Konica Minolta 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

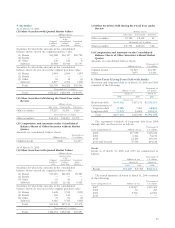

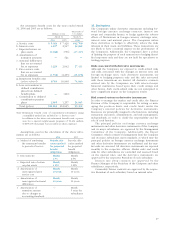

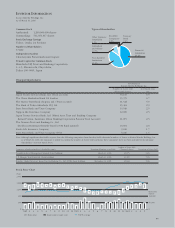

A summary of derivative instruments at March 31, 2006 and 2005 is as follows:

(1) Currency-Related Derivatives

Millions of yen Thousands of U.S. dollars

March 31 March 31

2006 2005 2006

Contract value Contract value Contract value

(notional (notional (notional

principal Fair Unrealized principal Fair Unrealized principal Fair Unrealized

amount) value gain (loss) amount) value gain (loss) amount) value gain (loss)

Forward foreign currency

exchange contracts:

To sell foreign currencies:

US$ ¥30,849 ¥31,081 ¥(231) ¥39,233 ¥40,358 ¥(1,124) $262,612 $264,587 $(1,966)

EURO 33,433 33,928 (494) 28,960 29,268 (308) 284,609 288,823 (4,205)

Other ———1,075 1,082 (7) ———

Total ¥64,283 ¥65,009 ¥(726) ¥69,269 ¥70,710 ¥(1,440) $547,229 $553,409 $(6,180)

To buy foreign currencies:

US$ ¥ 6,672 ¥ 6,682 ¥ 10 ¥ 4,342 ¥ 4,515 ¥ 173 $ 56,797 $ 56,883 $ 85

EURO ———614 622 7 ———

Other ———127 123 (3) ———

Total ¥ 6,672 ¥ 6,682 ¥ 10 ¥ 5,084 ¥ 5,261 ¥ 177 $ 56,797 $ 56,883 $ 85

Notes: 1. Fair value is calculated based on the forward foreign currency exchange rates prevailing as of March 31, 2006 and 2005,

respectively.

2. Derivative instruments with hedge accounting applied are excluded from the above table.

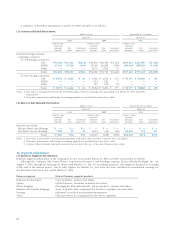

(2) Interest Rate-Related Derivatives

Millions of yen Thousands of U.S. dollars

March 31 March 31

2006 2005 2006

Contract value Contract value Contract value

(notional (notional (notional

principal Fair Unrealized principal Fair Unrealized principal Fair Unrealized

amount) value gain (loss) amount) value gain (loss) amount) value gain (loss)

Interest rate swaps:

Receive fixed, pay floating ¥— ¥— ¥— ¥— ¥— ¥— $— $— $—

Pay fixed, receive floating 7,285 32 32 6,943 (36) (36) 62,016 272 272

Total ¥7,285 ¥32 ¥32 ¥6,943 ¥(36) ¥(36) $62,016 $272 $272

Notes: 1. Fair value is provided by the financial institutions with whom the derivative contracts were concluded.

