Konica Minolta 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

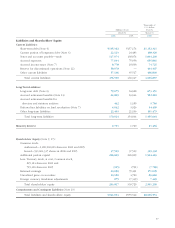

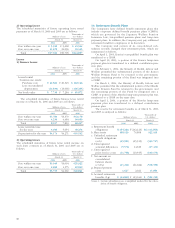

2) Operating Leases

The scheduled maturities of future operating lease rental

payments as of March 31, 2006 and 2005 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

Due within one year ¥ 5,350 ¥ 9,668 $ 45,544

Due over one year 11,670 21,036 99,345

Total ¥17,021 ¥30,705 $144,897

Lessor

1) Finance Leases

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

Leased rental

business-use assets:

Purchase cost ¥22,569 ¥ 20,345 $192,126

Less: Accumulated

depreciation (14,830) (13,060) (126,245)

Net book value ¥7,738 ¥ 7,284 $65,872

The scheduled maturities of future finance lease rental

income as of March 31, 2006 and 2005 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

Due within one year ¥3,780 ¥3,379 $32,178

Due over one year 4,236 4,484 36,060

Total 8,017 7,863 68,247

Lease rental income

for the year 4,496 5,054 38,274

Depreciation for the year ¥4,174 ¥4,271 $35,532

2) Operating Leases

The scheduled maturities of future lease rental income on

such lease contracts as of March 31, 2006 and 2005 are as

follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

Due within one year ¥3,045 ¥3,094 $25,922

Due over one year 2,690 1,575 22,899

Total ¥5,735 ¥4,669 $48,821

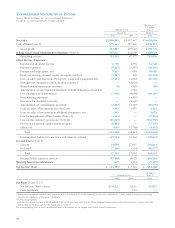

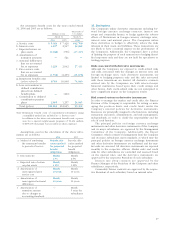

14. Retirement Benefit Plans

The Companies have defined benefit retirement plans that

include corporate defined benefit pensions plans (CDBPs),

which are governed by the Japanese Welfare Pension

Insurance Law, tax-qualified pension plans and lump-sum

payment plans. In addition, the Company may pay additional

retirement benefits to employees at its discretion.

The Company and certain of its consolidated sub-

sidiaries recently changed their retirement plans, which are

summarized as follows.

On April 1, 2003, Konica’s tax-qualified benefit plan was

transferred to a CDBP.

On April 30, 2003, a portion of the Konica lump-sum

payment plan was transferred to a defined contribution pen-

sion plan.

On February 1, 2004, the Ministry of Health, Labour and

Welfare permitted the substitutional portion of the Konica

Welfare Pension Fund to be returned to the government,

and the remaining portion of the Fund was integrated into

a CDBP.

On March 1, 2004, the Ministry of Health, Labour and

Welfare permitted that the substitutional portion of the Minolta

Welfare Pension Fund be returned to the government, and

the remaining portion of the Fund be integrated into a

CDBP. A portion of the Minolta lump-sum payment plan was

transferred to a CDBP on the same date.

On April 1, 2004, a portion of the Minolta lump-sum

payment plan was transferred to a defined contribution

pension plan.

The reserve for retirement benefits as of March 31, 2006

and 2005 is analyzed as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

a. Retirement benefit

obligations ¥(154,221) ¥(142,123) $(1,312,854)

b. Plan assets 108,320 76,808 922,108

c. Unfunded retirement

benefit obligations

(a+b) (45,901) (65,315) (390,747)

d. Unrecognized

actuarial differences (5,572) 14,638 (47,433)

e. Unrecognized

prior service costs (11,768) (10,345) (100,179)

f. Net amount on

consolidated

balance sheets

(c+d+e) (63,241) (61,022) (538,359)

g. Prepaid pension

costs 1,627 2,021 13,850

h. Accrued retirement

benefits (f-g) ¥ (64,869) ¥ (63,044) $ (552,218)

Notes: 1. Certain subsidiaries use a simplified method for the calcu-

lation of benefit obligation.