Konica Minolta 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the scal years ended March 31, 2012 and 2011

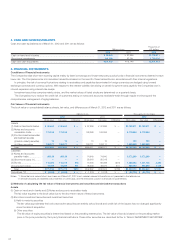

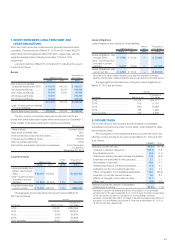

1. BASIS OF PRESENTING FINANCIAL STATEMENTS

The accompanying consolidated fi nancial statements of Konica Minolta

Holdings, Inc., (the “Company”) and its consolidated subsidiaries (the

“Companies”) are prepared on the basis of accounting principles

generally accepted in Japan, which are different in certain respects

regarding application and disclosure requirements of International

Financial Reporting Standards, and are compiled from the consolidated

fi nancial statements prepared by the Company as required by the

Securities and Exchange Law of Japan. Accounting principles generally

accepted in Japan allow consolidation of foreign subsidiaries based on

their fi nancial statements in conformity with International Financial

Reporting Standards and accounting principles generally accepted in the

United States.

The accompanying consolidated fi nancial statements incorporate

certain reclassifi cations in order to present them in a format that is more

appropriate to readers outside Japan. In addition, the notes to the

consolidated fi nancial statements include information that is not

required under generally accepted accounting principles in Japan, but

is provided herein as additional information.

As permitted under the Securities and Exchange Law of Japan,

amounts of less than one million yen have been omitted. As a result, the

totals shown in the accompanying consolidated fi nancial statements

(both in yen and in dollars) do not necessarily agree with the sums of the

individual amounts.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

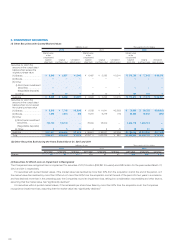

(a) Principles of Consolidation

The consolidated fi nancial statements include the accounts of the

Company and, with certain exceptions which are not material, those of

its 92 subsidiaries (89 subsidiaries for 2011) for which it retains control.

All signifi cant intercompany transactions, balances and unrealized

profi ts among the Companies are eliminated on consolidation.

Investments in 3 unconsolidated subsidiaries (3 unconsolidated

subsidiaries for 2011) and 2 signifi cant affi liates (2 signifi cant affi liates for

2011) are accounted for using the equity method of accounting.

Investments in the other unconsolidated subsidiaries and affi liates are

stated at cost, since they have no material effect on the consolidated

fi nancial statements.

(b) Translation of Foreign Currencies

Translation of Foreign Currency Transactions and Balances

All monetary assets and liabilities denominated in foreign currencies,

whether long-term or short-term, are translated into Japanese yen at the

exchange rates prevailing at the balance sheet date. The resulting

exchange gains and losses are charged or credited to income.

Translation of Foreign Currency Financial Statements

The translation of foreign currency fi nancial statements of overseas

consolidated subsidiaries into Japanese yen is done by applying the

exchange rates prevailing at the balance sheet dates for balance sheet

items, except common stock, additional paid-in capital and retained

earnings accounts, which are translated at the historical rates, and the

statements of income and retained earnings which are translated at

average exchange rates.

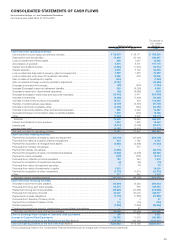

(c) Cash and Cash Equivalents

Cash and cash equivalents in the consolidated cash fl ow statements

comprise cash on hand and short-term investments that are due for

redemption in one year or less and are easily converted into cash with

little risk to changes in value.

(d) Allowance for Doubtful Accounts

The allowance for doubtful accounts is provided for possible losses

from uncollectible receivables based on specifi c doubtful accounts

identifi ed and historical loss experience.

(e) Inventories

Inventories held by domestic consolidated subsidiaries are mainly

stated using the cost price method (carrying amount in the balance

sheet is calculated with consideration of write-down due to decreased

profi tability) determined using the total average method. Inventories held

by overseas consolidated subsidiaries are mainly stated at the lower of

cost or market value or net realizable value, where cost is determined

using the fi rst-in, fi rst-out method.

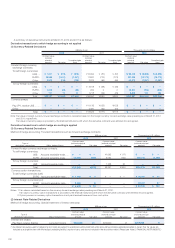

(f) Property, Plant and Equipment

Depreciation of property, plant and equipment (excluding lease assets)

for the Company and domestic consolidated subsidiaries is calculated

using the declining balance method, except for depreciation of buildings

acquired after April 1, 1998, which are depreciated using the

straight-line method over their estimated useful lives. Depreciation of

property, plant and equipment (excluding lease assets) for overseas

consolidated subsidiaries is calculated using the straight-line method.

For fi nance leases where ownership is not transferred, depreciation

is calculated using the straight-line method over the lease period

utilizing a residual value of zero. For fi nance leases held by the Company

and its domestic consolidated subsidiaries that do not transfer

ownership and for which the starting date for the lease transaction is

prior to March 31, 2008, lease payments are recognized as an expense.

(g) Intangible Assets

Intangible assets (excluding lease assets) are depreciated using the

straight-line method. In addition, software is depreciated using the

straight-line method over its estimated useful life (5 years).

(h) Goodwill

Goodwill is amortized on a straight-line basis over a period not

exceeding 20 years.

(i) Income Taxes

Deferred income taxes are recognized based on temporary differences

between the tax basis of assets and liabilities and those as reported in

the consolidated fi nancial statements.

(j) Research and Development Costs

Research and development costs are expensed as incurred.

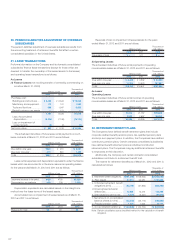

(k) Financial Instruments

Derivatives

All derivatives are stated at fair market value, with changes in fair market

value included in net income for the period in which they arise, except

for derivatives that are designated as “hedging instruments” (see Hedge

Accounting below).

Securities

Investments in equity securities issued by unconsolidated subsidiaries

and affi liates are accounted for using the equity method of accounting;

however, investments in certain unconsolidated subsidiaries and

affi liates are stated at cost due to the effect of the application of the

equity method of accounting being immaterial.