Konica Minolta 2012 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

billion in the Business Technologies Business, decreased 1.1% to ¥10.2 billion in the

Optics Business, decreased 31.5% to ¥4.9 billion in the Healthcare Business, and

increased 10.8% to ¥13.1 billion in other businesses.

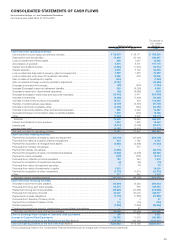

Financial Position and Liquidity

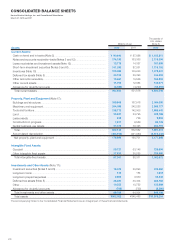

Assets

Current assets at March 31, 2012 increased ¥64.0 billion, or 12.8%, from a year

earlier to ¥565.9 billion. Cash on hand and in banks increased ¥2.7 billion, short-term

investment securities increased ¥5.4 billion, and notes and accounts receivable-trade

increased ¥10.8 billion. Deferred tax assets decreased ¥10.2 billion.

Property, plant and equipment as of March 31, 2012 decreased ¥11.7 billion from a

year earlier to ¥178.9 billion due to normal depreciation. Intangible assets decreased ¥1.0

billion from a year earlier to ¥87.3 billion due to amortization despite increased goodwill

as a result of business acquisitions in the Business Technologies Business.

Investments and other assets as of March 31, 2012 increased ¥5.2 billion from a

year earlier to ¥69.7 billion. Investment securities decreased ¥1.8 billion from a year

earlier largely because of reduced book value due to lower stock prices. However,

deferred tax assets increased ¥7.8 billion from a year earlier.

As a result of these factors, total assets at March 31, 2012 increased ¥56.5 billion,

or 6.7%, from a year earlier to ¥902.0 billion.

Liabilities

Current liabilities at March 31, 2012, decreased ¥13.5 billion from a year earlier.

Notes and accounts payable-trade increased ¥13.4 billion, while the total of short-term

debt and the current portion of long-term debt decreased ¥29.6 billion.

Long-term liabilities at March 31, 2012 increased ¥64.1 billion from a year earlier

because bonds payable increased ¥40.0 billion due to the issue of bonds and long-term

loans payable increased ¥24.9 billion.

As a result of the above, total liabilities as of March 31, 2012 increased ¥50.5 billion,

or 12.1%, from a year earlier to ¥467.0 billion.

Interest-bearing debt as of March 31, 2012 increased ¥35.3 billion from a year

earlier to ¥227.9 billion.

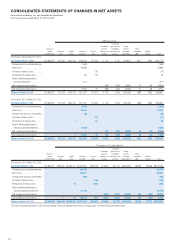

Net Assets

After net income of ¥20.4 billion and dividend payments of ¥7.9 billion, retained

earnings at March 31, 2012 increased ¥11.3 billion from a year earlier to ¥222.8 billion.

On the other hand, foreign currency translation adjustments reduced net assets by an

additional ¥6.0 billion compared with a year earlier due to the higher yen.

As a result of the above, net assets at March 31, 2012 increased ¥5.9 billion, or

1.4%, from a year earlier to ¥434.9 billion.

At March 31, 2012, the equity ratio decreased 2.5 percentage points from a year

earlier to 48.1%.

Dividend Policy

Basic Dividend Policy

The Company considers distribution of earnings to shareholders a management

priority under a basic policy of sustained distribution of earnings to shareholders after

comprehensive consideration of factors including consolidated results and strategic

investment in growth areas. The Company’s specifi c medium-to-long-term benchmark

for dividends is a consolidated payout ratio of 25% or higher. The Company also

considers factors such as fi nancial position and share price in making decisions about

share repurchases as another means of distributing earnings to shareholders.

Dividends for the Fiscal Year Ending March 31, 2012 and Planned Dividends for the

Fiscal Year Ending March 31, 2013

Increasing market competition and the appreciation of the yen during the fi scal year

ended March 31, 2012, along with production adjustments among customers and two

major natural disasters that impacted supply chains, created continued challenging

