Konica Minolta 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

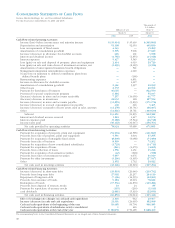

Capital Expenditure, Depreciation and Amortization

Capital expenditure increased ¥11.1 billion year-on-year

to ¥67.6 billion

Business Technologies-related capital expenditure was

¥28.8 billion and included the construction of an equip-

ment assembly plant in Wuxi, China, construction of

a new polymerized toner plant and purchases of dies for

new products. Optics-related capital expenditures were

¥21.8 billion and included the expansion of the manufac-

turing line for the Group’s third TAC film plant. Medical

and Graphic Imaging-related expenditure was ¥6.7 bil-

lion and included the acquisition of American Litho Inc.,

a major U.S. plate manufacturer, as part of efforts for an

early expansion in the plate business. In Photo Imaging,

capital expenditure declined 59.6% year-on-year to ¥3.0

billion reflecting the decision to exit the business.

Cash Flows

Net cash provided by operating activities in the fiscal year

was ¥78.9 billion. While the loss before income taxes and

minority interests was ¥35.9 billion, cash was provided by

recorded losses of ¥96.6 billion related to the decision to

exit the Photo Imaging business, depreciation expenses,

impairment losses and amortization of consolidation

goodwill that did not involve the use of cash.

Net cash used in investing activities was ¥43.1 billion,

largely as the result of purchases of property, plant and

equipment. Property, plant and equipment expenditures

included investment in dies mainly for new products,

and production capacity expansion for the assembly of

business technology equipment, polymerized toner,

aspherical plastic object lenses for optical disks and

LCD-use TAC film.

Net cash used in financing activities was ¥16.9 billion,

mainly reflecting efforts to further reduce interest-bearing

debt, centering on the redemption of corporate bonds.

Future Financial Strategies

In making a new start, the Group has created a new

medium-term management plan called FORWARD08 that

covers the three fiscal years beginning from April 2006

and is aimed at winning the global competition and

achieving sustainable growth. FORWARD08 sets the future

direction for the Group’s businesses, clarifies priority

issues, and through its unfailing execution, the Group aims

to provide for the expanding value of new businesses

and a maximization of the Group’s corporate value.

The financial strategies in order to achieve this place

first priority on increasing sales as a means of creating

cash, and includes the reduction of interest-bearing debt

which was ¥236.6 billion at the end of the fiscal year

under review to less than ¥200 billion. On the other

hand, short-term debt has been shifted to long-term debt

as a countermeasure for rising interest rates, and in order

to provide for proactive investment in growth areas,

while the Group also plans to increase its shareholders’

equity ratio which has temporarily declined as a result of

losses recorded because of the decision to exit the Photo

Imaging business.

04 05 06

0

250

500

750

Total Assets (left scale)

Shareholders’ Equity (left scale)

Return on Equity (right scale)

Total Assets,

Shareholders’ Equity and

Return on Equity (ROE)

(Billions of Yen, %)

0

250

500

750

1,000

–20

–10

0

10

20

04 05 06

0

20

40

60

80

Capital Expenditure

(Billions of Yen)