Konica Minolta 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

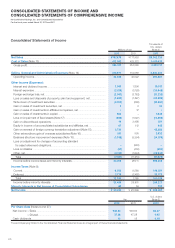

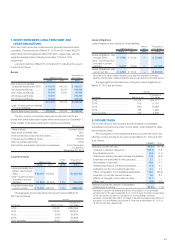

CONSOLIDATED STATEMENTS OF INCOME AND

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the scal years ended March 31, 2012 and 2011

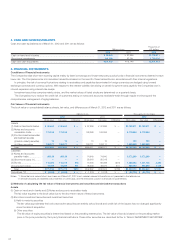

Consolidated Statements of Income

Millions of yen

Thousands of

U.S. dollars

(Note 3)

2012 2011 2012

Net Sales .................................................................................................................. ¥767,879 ¥777,953 $9,342,730

Cost of Sales (Note 13) ............................................................................................ 412,562 423,372 5,019,613

Gross profi t ............................................................................................................. 355,317 354,580 4,323,117

Selling, General and Administrative Expenses (Note 14) ..................................... 314,971 314,558 3,832,230

Operating income ................................................................................................... 40,346 40,022 490,887

Other Income (Expenses):

Interest and dividend income ................................................................................. 1,563 1,806 19,017

Interest expenses ................................................................................................... (2,519) (3,129) (30,648)

Foreign exchange loss, net ..................................................................................... (2,567) (3,762) (31,233)

Loss on sales and disposals of property, plant and equipment, net ...................... (1,693) (1,527) (20,599)

Write-down of investment securities ....................................................................... (2,700) (680) (32,851)

Gain on sales of investment securities, net ............................................................ 2 3 24

Gain on sales of investments in affi liated companies, net ...................................... –12 –

Gain on sales of investments in capital ................................................................... 604 –7,3 49

Loss on impairment of fi xed assets (Note 17) ......................................................... (893) (1,027) (10,865)

Gain on discontinued operations ........................................................................... 19 2,498 231

Equity in income of unconsolidated subsidiaries and affi liates, net ........................ 67 112 815

Gain on reversal of foreign currency translation adjustment (Note 15) .................... 3,730 –45,383

Other extraordinary gain of overseas subsidiaries (Note 16) .................................. 241 505 2,932

Business structure improvement expenses (Note 18) ............................................ (1,198) (3,394) (14,576)

Loss on adjustment for changes of accounting standard

for asset retirement obligations............................................................................ –(983) –

Loss on disaster .................................................................................................... (57) (450) (694)

Other, net ................................................................................................................ (2,132) (1,894) (25,940)

Total ..................................................................................................................... (7,531) (11,910) (91,629)

Income before income taxes and minority interests ............................................... 32,815 28,111 399,258

Income Taxes (Note 8):

Current.................................................................................................................... 9,553 9,580 116,231

Deferred .................................................................................................................. 2,776 (7,420) 33,775

Total ..................................................................................................................... 12,330 2,160 150,018

Income before minority interests ............................................................................ 20,484 25,951 249,227

Minority Interests in Net Income of Consolidated Subsidiaries ......................... 60 54 730

Net Income ............................................................................................................... ¥ 20,424 ¥ 25,896 $ 248,497

Yen

U.S. dollars

(Note 3)

2012 2011 2012

Per Share Data (Notes 9 and 27):

Net income —Basic ................................................................................................ ¥38.52 ¥48.84 $0.47

—Diluted .............................................................................................. 37.28 47.28 0.45

Cash dividends ....................................................................................................... 15 15 0.18

The accompanying Notes to the Consolidated Financial Statements are an integral part of these fi nancial statements.