Konica Minolta 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

04 05 06

0

25

50

75

100

0

2

4

6

8

Operating Income (left scale)

Operating Income Ratio (right scale)

Operating Income and

Operating Income Ratio

(Billions of Yen, %)

04 05 06

-60

-30

0

30

60

-100

-50

0

50

100

Net Income (Loss) (left scale)

Earnings per Share (EPS) (right scale)

Net Income (Loss) and

Earnings per Share (EPS)

(Billions of Yen, Yen)

expanding in the major regions of Japan, the U.S. and

Europe, in addition to sales growth in light production

printing domains such as in-house printing divisions of

large corporations, data centers and large scale fran-

chise copy shops. On the other hand, LBP sales and

earnings declined year-on-year reflecting more intense

price competition.

Optics segment sales increased 20.4% year-on-year to

¥110.4 billion, while operating income also increased

10.0% year-on-year to ¥17.6 billion. The segment total

reflected growth in LCD-use TAC film sales as

a result of the diffusion of LCD TVs, as well as strong

growth in glass hard disk substrates for notebook PCs

and digital home appliances. As a result, both sales and

operating income recorded growth for the fiscal year.

Medical and Graphic Imaging sales grew 12.9% year-

on-year to ¥146.6 billion and operating income increased

75.6% year-on-year to ¥11.7 billion. Growth here was

supported by strong sales of X-ray digital input/output

equipment and dry film for such digital equipment

owing to the growing shift to digitization and network-

ing in Japan and overseas markets. In the graphic imag-

ing area on the other hand, the digitization of printing

processes is accelerating the shift to film-less processes.

Sales limited to a slight decline from the previous fiscal

year and operating income increased year-on-year partic-

ularly as the result of a special emphasis on film sales in

the Asian region.

Photo Imaging sales reflected the Group’s decision in

January 2006 to exit the business and preparations for

this exit in each related product area. As a result, sales

for the segment declined 30.3% year-on-year to ¥187.1

billion and the operating in loss was ¥7.1 billion, which

represents a ¥1.5 billion improvement over the previous

fiscal year.

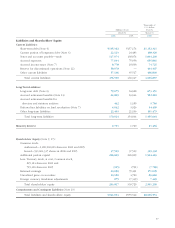

Earnings Analysis

As explained above, while earnings were impacted by

the decision to exit the Photo Imaging business, this was

covered by revenue and earnings growth in other

businesses. As a result, operating income for the fiscal

year ended March 31, 2006 increased 23.4% year-on-year

to ¥83.4 billion.

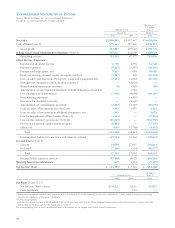

Net other expenses (income) deteriorated ¥87.2 billion

from the previous fiscal year to ¥119.4 billion. The major

reasons for this were the decision to exit the Photo

Imaging business and related business withdrawal costs,

and collective liquidation expenses for obligations

incurred as a result of the management integration,

including special retirement allowances under the spe-

cial retirement transition assistance program. Earnings

contributors included foreign exchange gains of ¥5.4 bil-

lion due to a weaker yen and a gain of ¥1.5 billion on

the sale of investment securities. In addition, foreign

exchange gains of ¥0.7 billion were recorded in the

previous fiscal year. In terms of factors detracting from

earnings, special losses related to discontinud operations