Konica Minolta 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

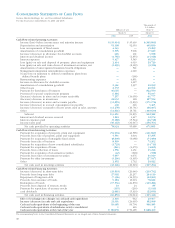

Thousands of

U.S. dollars

Millions of yen (Note 3)

March 31 March 31

2006 2005 2006

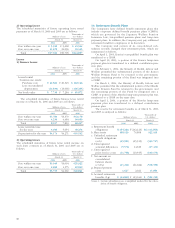

Cash Flows from Operating Activities:

Income (loss) before income taxes and minority interest ¥(35,934) ¥ 35,430 $(305,899)

Depreciation and amortization 51,198 52,953 435,839

Loss on impairment of fixed assets 4,143 —35,269

Amortization of consolidation goodwill 5,595 5,906 47,629

Increase (decrease) in allowance for doubtful accounts 465 101 3,958

Interest and dividend income (1,756) (1,353) (14,948)

Interest expenses 5,427 5,549 46,199

Loss (gain) on sale and disposal of property, plant and equipment 2,434 4,010 20,720

Loss (gain) on sale and write-down of investment securities, net (1,099) (2,129) (9,356)

Amortization of unrecognized transition benefit obligations —521 —

Management integration rationalization expenses —4,020 —

(Gain) loss on transition to defined contribution plans from

defined benefit plans —(160) —

Restructuring expenses —4,851 —

Increase in allowance for doubtful accounts —1,627 —

Amortization of consolidation goodwill 2,361 5,397 20,099

Other losses 2,372 —20,192

Payment for dissolution of business 96,625 —822,550

Provision for special outplacement program 6,484 —55,197

(Increase) decrease in notes and accounts receivable 7,257 (14,056) 61,777

(Increase) decrease in inventories 22,032 128 187,554

Increase (decrease) in notes and accounts payable (31,855) (9,239) (271,176)

Increase (decrease) in accrued consumption tax payable 400 646 3,405

Increase (decrease) on transfer of lease assets used in sales activities (11,278) (16,731) (96,007)

Other (11,821) 13,761 (100,630)

Subtotal 113,051 91,235 962,382

Interest and dividend income received 1,524 1,417 12,974

Interest expenses paid (5,488) (5,524) (46,718)

Income taxes paid (30,162) (31,447) (256,763)

Net cash provided by operating activities 78,924 55,680 671,865

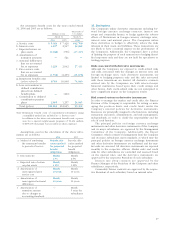

Cash Flows from Investing Activities:

Payment for acquisition of property, plant and equipment (51,904) (46,585) (441,849)

Proceeds from sale of property, plant and equipment 5,551 3,604 47,255

Payment for acquisition of intangible fixed assets (8,809) (9,088) (74,989)

Proceeds from sale of business 8,599 —73,202

Payment for acquisition of new consolidated subsidiaries (1,729) —(14,719)

Payment for acquisition of loans (541) (1,670) (4,605)

Proceeds from collection of loans 1,556 1,431 13,246

Payment for acquisition of investment securities (42) (348) (358)

Proceeds from sales of investment securities 5,057 4,976 43,049

Payment for other investments (3,236) (3,395) (27,547)

Other 2,352 1,732 20,022

Net cash used in investing activities (43,146) (49,343) (367,294)

Cash Flows from Financing Activities:

Increase (decrease) in short-term debt (25,819) (29,640) (219,792)

Proceeds from long-term debt 27,502 29,257 234,119

Repayment of long-term debt (7,396) (14,535) (62,961)

Proceeds from issuance of bonds 9,184 13,694 78,182

Redemption of bonds (17,536) (24,870) (149,281)

Proceeds from disposal of treasury stocks 10 24 85

Payment for repurchase of treasury stocks (135) (233) (1,149)

cash dividends (2,661) (5,310) (22,653)

Net cash used in financing activities (16,850) (31,614) (143,441)

Effect of exchange rate changes on cash and cash equivalents 2,463 642 20,967

Increase (decrease) in cash and cash equivalents 21,391 (24,635) 182,098

Cash and cash equivalents at the beginning of the year 59,485 83,704 506,385

Cash and cash equivalents of subsidiaries newly consolidated 1416 9

Cash and cash equivalents at the end of the year ¥80,878 ¥ 59,485 $688,499

The accompanying Notes to the Consolidated Financial Statements are an integral part of these financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the fiscal years ended March 31, 2006 and 2005