Konica Minolta 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

CHAPTER 02

Market Analysis

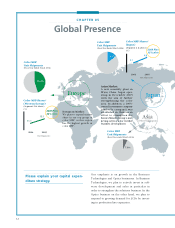

In developed markets such as Japan, the U.S. and

Europe, there is a rapid shift to color in office

documents, and the color MFP market is also

rapidly expanding as a result. As the convenience

of color, which has much more information con-

tent than monochrome is overwhelmingly high,

we foresee an accelerating shift to color. In fact,

in looking at global industry MFP shipments in

the fiscal year ended March 2006, the color MFP

segment recorded over 30% year-on-year growth

while overall unit growth was flat.

What is the market environment

for the general office and industry

specific markets related to the MFP

business?

The impact is extremely significant, and we are

convinced it will lead to a major change in cor-

porate market shares in the MFP industry. For

example, Konica Minolta’s brand value is steadily

increasing in the European and U.S. markets.

Looking at segment 2* and above color MFP mar-

ket shares in calendar 2005, our market share in

the European market grew from 11% in the

previous year to 15%, while it increased from

16% to 19% in the U.S. market, and we have

secured a position within the top group. On the

other hand, while we have struggled in Japan,

our market share has risen from 3% to 5% in the

past fiscal year and steadily continues to expand.

Overall, however, color MFP unit shipments also

increased by two-fold year-on-year. This is a sig-

nificant result of our strategy to shift to color dur-

ing this period. While our positioning in the

Japanese market heretofore was somewhat fixed

by monochrome MFP, we believe the rapid shift

to color will lead to the kind of substantial repo-

sitioning that was seen in the European and U.S.

markets. By the fiscal year ending March 2009,

the Konica Minolta Group plans to ensure a

worldwide market share of 25%, and market

shares of over 30% in Europe and the U.S. in

sales of segment 2 and above color MFP.

What impact is the rapid shift to

color having on the industry?

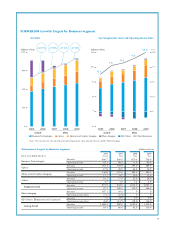

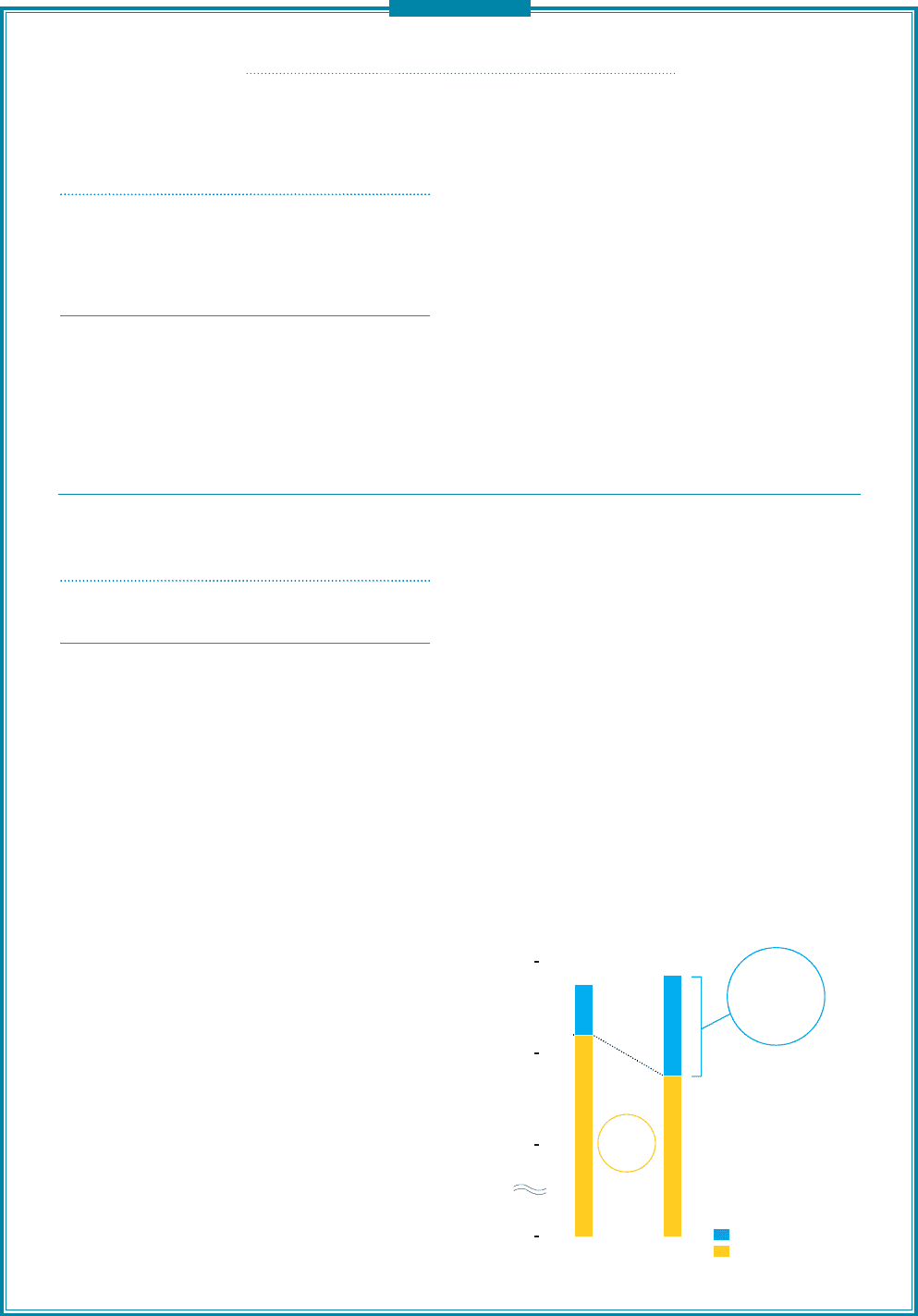

MFP Unit Shipments

(2005 MFP Shipments as an Index of 100)

UP

100%

down

11%

2005 2006

Color

Monochrome

100

101

0

65

85

105

89

80

11

21

* Note: Segment 1: 11–20 pages per minute

Segment 2: 21–30 pages per minute

Segment 3: 31–40 pages per minute

Segment 4: 41–69 pages per minute

(A4/Letter size output speeds in monochrome mode)