Konica Minolta 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

Held-to-maturity securities are recognized using the amortized cost

method (straight-line method).

Other securities for which market quotes are available are stated at

fair market value. Net unrealized gains or losses on these securities are

reported, net of tax, as a separate component of net assets.

Other securities for which market quotes are unavailable are stated

at cost, except in cases where the fair market value of equity securities

issued by unconsolidated subsidiaries and affi liates or other securities

has declined signifi cantly and such decrease in value is deemed other

than temporary. In these instances, securities are written down to the

fair market value and the resulting losses are charged to income during

the period.

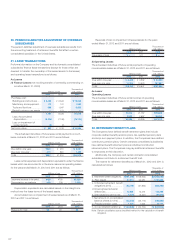

Hedge Accounting

Gains or losses arising from changes in fair market value of derivatives

designated as “hedging instruments” are deferred as an asset or a

liability and charged or credited to income in the same period that the

gains and losses on the hedged items or transactions are recognized.

Derivatives designated as hedging instruments are primarily interest

rate swaps, currency options and forward foreign currency exchange

contracts. The related hedged items are trade accounts receivable,

trade accounts payable and long-term bank loans.

The Companies’ policy is to utilize the above hedging instruments in

order to reduce exposure to the risks of interest rate and exchange rate

fl uctuations. As such, the Companies’ purchases of the hedging

instruments are limited to, at maximum, the amounts of the hedged

items.

The Companies evaluate the effectiveness of their hedging activities

by reference to the accumulated gains or losses on the hedging

instruments and the related hedged items on the date of commencement

of the hedges.

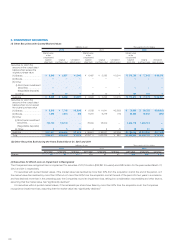

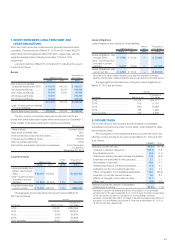

(l) Retirement Benefi t Plans

Retirement Benefi ts for Employees

The Company, domestic consolidated subsidiaries and certain overseas

consolidated subsidiaries have obligations to make defi ned benefi t

retirement payments to their employees and, therefore, provide for

accrued retirement benefi ts based on the estimated amount of

projected benefi t obligations and the fair value of plan assets.

For the Company and its domestic consolidated subsidiaries,

unrecognized prior service cost is amortized using the straight-line

method over a 10-year period, which is shorter than the average

remaining years of service of the eligible employees. Unrecognized net

actuarial gains or losses are primarily amortized in the following year

using the straight-line method over a 10-year period, which is shorter

than the average remaining years of service of the eligible employees.

Accrued Retirement Benefi ts for Directors and Statutory Auditors

Domestic consolidated subsidiaries recognize a reserve for retirement

benefi ts for directors and statutory auditors based on the amount

payable at the end of the period in accordance with their internal

regulations.

(m) Per Share Data

Net income per share of common stock is calculated based on the

weighted-average number of shares outstanding during the year.

Cash dividends per share for each year as disclosed in the

accompanying consolidated fi nancial statements are dividends declared

for the respective year.

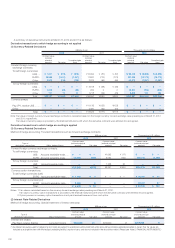

(n) Practical Solution on Unifi cation of Accounting Policies

Applied to Foreign Subsidiaries for Consolidated Financial

Statements

Effective from the year ended March 31, 2009, the Company applied

the “Practical Solution on Unifi cation of Accounting Policies Applied to

Foreign Subsidiaries for Consolidated Financial Statements”

(Accounting Standards Board of Japan (ASBJ) Practical Issues Task

Force (PITF) No. 18, issued by the ASBJ on May 17, 2006).

The Company has made necessary adjustments upon consolidation

to unify accounting standards for foreign subsidiaries to be consistent

with the Company.

(o) Accounting Changes and Error Corrections

Application of Accounting Standards

The Company adopted “Accounting Standard for Accounting Changes

and Error Corrections” (ASBJ Statement No. 24, issued on December 4,

2009) and “Guidance on Accounting Standard for Accounting Changes

and Error Corrections” (ASBJ Guidance No. 24, issued on December 4,

2009) for accounting changes and corrections of prior period errors

which are made from the fi scal year beginning on April 1, 2011.

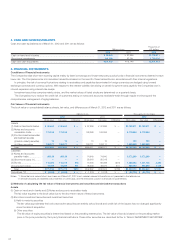

3. U.S. DOLLAR AMOUNTS

The translation effect of Japanese yen amounts into U.S. dollars is

included solely for the convenience of the reader, using the prevailing

exchange rate at March 31, 2012, of ¥82.19 to U.S.$1.00. The translations

should not be construed as representations that the Japanese yen

amounts have been, could have been, or could in the future be,

converted into U.S. dollars at this or any other exchange rate.