Management’s Discussion and Analysis

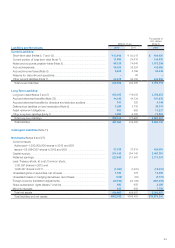

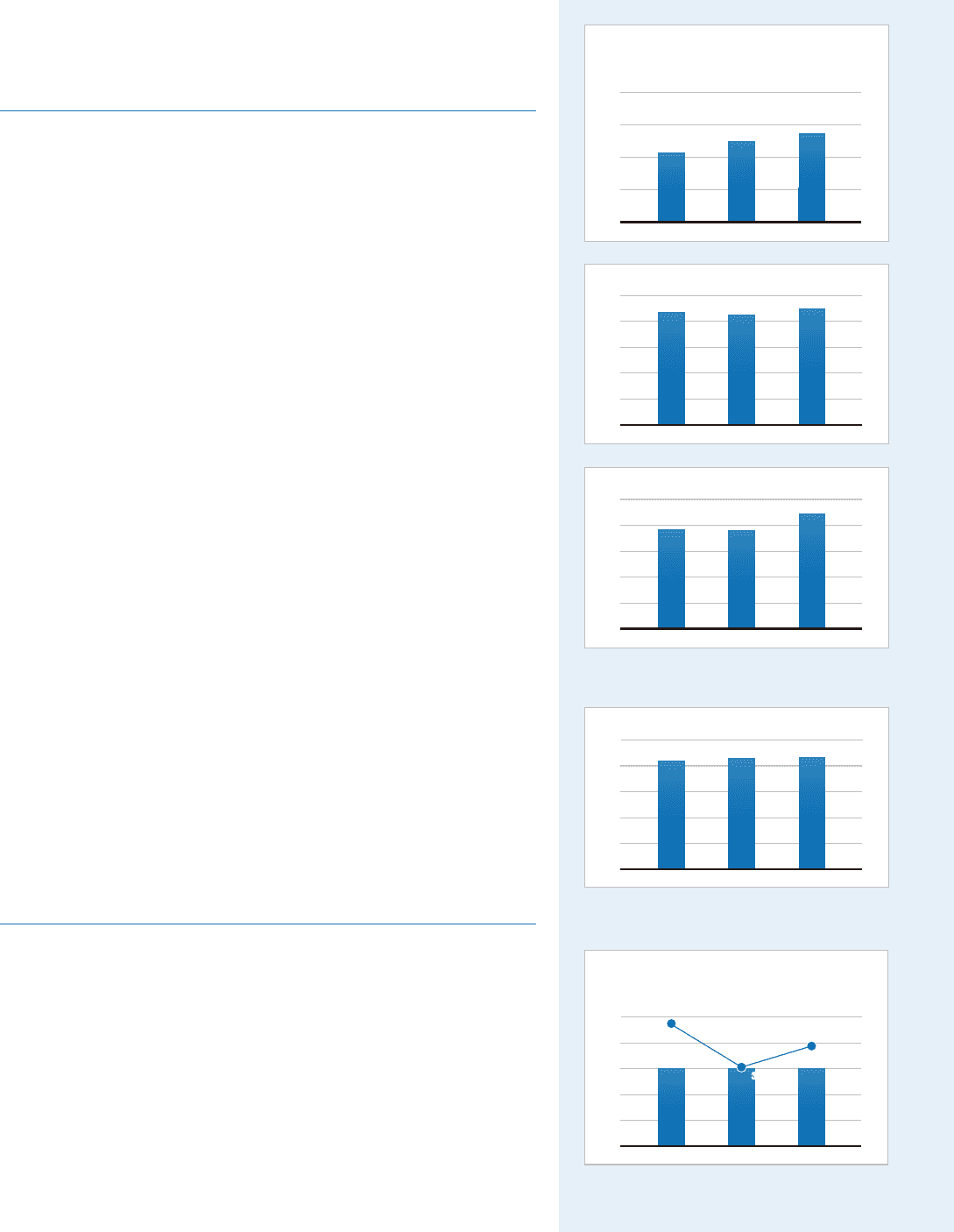

R&D expenses for Common Technology

Platforms and Leading-Edge Technologies

20

11.6 12.4 13.1

15

10

5

FY2009 FY2010 FY2011

0

(Billions of yen)

Total assets

1000 865.7 845.4 902.0

800

600

400

200

FY2009 FY2010 FY2011

0

(Billions of yen)

Interest-bearing debt

250

197.3 192.5

227.9

200

150

100

50

FY2009 FY2010 FY2011

0

(Billions of yen)

Net assets

500 420.7 428.9 434.9

400

300

200

100

FY2009 FY2010 FY2011

0

(Billions of yen)

Cash dividends per share and

consolidated payout ratio

25

15.00 15.00 15.00

20

15

10

5

FY2009 FY2010 FY2011

0

50

40

30

20

10

0

(Billions of yen) (%)

30.7%

30.7%

47.0%

39.9%

18