Konica Minolta 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fundamental Group Management Policy

Maximize Corporate Group Values

1. Consistently execute business portfolio management.

2. Promote Groupwide corporate governance focusing on transparency.

3. Promote Groupwide R&D strategies and ensure penetration of the Konica Minolta brand in the field of imaging.

4. Promote performance-oriented human resource policies.

5. Enhance corporate social responsibilities.

5

Q. While Japan’s manufacturing industry is exhibiting signs of increased capital invest-

ment activity, please tell us how you view future global economic conditions.

A. Despite uncertainty surrounding the situation in Iraq, I see global economic conditions as

generally on the rise. Amid this favorable operating environment, identifying growth industries

assumes critical importance. In May 2004, Japan’s Ministry of Economy, Trade and Industry

(METI) formulated its New Industry Promotion Strategy. In its report, METI identified home infor-

mation appliances, robotics, fuel cells and contents as providing the platform for the Japanese

economy’s future growth. Historically, the petroleum and automobile industries have led Japan

in its push onto the world stage, and I suppose this is the first time “Intelligent Capital” has

assumed such a prominent position. I believe this is also representative of the major shift

impacting global industries. Identified as a growth domain, digital home information appli-

ances, a field in which we maintain close links, is of particular interest. This business is antici-

pated to expand significantly, representing a market of approximately ¥96 trillion by fiscal

2010. In fiscal 2003, the market was estimated at ¥54 trillion. Accordingly, we can expect

growth exceeding nearly 80% over the next seven years.

Q. Against this backdrop of continuous change, what are the objectives, numerical tar-

gets and principal underlying themes of the Company’s medium-term management integra-

tion plan?

A. Konica Minolta’s medium-term management integration plan provides the guidelines for

maximizing the benefits of management integration, and is scheduled for completion in the fis-

cal year ending March 31, 2007. The plan was formulated to clarify the Group’s fundamental

management strategies and to position Konica Minolta as a global leader in those fields in

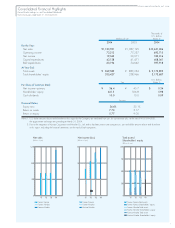

which it operates. In fiscal 2006, the final year of the plan, we have identified the numerical

targets of consolidated net sales at ¥1,330 billion, operating income at ¥160 billion, and net

income at ¥80 billion. To this end, we have formulated three underlying initiatives, to imple-

ment business portfolio management, to swiftly realize synergy and integration benefits, and to

create a new corporate culture. In our efforts to implement business portfolio management, we

KONICA MINOLTA HOLDINGS, INC. 2004

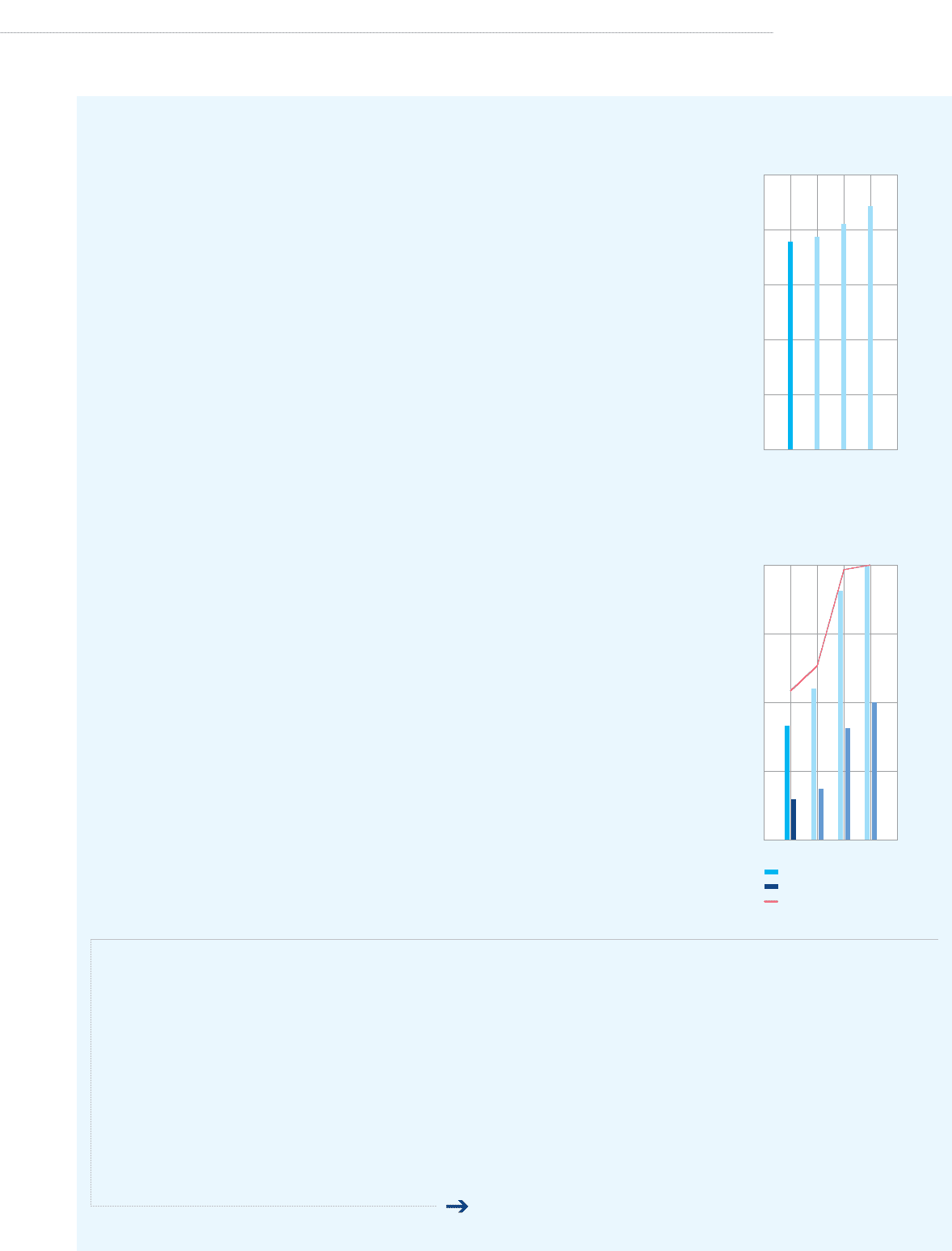

Net sales targets

(Billions of yen)

600

300

900

1,200

1,500

0’04 ’05 ’06 ’07

’04 ’05 ’06 ’07

40

80

120

160

0

3

6

9

12

0

Operating income

Net income

Operating income ratio

Operating income and

Net income targets

(Billions of yen) (%)