Konica Minolta 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

CONSOLIDATED FINANCIAL REVIEW

Scope of Consolidated Financial Statements

The Konica Minolta Group comprises Konica Minolta

Holdings, Inc. and its 124 subsidiaries, 30 unconsolidated

subsidiaries and 11 affiliated companies.

The business segments of the Group are organized

and segmented by type of product and the markets in

which these products are sold. These five segments are:

Business Technologies, Optics, Photo Imaging, Medical

and Graphic Imaging and Other Businesses.

In addition, the Group decided to exit the Photo

Imaging business in stages by the end of September 2007.

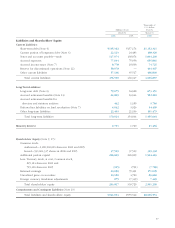

Consolidated Business Results

Consolidated Net Sales

Consolidated sales for the fiscal year ended March 31,

2006 reflected the decision to exit the Photo Imaging

business and increased ¥0.9 billion over the previous fis-

cal year to ¥1,068.4 billion. However, strong business

performance was recorded in the main three business

segments of Business Technologies, Optics and Medical

and Graphics Imaging, which recorded an increase of

¥77.3 billion over the previous fiscal year.

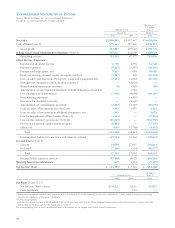

Cost of Sales, Selling, General and Administrative Expenses

The cost of sales for the fiscal year was ¥575.2 billion,

reflecting in a shrinkage in the Photo Imaging segment,

a change in business structure from growth in other

segments and the effects of cost reductions. As a result,

gross profit was ¥493.2 billion and the gross profit margin

was 46%, which represented a 2 percentage point

improvement over the previous fiscal year.

Selling, general and administrative expenses increased

¥7.7 billion over the previous fiscal year to ¥409.8 billion.

In addition to a ¥6.7 billion increase owing to the effects

of a weaker yen, research and development expenses

for new product development in the Group’s three major

business segments were also a factor.

Research and Development Expenses

Total research and development expenditures were

¥67.2 billion. In Business Technologies, R&D expenses

primarily for software and applications for the provision

of total network solutions were ¥38.1 billion, which was

higher than in the previous fiscal year. In Optics, R&D

expenses centering on next generation pickup lenses

and LCD-use film were ¥8.9 billion and higher than in

the previous fiscal year. In Medical & Graphic Imaging,

R&D expenses primarily for high resolution X-ray

input/output equipment and development of software

for internal hospital networks were ¥8.5 billion and

higher than in the previous fiscal year.

Segment Information

Sales in Business Technologies rose 7.4% year-on-year

to ¥606.7 billion and operating income increased 16.6%

year-on-year to ¥65.1 billion. The main reasons for the

increases were strong sales growth from the introduc-

tion of new color MFP products, where demand is

04 05 06

0

200

400

600

800

0

15

30

45

60

Cost of Sales (left scale)

Cost of Sales Ratio (right scale)

Cost of Sales and

Cost of Sales Ratio

(Billions of Yen, %)

04 05 06

0

300

600

900

Business Technologies

Optics

Photo Imaging

Medical and Graphic Imaging

Sensing

Other

Net Sales

(Billions of Yen)

1,200