Konica Minolta 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

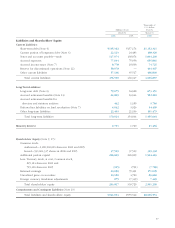

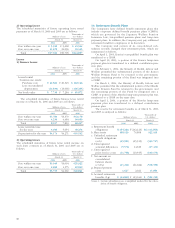

Net retirement benefit costs for the years ended March

31, 2006 and 2005 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2006 2005 2006

a. Service costs ¥ 5,024 ¥ 7,426 $42,768

b. Interest costs 4,107 2,947 34,962

c. Expected return on

plan assets (2,046) (736) (17,417)

d. Amortization of

transition amounts —521 —

e. Actuarial differences

that are accounted

for as expenses 3,220 2,042 27,411

f. Prior service costs

that are accounted

for as expenses (1,536) (1,233) (13,076)

g. Retirement benefit costs

(a+b+c+d+e+f) 8,769 10,968 74,649

h. Loss on transition to

defined contribution

plans from defined

benefit plans —(160) —

i. Contribution to defined

contribution pension

plans 2,895 1,257 24,645

Total (g+h+i) ¥11,665 ¥12,065 99,302

Note: Retirement benefit costs of consolidated subsidiaries using

a simplified method are included in “a. Service costs.”

In addition to the above net retirement benefit costs, a provi-

sion for a special outplacement program of ¥6,484 million

(US$55,198 thousand) was recorded as other expenses.

Assumptions used in the calculation of the above infor-

mation are as follows:

2006 2005

a. Method of attributing Periodic allo- Periodic allo-

the retirement benefits cation method cation method

to periods of service for projected for projected

benefit benefit

obligations obligations

b. Discount rate Mainly Mainly

2.5% 2.5%

c. Expected rate of return Mainly Mainly

on plan assets 1.25% 1.25%

d. Amortization of Mainly Mainly

unrecognized prior 10 years 10 years

service cost

e. Amortization of Mainly Mainly

unrecognized actuarial 10 years 10 years

differences

f. Amortization of —Mostly

transition amount 5 years for

due to changes in subsidiaries

accounting standards

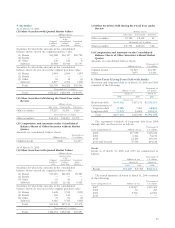

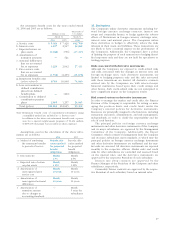

15. Derivatives

The Companies utilize derivative instruments including for-

ward foreign currency exchange contracts, interest rate

swaps and commodity futures, to hedge against the adverse

effects of fluctuations in foreign currency exchange rates,

interest rates and material prices. The Companies utilize

these derivatives as hedges to effectively reduce the risks

inherent in their assets and liabilities. These transactions are

not likely to have a material impact on the performance of

the Companies. Additionally, the Companies have a policy

of limiting the purpose of such transaction to hedging identi-

fied exposures only and they are not held for speculative or

trading purposes.

Risks associated with derivative instruments

Although the Companies are exposed to credit-related risks

and risks associated with the changes in interest rates and

foreign exchange rates, such derivative instruments are

limited to hedging purposes only and the risks associated

with these transactions are limited. All derivative contracts

entered into by the Companies are with selected major

financial institutions based upon their credit ratings and

other factors. Such credit-related risks are not anticipated to

have a significant impact on the Companies results.

Risk control system on derivative instruments

In order to manage the market and credit risks, the Finance

Division of the Company is responsible for setting or man-

aging the position limits and credit limits under the

Company’s internal policies for derivative instruments.

Resources are principally assigned to the functions, including

transaction execution, administration, and risk management,

independently, in order to clarify the responsibility and the

role of each function.

The principal policies on foreign currency exchange

instruments and other derivative instruments of the Company

and its major subsidiaries are approved by the Management

Committee of the Company. Additionally, the Expert

Committee, which consists of management from the Company

and its major subsidiaries meets regularly, at which time the

principal policies on foreign currency exchange instruments

and other derivative instruments are reaffirmed and the mar-

ket risks are assessed. All derivative instruments are reported

monthly to the respective officers. Market risks and credit

risks for other subsidiaries are controlled and assessed based

on the internal rules, and the derivative instruments are

approved by the respective President of each subsidiary.

Interest rate swap contracts are approved by the

Finance Manager of the President of the Company and other

subsidiaries, respectively.

Commodity futures contracts are approved by the respec-

tive President of each subsidiary based on internal rules.