Konica Minolta 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

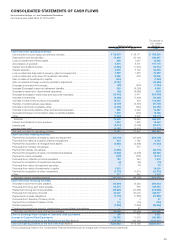

conditions for sales. However, increased sales of profi table core

products and thorough cost controls enabled the Group to

generally achieve its earnings targets from operating income to

net income. Based on these circumstances, the Company

declared a year-end cash dividend of ¥7.50 per share. In

conjunction with the interim cash dividend, cash dividends per

share for the year ended March 31, 2012 totaled ¥15.00.

While the operating environment remains uncertain, for the

fi scal year ending March 31, 2013, the Company assumes it

will achieve its performance targets and therefore plans to pay

an interim and a year-end cash dividend per share of ¥7.50

each for total annual dividends of ¥15.00 per share.

Outlook for the Fiscal Year Ending March 31, 2013

Looking at the global economic conditions surrounding the

Group, the outlook for the European economy remains

uncertain due to its fi scal problems. We expect that the United

States will grow moderately overall but will continue to expand

and contract. Growth in emerging economies, especially China,

India, and other Asian economies, is expected to slow, but we

expect these economies to maintain higher economic growth

rates than those of developed economies. The Japanese

economy is expected to recover, backed by demand

associated with post-earthquake reconstruction.

In the Business Technologies Business, we expect that

demand for production printing products will continue to

expand both in Japan and in overseas markets. We also

forecast that growth in emerging markets will drive demand for

offi ce MFPs. In developed countries, we expect to boost

demand from global major accounts by leveraging the

development of OPS. In the Industrial Business*, prolonged

adjustments of digital consumer electronics inventory, including

LCD TVs, are expected to come to an end, bringing an overall

recovery in demand. In the Healthcare Business, we anticipate

that demand for cassette DR and compact CR will continue to

expand, especially in the hospital and clinic markets.

*

The reportable segments in the fi scal year ended March 31, 2012 were the

Business Technologies Business, the Optics Business, and the Healthcare

Business. However, with the reorganization of the Group in April 2012, the

reportable segments will be the Business Technologies Business, Industrial

Business, and Healthcare Business from the fi scal year ending March 31, 2013.

Considering the above circumstances, we have made the

following forecasts for the fi scal year ending March 31, 2013.

We assume exchange rates of JPY 80 to USD 1 and JPY

100 to EUR 1.

Konica Minolta Group Risks

The following risks could have a signifi cant effect on the

judgment of investors in the Group. Further, the forward-looking

statements in the following section are the Group’s judgments

as of June 21, 2012.

Economic Risks

(1) Economic Trends in Primary Markets

The Group provides MFPs, production printing

equipment, image input/output components, display

materials, products and equipment for use in healthcare, and

related services to customers worldwide. Economic

conditions in national markets signifi cantly affect sales and

earnings in these businesses.

Risks of concern in the global economy include the

protracted debt problems in Europe, high crude oil prices due

to political instability in oil-producing countries, and economic

policy revisions in leading countries due to major elections.

Japan’s economy is expected to recover moderately because

of the impact of reconstruction and restoration demand

following the Great East Japan Earthquake and the fl ooding in

Thailand, but conditions remain unclear. Recessions in

national markets that cause customers to restrain investment,

reduce operating expenses or reduce consumption could

adversely affect the Group’s results or fi nances in ways such

as causing inventories to increase, reducing sales prices by

increasing competition, or reducing sales volume.

(2) Changes in Exchange Rates

Overseas sales account for 72.0% of the Group’s net

sales. The Group operates globally and is signifi cantly affected

by exchange rate fl uctuations.

The Group ameliorates the impact of exchange rates by

conducting hedging transactions centered on futures

contracts for major currencies including the U.S. dollar and

the euro. In addition, the impact of USD-denominated

procurement for the MFPs and printers the Business

Technologies Business produces in China is light because it is

basically offset by sales and payables in regions where sales

are denominated in U.S. dollars. However, fl uctuations in euro

exchange rates directly impact earnings. Generally, yen

appreciation versus the U.S. dollar and euro negatively affects

results, while yen depreciation versus these currencies

positively affects results.

The Group takes steps to ameliorate the impact of

currency exchange rate fl uctuations because yen appreciation

negatively affects its results. However, continued yen

appreciation could negatively affect the Group’s results.

Industry and Business Activity Risks

(3) Competition in Technology Innovation

The ability to innovate faster than other companies is the

primary source of competitive advantage in the Group’s core

businesses including MFPs, production printing equipment

and other information equipment, TAC polarizing fi lm for

LCDs, and pickup lenses for optical disks, and in the Group’s

key areas for future development including organic

electroluminescent (EL) lighting.

