Konica Minolta 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

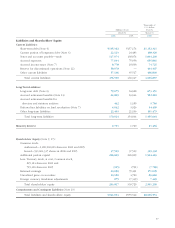

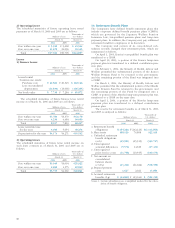

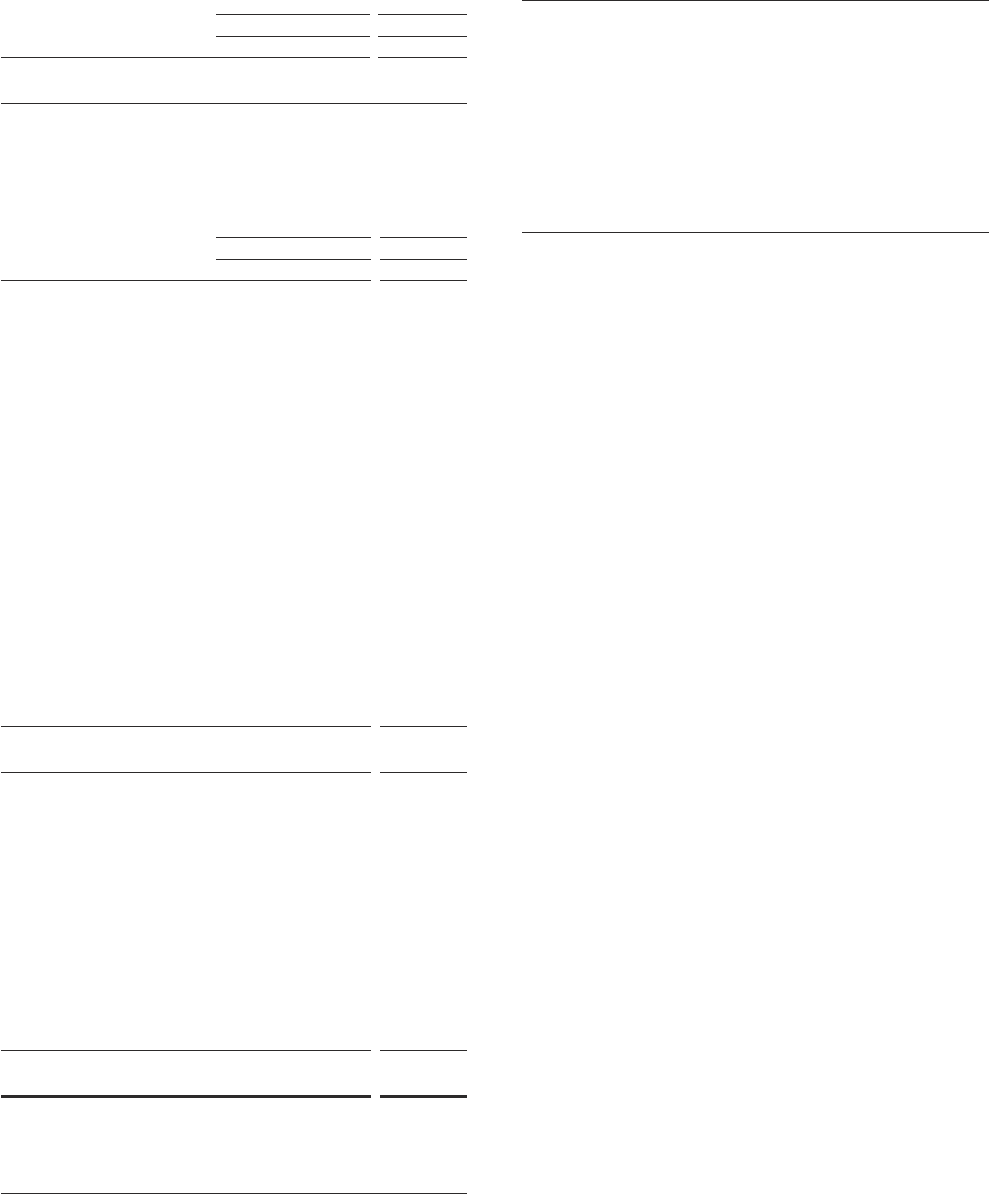

Assets pledged as collateral for short-term debt, long-

term debt and guarantees at March 31, 2006 and 2005 are as

follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

Property, plant and

equipment ¥821 ¥887 $6,989

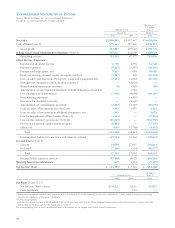

7. Income Taxes

At March 31, 2006 and 2005, significant components of

deferred tax assets and liabilities are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

