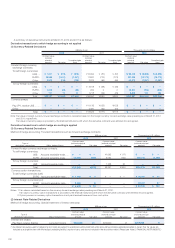

Konica Minolta 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

11. CONTINGENT LIABILITIES

The Companies were contingently liable at March 31, 2012 for loan and

lease guarantees of ¥652 million ($7,933 thousand) and at March 31,

2011 for loan and lease guarantees of ¥770 million.

12. COLLATERAL ASSETS

Assets pledged as collateral at March 31, 2012 for short-term debt of

¥54 million ($657 thousand) are accounts receivable–trade and lease

investment assets of ¥54 million ($657 thousand). Assets pledged as

collateral at March 31, 2011 for short-term debt of ¥82 million, are notes

receivable of ¥47 million.

13. COST OF SALES

The Companies have recognized valuation losses associated with the

writing down of inventories of ¥1,511 million ($18,384 thousand) and

¥1,888 million for the years ended March 31, 2012 and 2011,

respectively, due to decline in profi tability. These losses are included

within the cost of sales.

14. RESEARCH AND DEVELOPMENT COSTS

Research and development costs included in selling, general and

administrative expenses for the years ended March 31, 2012 and 2011

are ¥72,530 million ($882,467 thousand) and ¥72,617 million,

respectively.

15. GAIN ON REVERSAL OF FOREIGN CURRENCY

TRANSLATION ADJUSTMENT

The gain on reversal of foreign currency translation adjustment resulted

from the liquidation of a U.S. subsidiary.

16. OTHER EXTRAORDINARY GAIN OF OVERSEAS

SUBSIDIARIES

Other extraordinary gain of overseas subsidiaries represents the

reduction in refund obligation, etc. in accordance with U.S. state laws

for the U.S. subsidiary.

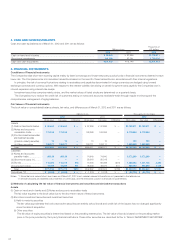

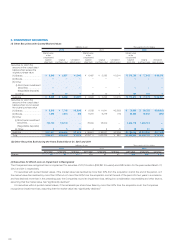

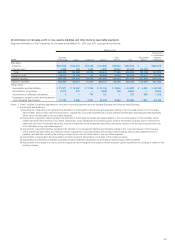

17. LOSS ON IMPAIRMENT OF FIXED ASSETS

The Companies have recognized loss on impairment of ¥893 million

($10,865 thousand) and ¥1,027 million for the following groups of assets

for the years ended March 31, 2012 and 2011, respectively:

Amount

Millions of yen

Thousands of

U.S. dollars

Description Classifi cation 2012 2011 2012

Manufacturing

equipment of

micro-camera units

for mobile phones

Machinery and

equipment, Tools

and furniture,

Others

¥ — ¥ 514 $ —

Rental assets

Rental

business-use

assets

88 24 1,071

Idle assets

Buildings and

structures,

Machinery and

equipment,

Others

614 488 7,470

Others

Investments and

other assets,

Others

190 —2,312

Total ¥893 ¥1,027 $10,865

(1) Cash-generating units have been identifi ed based on product lines

and geographical areas as a group of assets. For rental assets, cash-

generating units are identifi ed based on rental contracts and each

geographical area. Each idle asset is also identifi ed as a

cash-generating unit.

(2) Fixed assets have been written down to the recoverable amount and

corresponding impairment losses have been recognized due to the

poor performance and profi tability of rental and idle assets. In

addition, the revaluation of the other assets category has contributed

to the write down amount.

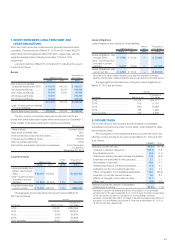

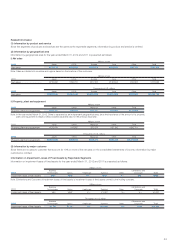

(3) Details of impairment of fi xed assets

Amount

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Buildings and structures ....... ¥254 ¥ — $3,090

Machinery and equipment .... 346 897 4,210

Rental business-use assets .. 88 —1,071

Others ............................... 203 130 2,470

(4) Measurement of recoverable amount

The recoverable amount of a cash-generating unit is the fair value

less costs to sell. The fair value is supported by an appraisal report

for land and buildings and structures, or a management estimate for

rental business-use assets.

18. BUSINESS STRUCTURE IMPROVEMENT EXPENSES

Business structure improvement expenses comprise expenses incurred

on retirement allowances, etc. associated with staff allocation/

optimization in the Business Technologies business.

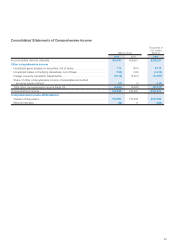

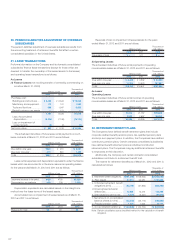

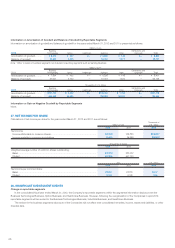

19. OTHER COMPREHENSIVE INCOME

Recycling and Tax Effect Relating to Other Comprehensive Income

Amounts reclassifi ed to net income (loss) in the current period that were

recognized in other comprehensive income in the current or previous

periods and tax effects for each component of other comprehensive

income are as follows:

Millions of yen

Thousands of

U.S. dollars

2012 2012

Unrealized gains (losses) on securities

Increase (decrease) during the year ....... ¥ (247) $ (3,005)

Reclassifi cation adjustments ................ 1,104 13,432

Sub-total, before tax ........................... 856 10,415

Tax (expense) or benefi t ....................... (140) (1,703)

Sub-total, net of tax ............................ 716 8,712

Unrealized losses on hedging derivatives

Increase (decrease) during the year ....... 161 1,959

Reclassifi cation adjustments ................ (369) (4,490)

Sub-total, before tax ........................... (207) (2,519)

Tax (expense) or benefi t ....................... 74 900

Sub-total, net of tax ............................ (133) (1,618)

Foreign currency translation adjustments

Increase (decrease) during the year ....... (2,381) (28,969)

Reclassifi cation adjustments ................ (3,730) (45,383)

Sub-total ........................................... (6,112) (74,364)

Share of other comprehensive income of

associates accounted for using equity method

Increase (decrease) during the year ....... (12) (146)

Total other comprehensive income.......... ¥(5,541) $(67,417)