Konica Minolta 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

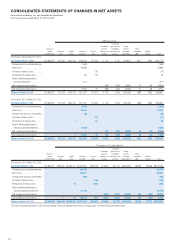

9. NET ASSETS

The Japanese Corporate Law became effective on May 1, 2006,

replacing the Commercial Code. Under Japanese laws and regulations,

the entire amount paid for new shares is required to be designated as

common stock. However, a company may, by a resolution of the Board of

Directors, designate an amount not exceeding one half of the price of the

new shares as additional paid-in capital, which is included in capital

surplus.

The Japanese Corporate Law provides that an amount equal to 10%

of distributions from retained earnings paid by the Company and its

Japanese subsidiaries be appropriated as additional paid-in capital or

legal earnings reserve. Legal earnings reserve is included in retained

earnings in the accompanying consolidated balance sheets. No further

appropriations are required when the total amount of the additional

paid-in capital and the legal earnings reserve equals 25% of their

respective stated capital. The Japanese Corporate Law also provides

that additional paid-in capital and legal earnings reserve are available for

appropriations by the resolution of the Board of Directors.

Cash dividends and appropriations to the additional paid-in capital or

the legal earnings reserve charged to retained earnings for the years

ended March 31, 2012 and 2011 represent dividends paid out during

those years and the related appropriations to the additional paid-in

capital or the legal earnings reserve.

Retained earnings at March 31, 2012 do not refl ect current year-end

dividends in the amount of ¥3,977 million ($48,388 thousand) approved

by the Board of Directors, which will be payable in May 2012.

The amount available for dividends under the Japanese Corporate

Law is based on the amount recorded in the Company’s

nonconsolidated books of account in accordance with accounting

principles generally accepted in Japan.

On October 28, 2011, the Board of Directors approved cash

dividends to be paid to shareholders of record as of September 30,

2011, totaling ¥3,976 million ($48,376 thousand), at a rate of ¥7.5 per

share. On May 10, 2012, the Board of Directors approved cash

dividends to be paid to shareholders of record as of March 31, 2012,

totaling ¥3,977 million ($48,388 thousand), at a rate of ¥7.5 per share.