2. Derivative transactions with hedge accounting applied are excluded from the above table.

3. Contract value (notional principal amount) does not show the size of the risk of interest rate swaps.

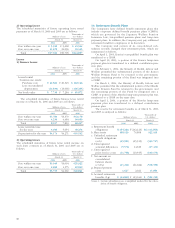

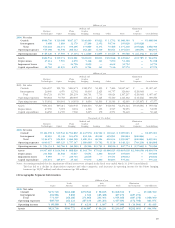

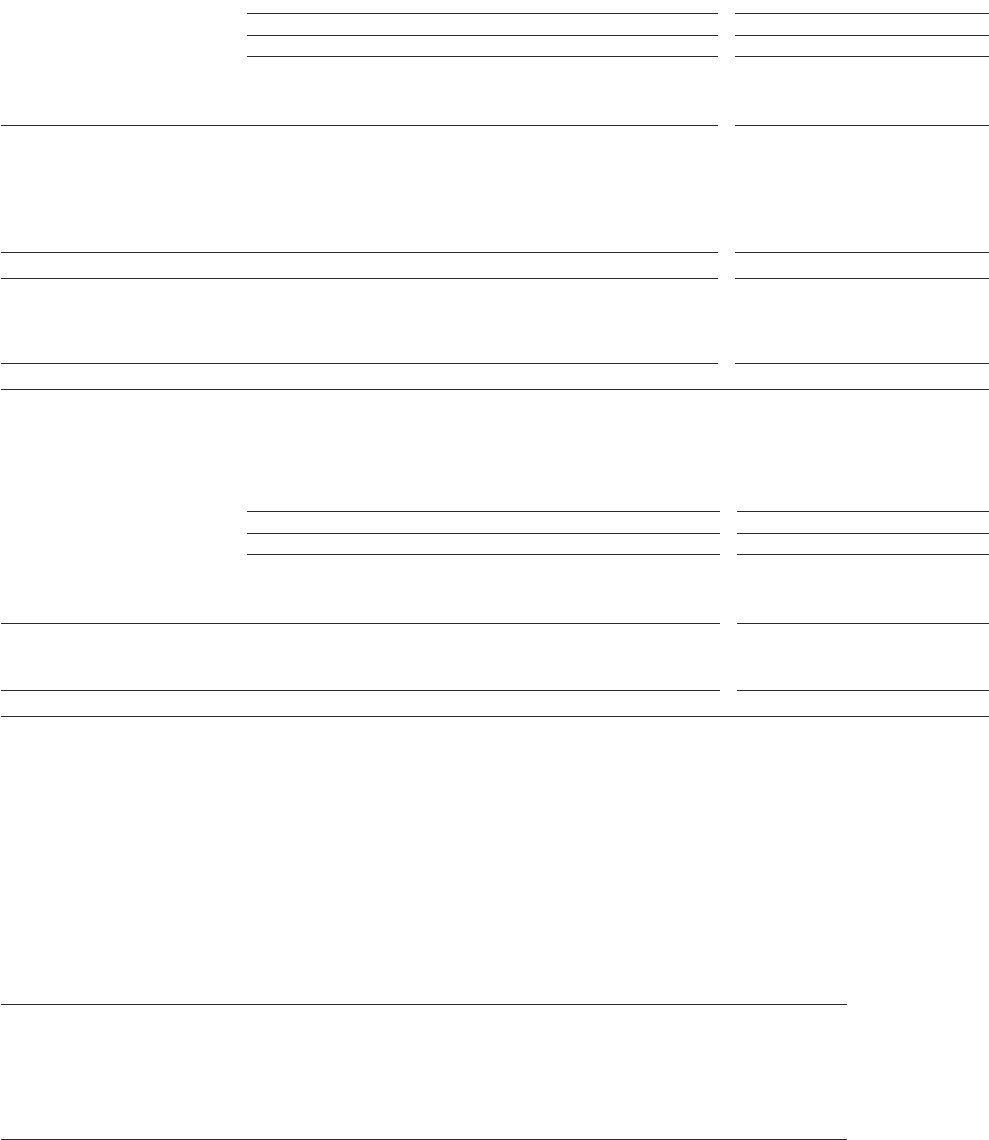

16. Segment Information

(1) Business Segment Information

Business segment information of the Companies for the years ended March 31, 2006 and 2005 is presented as follows:

Although the Company (the former Konica Corporation) became a new holding company, Konica Minolta Holdings, Inc., on

August 5, 2003, through an exchange of shares with Minolta Co., Ltd. for accounting purposes, this merger is deemed as occurring

at the end of the interim period, and as such, figures for Minolta Co., Ltd. have not been included in consolidated earnings for

the first half of the fiscal year ended March 31, 2004.

Business segment Related business segment products

Business Technologies: Copy machines, printers and others

Optics: Optical devices, electronic materials and others

Photo Imaging: Photographic film and materials, ink-jet products, cameras and others

Medical and Graphic Imaging: X-ray or graphic film, equipment for medical or graphic use and others

Sensing: Industrial or medical measurement instruments

Other: Others products not categorized in the above segments