Konica Minolta 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

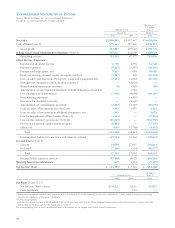

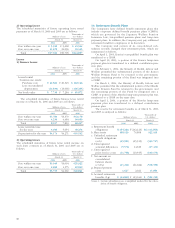

38

Thousands of

U.S. dollars

Millions of yen (Note 3)

March 31 March 31

2006 2005 2006

Net Sales ¥1,068,390 ¥1,067,447 $9,095,003

Cost of Sales (Note 8) 575,163 597,800 4,896,254

Gross profit 493,227 469,647 4,198,749

Selling, General and Administrative Expenses (Note 8) 409,811 402,069 3,488,644

Operating income 83,415 67,577 710,096

Other Income (Expenses):

Interest and dividend income 1,756 1,353 14,948

Interest expenses (5,427) (5,549) (46,199)

Foreign exchange gains, net 5,413 684 46,080

Equity in earnings (losses) under the equity method (2,507) 108 (21,342)

Loss on sales and disposals of property, plant and equipment, net (2,434) (4,010) (20,720)

Management integration rationalization expenses* —(4,020) —

Write-down of investment securities (8) (325) (68)

Amortization of unrecognized transition benefit obligations (Note 14) —(521) —

Loss on disposal of inventories (7,540) (8,698) (64,187)

Restructuring expenses* —(4,851) —

Provision for doubtful accounts —(1,627) —

Amortization of consolidation goodwill (2,361) (5,397) (20,099)

Gain on sales of investment securities, net 1,107 2,455 9,424

Gain on sales of investment in affiliated companies, net 549 —4,674

Loss on impairment of fixed assets (Note 11) (4,143) —(35,269)

Loss on discontinued operations (Note 12) (96,625) —(822,550)

Provision for special outplacement program (6,484) —(55,197)

Other, net (645) (1,746) (5,491)

Total (119,350) (32,147) (1,016,004)

Income (loss) before income taxes and minority interest (35,934) 35,430 (305,899)

Income Taxes (Note 7):

Current 24,650 27,947 209,841

Deferred (7,116) (594) (60,577)

Total 17,533 27,352 149,255

Income before minority interest (53,468) 8,077 (455,163)

Minority Interest in Subsidiaries (837) (553) (7,125)

Net Income (loss) ¥(54,305) ¥ 7,524 $(462,288)

U.S. dollars

Millions of yen (Note 3)

2006 2005 2006

Per Share (Notes 9, 17):

Net income (loss)—Basic ¥(102.2) ¥14.1 $(0.87)

Cash dividends —10.0 —

*Management integration rationalization expenses of ¥3,096 million (US$ 28,829 thousand) for the year ended March 31,2005 mainly represent restructuring

expenses for employees of European subsidiaries.

*Restructuring expenses

Expenses for structual reform of ¥3,628 million (US$ 33,783 thousand) related to the Photo Imaging business and accelerated depreciation charges of ¥1,223

million (US$ 11,388 thousand) for the digital camera business.

The accompanying Notes to the Consolidated Financial Statements are an integral part of these financial statements.

CONSOLIDATED STATEMENTS OF INCOME

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the fiscal years ended March 31, 2006 and 2005