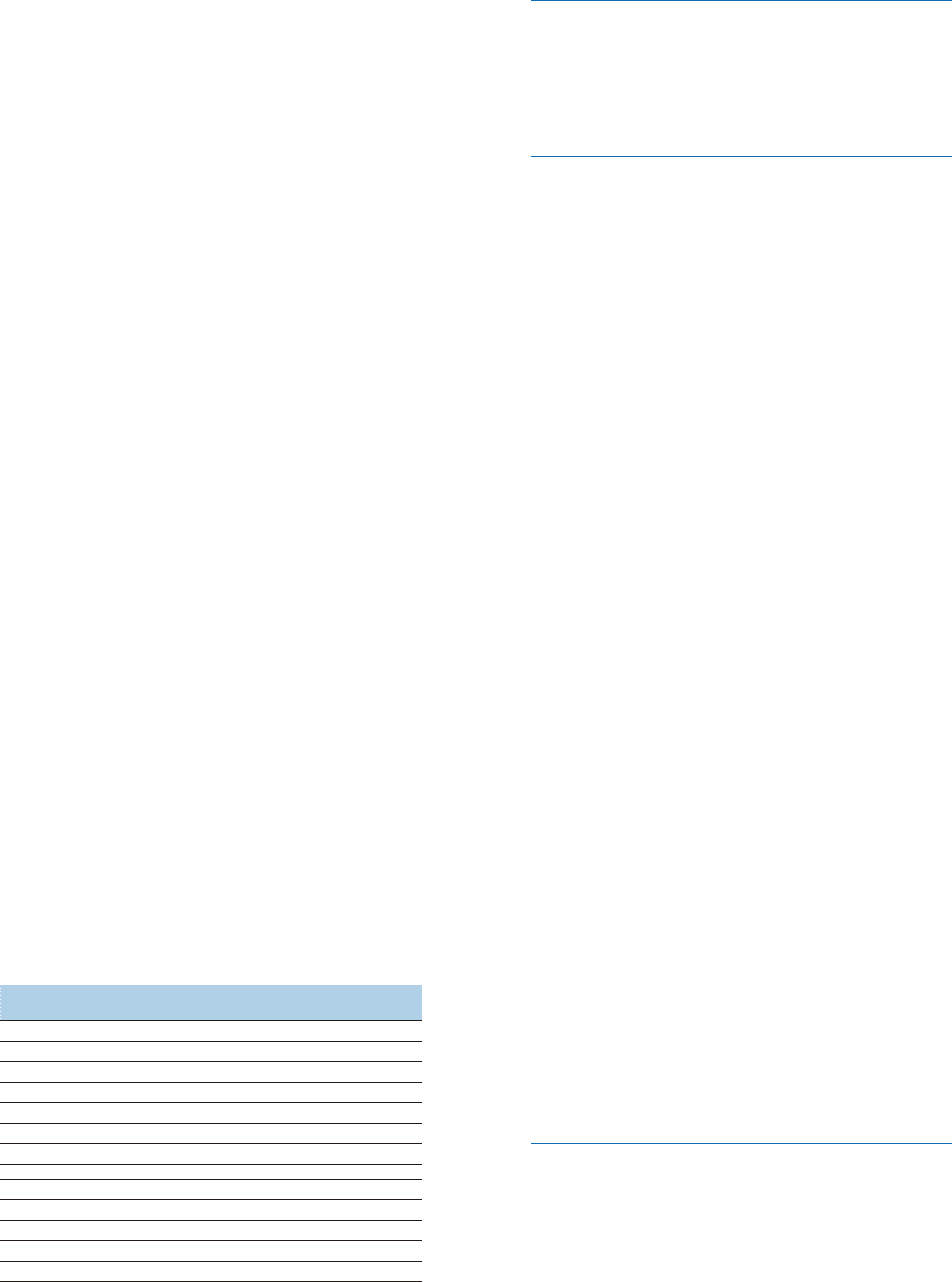

Performance Forecast for the Fiscal Year Ending

March 31, 2013 (As of July 27, 2012)

(Billions of

yen)

Net sales 800.0

Operating income 48.0

Operating income ratio 6.0%

Amortization of goodwill 8.8

Operating income before amortization of goodwill 56.8

Operating income ratio before amortization of goodwill 7.1%

Net income 22.0

Capital expenditure 50.0

Depreciation 55.0

Research and development costs 73.0

Free cash flow (10.0)

CF from operating activities - CF from investing activities 30.0

19