Deferred tax assets:

Reserve for retirement

benefits ¥32,417 ¥ 31,309 $ 275,960

Net operating tax loss

carried forward 23,529 17,112 200,298

Elimination of unrealized

intercompany profits 14,807 14,651 126,049

Provision for dissolution

of businesses 14,405 —122,627

Write-down of assets 11,457 7,119 97,531

Depreciation and

amortization 7,446 1,497 63,386

Tax effects related to

investments 6,054 —51,537

Accrued bonuses over

deductible limit 5,621 5,993 47,851

Allowance for doubtful

accounts 3,157 1,693 26,875

Provision for special

outplacement program 2,638 —22,457

Enterprise taxes 1,728 1,556 14,710

Other 13,999 12,285 119,171

Gross deferred tax assets 137,265 93,220 1,168,511

Valuation allowance (52,392) (18,264) (446,003)

Total deferred tax assets 84,872 74,955 722,499

Deferred tax liabilities:

Unrealized gains on

securities (7,689) (4,299) (65,455)

Gains on securities

contributed to employees’

retirement benefit trust (3,161) (3,353) (26,909)

Retained profit of

overseas subsidiaries (2,185) (1,870) (18,600)

Special tax-purpose

reserve for condensed

booking of fixed assets (1,448) (1,440) (12,327)

Other (111) —(945)

Gross deferred tax liabilities (14,596) (10,964) (124,253)

Net deferred tax assets ¥70,276 ¥ 63,991 $ 598,246

Deferred tax liabilities

related to revaluation:

Deferred tax liabilities

on land revaluation ¥(4,042) ¥ (3,926) $(34,409)

At March 31, 2006 and 2005, the reconciliation of the

statutory income tax rate to the effective income tax rate is

as follows:

2006 2005

Statutory income tax rate 40.7% 40.7%

(Reconciliation)

Valuation allowance (95.0) (3.5)

Tax deduction 6.5 (8.6)

Amortization of consolidation

goodwill (9.0) 12.9

Effect of the introduction of

a consolidated tax return system —28.6

Other, net 8.0 7.1

Income tax rate per

statements of income (48.8) 77.2%

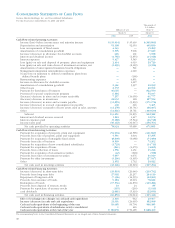

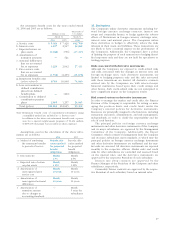

8. Research and Development Costs

Research and development costs included in cost of sales and

selling, general and administrative expenses for the years

ended March 31, 2006 and 2005 are ¥67,178 million

(US$571,874 thousand) and ¥65,994 million, respectively.

9. Shareholders’ Equity

As a result of huge losses of ¥116.1 billion (exiting of Photo

Imaging business, loss on impairment of fixed assets and

provision for special outplacement program etc.), the com-

pany reported a net loss of ¥54.3 billion and Shareholders’

equity dropped ¥45.9 billion year on year, to ¥293.8 billion.

Shareholders’ equity per share was ¥553.50 and the equity

ratio was 31.1%.

In view of this situation, on May 11, 2006, the Board of

Director’s meeting approved to continue the suspension of

cash dividends.

10. Contingent Liabilities

The companies were contingently liable at March 31, 2006 for

loan guarantees of ¥2,620 million (US$22,304 thousand), and

as of March 31, 2005 for loan guarantees of ¥2,195 million.

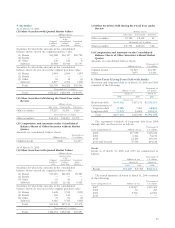

11. Loss on Impairment of Fixed Assets

The companies have recognized loss on impairment of

¥32,752 million ($278,812 thousand), for the following group

of assets as of March 31, 2006. Loss on impairment of fixed

assets ¥28,609 million ($243,543 thousand) concerning man-

ufacturing and sales of photographic paper, film, etc was

included in “Loss on discontinued operations”.