Konica Minolta 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

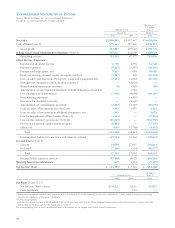

30

were ¥96.6 billion, including goodwill amortization of ¥2.4

billion and special retirement payments of ¥6.5 billion. A

loss of ¥2.5 billion was also recorded related to the equity

in investment losses arising from the decision to exit the

Photo Imaging business. Moreover, interest paid

declined owing to a reduction in interest-bearing debt.

As a result of the above, a loss before income taxes

and minority interests of ¥35.9 billion was recorded for

income before taxes, while the net loss for the period

was ¥54.3 billion. The net loss per share of common

stock was ¥102.29, while ROE was minus 17.1%.

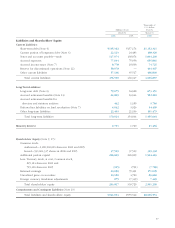

Liquidity and Financial Position

Total Assets, Liabilities and Shareholders’ Equity

Total assets at the end of the period were ¥944.1 billion

and ¥11.5 billion lower than at the end of the previous

fiscal year. In current assets, cash and cash equivalents

rose ¥21.5 billion as the result of preparations for the

exit from the Photo Imaging business. On the other

hand, inventories declined by ¥28.1 billion due to inven-

tory liquidations as a result of the decision to exit the

Photo Imaging business.

Total impairment losses of ¥32.8 billion were recorded

mainly in relation to the decision to exit the Photo

Imaging business. On the other hand, there were active

capital expenditures in the Business Technologies and

Optics segments. In addition, a ¥7.4 billion charge was

made for consolidation goodwill including ¥2.4 billion

one-time amortization of goodwill arising from the prior

management integration. In investments and other

assets, investment securities increased ¥4.3 billion

reflecting a rise in the current value of stocks held.

Under liabilities, interest-bearing debt declined ¥9.8

billion to ¥236.6 billion compared to the end of the

previous fiscal year. Short-term debt declined ¥21.8

billion, and outstanding corporate bonds declined ¥8.2

billion from the end of the previous fiscal year as the

result of efforts to promote redemption. On the other

hand, long-term debt including that portion due within

one year increased ¥20.3 billion. This increase reflected

a shift from short-term debt to long-term debt as a strategy

for future proactive investments. In addition, the deci-

sion to exit the Photo Imaging business resulted in the

recognition of ¥58.1 billion in reserves for discontinued

operations as well as special retirement payments of ¥6.5

billion under a special outplacement program that were

recorded under other current liabilities.

In shareholders’ equity, as net loss for the period was

¥54.3 billion, retained earnings declined ¥59.4 billion

from the end of the previous fiscal year. On the other

hand, unrealized gains on securities increased ¥5.4 billion

as a result of higher stock prices, while the foreign cur-

rency translation adjustment account improved ¥8.2

billion because of the weaker yen at the end of the

period. As a result of the above, shareholders’ equity

declined ¥45.9 billion from the end of the previous fis-

cal year, while shareholders’ equity ratio declined 4.5

percentage points to 31.1%.

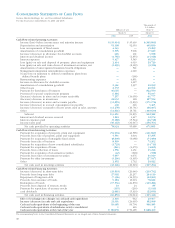

04 05 06

0

10

20

30

40

Equity Ratio

(%)

04 05 06

0

4

8

12

16

Interest Coverage Ratio

(times)