Konica Minolta 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.or delay production and shipments. Such disasters could also

disrupt or restrict use of essential utilities such as electricity, gas

and water; cause supply shortages of components and raw

materials by damaging suppliers; halt distribution; or disrupt

markets. Such circumstances could reduce net sales below

initial plans, incur signifi cant expenses to restore damaged

facilities, or have other outcomes that could adversely affect the

Group’s results.

The Group essentially resolved the component and raw

material procurement problems caused by the Great East

Japan Earthquake by the end of the second quarter of the fi scal

year ended March 31, 2012. Moreover, the fl ooding in Thailand

did not directly affect Group operations because the Group

does not have a production base there. However, the Group

has experienced increased procurement costs, suspended

orders and other issues resulting from supply chain disruptions

caused by the fl ooding. In the future, the impact of disasters on

suppliers or customers or the impact of issues such as

electricity shortages could adversely affect the Group’s results.

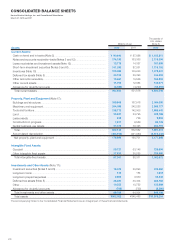

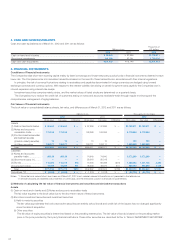

(17) Impairment of Long-Lived Assets

Effective the fi scal year ended March 31, 2006, the Group

adopted accounting standards for impairment of long-lived

assets including property, plant, equipment and goodwill. The

Group periodically evaluates the carrying value of long-lived

assets on the consolidated balance sheets to determine if their

residual value is recoverable with expected future cash fl ows

from the asset. The Group recognizes impairment when the

asset no longer generates suffi cient cash fl ow because its

operating profi tability has decreased due to competition or

other reasons, which could adversely affect the Group’s results.

Management’s Discussion and Analysis

22