the year ended March 31, 2012, net sales in the

Business Technologies Business and the Healthcare Business are ¥544,506 million and ¥80,122 million, respectively. Net sales in the Business Technologies

Business include ¥4,867 million of the former Graphic Imaging Business.

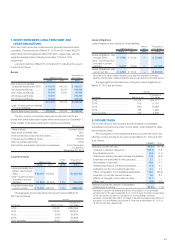

Thousands of U.S. dollars

2012

Business

Technologies Optics Healthcare Subtotal Other Total Adjustments

Total amounts

in consolidated

fi n a n c i a l

statements

Net sales

External .............................................. $6,662,319 $1,512,508 $888,746 $9,063,584 $279,146 $9,342,730 $ — $ 9,342,730

Intersegment ....................................... 22,545 9,186 23,482 55,226 586,519 641,745 (641,745) —

Total ................................................. 6,684,877 1,521,694 912,228 9,118,810 865,665 9,984,487 (641,745) 9,342,730

Segment profi t ....................................... 480,338 170,799 1,107 652,245 67,575 719,832 (228,945) 490,887

Segment assets ..................................... 4,863,779 1,446,210 790,850 7,100,864 688,563 7,789,427 3,185,777 10,975,204

Segment liabilities .................................. 2,376,250 807,896 499,087 3,683,258 313,031 3,996,289 1,686,446 5,682,735

Other items

Depreciation and amortization ................... $ 260,092 $ 202,665 $ 37,778 $ 500,548 $ 46,794 $ 547,354 $ 51,734 $ 599,087

Amortization of goodwill ........................ 101,132 4,222 — 105,353 1,764 107,118 — 107,118

Investments in affi liated companies ......... 37 — 8,931 8,967 — 8,967 11,984 20,951

Increases in property, plant and

equipment and intangible fi xed assets .... 216,340 80,375 28,604 325,332 72,345 397,676 16,389 414,077