Konica Minolta 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

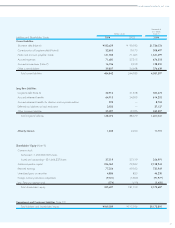

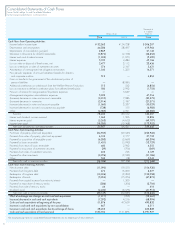

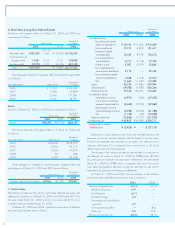

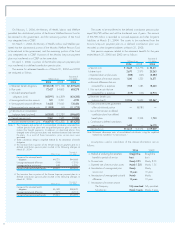

6. Short-Term & Long-Term Debt with Banks

Short-term and long-term debt as of March 31, 2004 and 2003 are

summarized as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

(Interest rate)

Short-term debt ¥182,429 1.46 ¥ 90,592 $1,726,076

Current portion of

long-term debt 14,251 2.14 5,121 134,838

Long-term debt 32,778 1.29 24,126 310,133

Total ¥229,459 ¥119,840 $2,171,057

The repayment schedule of long-term debt from 2006 through 2009

is as follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2006 ¥ 7,054 $ 66,742

2007 5,908 55,899

2008 12,406 117,381

2009 2,005 18,971

Bonds

Bonds as of March 31, 2004 and 2003 are summarized as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Bonds ¥38,492 ¥32,246 $364,197

The annual maturities of long-term debt as of March 31, 2004 are

as follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2005 ¥18,354 $173,659

2006 10,054 95,127

2007 5,054 47,819

2008 30 284

2009 5,000 47,308

Assets pledged as collateral for short-term debt, long-term debt and

guarantees as of March 31, 2004 and 2003 are as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Property, plant and equipment ¥3,044 ¥2,199 $28,801

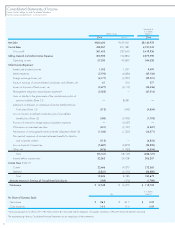

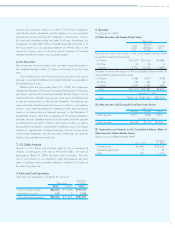

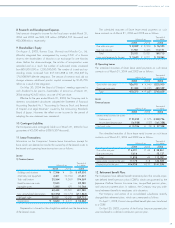

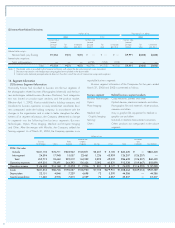

7. Income Taxes

The statutory income tax rate used for calculating deferred tax assets and

deferred tax liabilities as of March 31, 2004 and 2003 were 40.7% for

the year ended March 31, 2004 and 42.1% (current) and 40.5% (non-

current) for the year ended March 31, 2003.

At March 31, 2004 and 2003, significant components of deferred

tax assets and liabilities were as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Gross deferred tax assets:

Excess of reserve for retirement

benefits over deductible limit

¥ 33,194 ¥15,046 $ 314,069

Net loss carried forward

19,174 4,820 181,417

Elimination of unrealized

intercompany profits

14,185 8,170 134,213

Excess of accrued bonuses

over deductible limit

6,101 2,718 57,725

Write-down on assets

5,587 6,970 52,862

Excess of depreciation and

amortization over deductible limit

3,712 —35,122

Excess of allowance for doubtful

accounts over deductible limit

1,608 1,418 15,214

Other

11,660 11,940 110,323

Subtotal

95,225 51,085 900,984

Valuation allowance

(19,483) (6,587) (184,341)

Deferred tax assets total

75,742 44,497 716,643

Gross deferred tax liabilities:

Unrealized gains on securities

(4,991) (540) (47,223)

Gains on securities contributed to

employees’ retirement benefit trust

(3,442) (3,592) (32,567)

Special tax-purpose reserve for

condensed booking of fixed assets

(3,296) (3,340) (31,186)

Other

(1,155) (43) (10,928)

Deferred tax liabilities total

(12,886) (7,517) (121,923)

Net deferred tax assets

¥ 62,855 ¥36,980 $ 594,711

Deferred tax liabilities related to

revaluation of land

¥ (3,925) ¥ —$ (37,137)

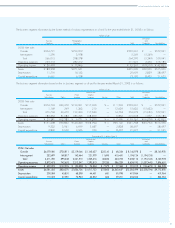

Deferred tax assets relating to net losses are recorded because the

Japanese accounting standard requires that the benefit of net loss carry-

forwards be estimated and recorded as an asset, with deduction of a

valuation allowance if it is expected that some portion or all of the

deferred tax assets will not be realized.

The change in the statutory income tax rate resulted in a reduction in

net deferred tax assets at March 31, 2004 by ¥788 million ($7,456

thousand) and an increase in income taxes—deferred for the year ended

March 31, 2004 by ¥788 million, compared with those that would

have been recognized if effective income tax rates 42.1% and 40.5%

had been fully applied to the temporary differences.

At March 31, 2004 and 2003, the reconciliation of the statutory

income tax rate to the effective income tax rate is as follows:

2004 2003

Statutory income tax rate 42.1% 42.1%

Valuation allowance 15.9 —

Tax Deduction (6.1) —

Tax Rate Change 2.4 —

Amortization of consolidation

goodwill 3.7 —

Unrecognized tax effect —(8.5)

Other, net 2.6 (0.5)

Effective income tax rate 60.6% 33.1%