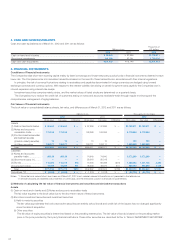

10. INVENTORIES

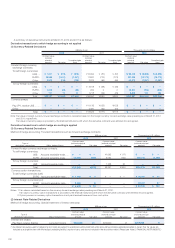

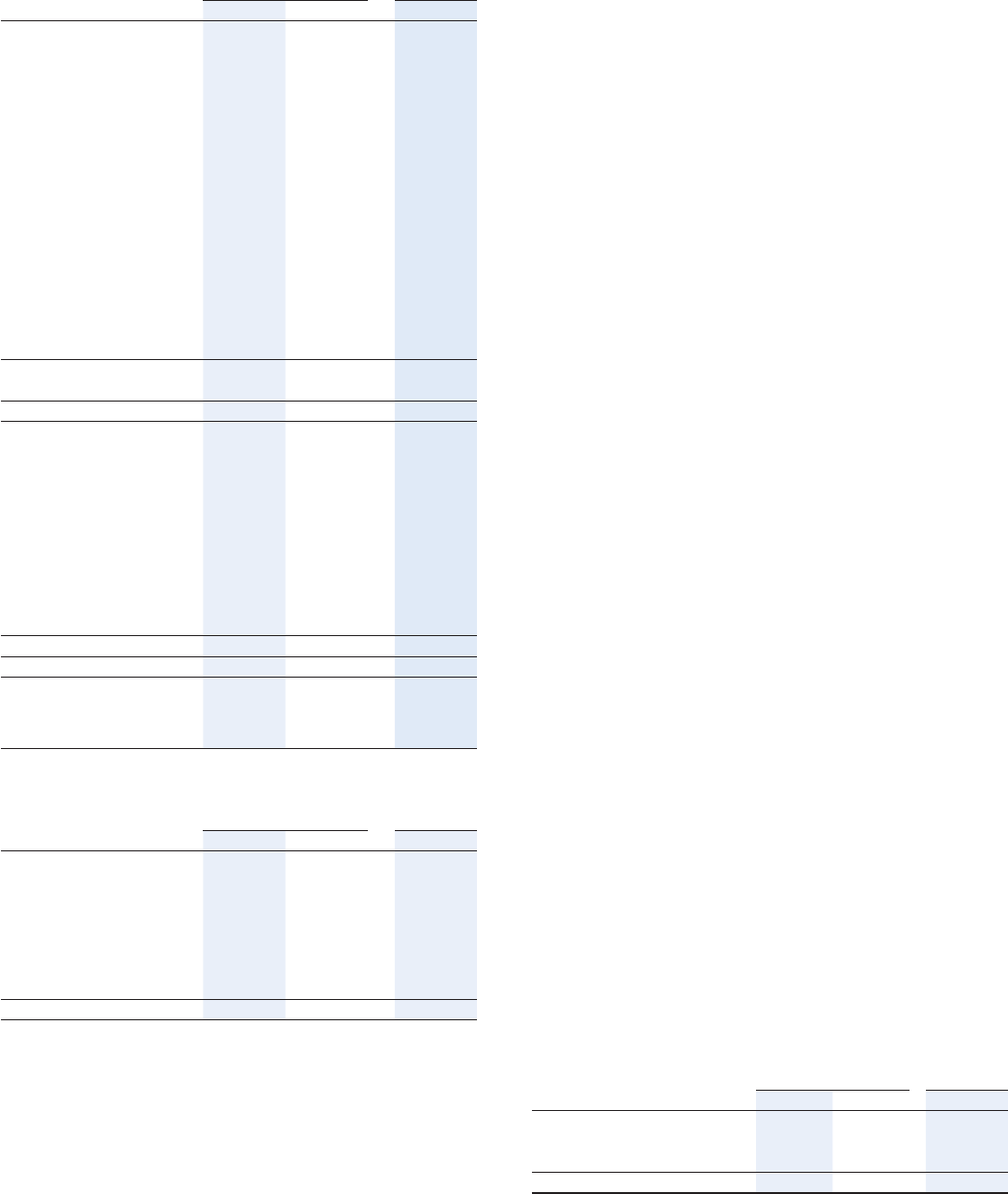

Inventories as of March 31, 2012 and 2011 are as follows:

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Merchandise and fi nished goods

..

¥ 71,211 ¥ 69,804 $ 866,419

Work in process

.........................

13,482 13,796 164,035

Raw materials and supplies

........

20,386 16,641 248,035

Total

...........................................

¥105,080 ¥100,243 $1,278,501

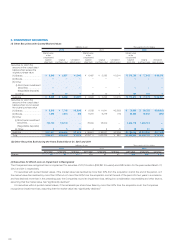

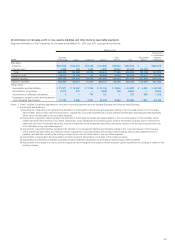

At March 31, 2012 and 2011, the signifi cant components of deferred tax

assets and liabilities in the consolidated fi nancial statements are as

follows:

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Deferred tax assets:

Net operating tax loss

carried forward ................ ¥ 49,046 ¥ 37,411 $ 596,739

Accrued retirement benefi ts .. 22,348 24,473 271,907

Depreciation and

amortization .................... 3,928 4,346 47,792

Accrued bonuses .............. 3,614 4,018 43,971

Write-down of assets ......... 3,177 3,876 38,654

Elimination of unrealized

intercompany profi ts ......... 3,018 3,538 36,720

Tax effects related to

investments .................... 1,905 21,182 23,178

Allowance for doubtful

accounts ........................ 992 1,134 12,070

Accrued enterprise taxes .... 778 777 9,466

Reserve for discontinued

operations ...................... —26 —

Other ............................... 8,483 9,540 103,212

Gross deferred tax assets ... 97,292 110,325 1,183,745

Valuation allowance ........... (31,036) (38,416) (377,613)

Total deferred tax assets..... ¥ 66,255 ¥ 71,909 $ 806,120

Deferred tax liabilities:

Retained earnings of

overseas subsidiaries ....... ¥ (2,316) ¥ (4,748) $ (28,179)

Gains on securities

contributed to employees’

retirement benefi t trust ..... (2,134) (2,490) (25,964)

Unrealized gains on

securities ........................ (381) (710) (4,636)

Special tax-purpose reserve

for condensed booking of

fi x e d a s s e t s ..................... (27) (43) (329)

Other ............................... (3,741) (3,886) (45,516)

Total deferred tax liabilities .. ¥ (8,601) ¥(11,878) $ (104,648)

Net deferred tax assets ...... ¥ 57,654 ¥ 60,030 $ 701,472

Deferred tax liabilities

related to revaluation:

Deferred tax liabilities on

land revaluation ............... ¥ (3,269) ¥ (3,733) $ (39,774)

Net deferred tax assets are included in the following items in the

consolidated balance sheets:

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Current assets–deferred tax

assets .............................. ¥20,100 ¥30,393 $244,555

Fixed assets–deferred tax

assets .............................. 38,281 30,404 465,762

Current liabilities–other

current liabilities ................ (606) (659) (7,373)

Long-term liabilities–other

long-term liabilities ............. (120) (108) (1,460)

Net deferred tax assets

.........

¥57,654 ¥60,030 $701,472

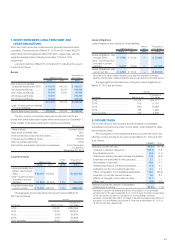

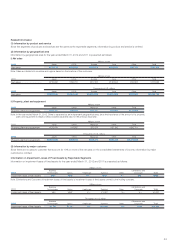

Adjustment of Deferred Tax Assets and Liabilities due to Changes

in Corporate Tax Rates

Following the enactment on December 2, 2011 of the “Act for Partial

Revision of the Income Tax Act, etc. for the Purpose of Creating

Taxation System Responding to Changes in Economic and Social

Structures” (Act No. 114 of 2011) and “Act on Special Measures for

Securing Financial Resources Necessary to Implement Measures for

Reconstruction following the Great East Japan Earthquake” (Act No. 117

of 2011), the corporate tax rate will be reduced and a special recovery

tax will be imposed effective from fi scal years beginning on or after April

1, 2012. In accordance with these changes, the effective statutory tax

rates will be reduced to 38.01% from 40.69% for the fi scal year

beginning on April 1, 2012 through the fi scal year beginning on April 1,

2014, and to 35.64% for fi scal years beginning on or after April 1, 2015.

As a result of these changes, net deferred tax assets and unrealized

losses on hedging derivatives, net of taxes as of March 31, 2012

decreased ¥3,276 million ($39,859 thousand) and ¥9 million ($110

thousand), respectively. Deferred income taxes for the years ended

March 31, 2012 and unrealized gains on securities, net of taxes as of

March 31, 2012 increased ¥3,320 million ($40,394 thousand) and ¥54

million ($657 thousand), respectively.